Institutional

Elemental Royalty’s decision to offer dividends in Tether Gold (XAUt) spotlights an emerging model: tokenized commodity payouts. This article explains the mechanics, market context, legal and tax questions, strategic implications for resource companies, and a practical investor checklist on custody, redemption and counterparty risk.

The CLARITY Act’s march toward implementation is redefining regulator roles and ETF engineering, while Abu Dhabi sovereign-linked funds quietly building IBIT stakes signal a new layer of institutional demand. Together these forces reshape allocation, liquidity risk, and cross‑border flows for long‑term BTC investors.

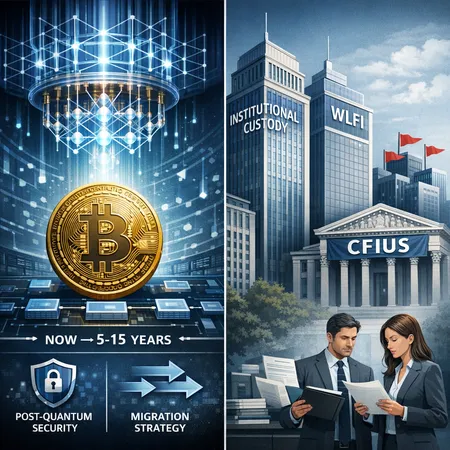

Quantum computers and geopolitical scrutiny of politically linked crypto investments together create a compound threat to Bitcoin. This article synthesizes developer warnings, institutional exposures, and policy risks — and lays out pragmatic mitigation steps for engineers and security leads.

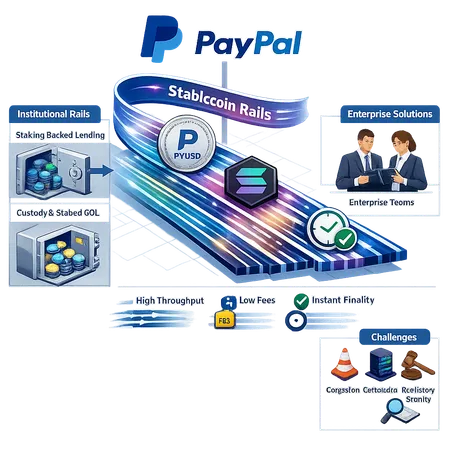

PayPal naming Solana as its default network for stablecoin processing is a watershed for blockchain payments. This piece examines the technical drivers, UX and institutional implications, risks, and practical recommendations for teams evaluating Solana as a stablecoin settlement layer.

Helius (HSDT) recently launched loans against staked SOL without unstaking — a step that could change staking economics, liquid‑staking pressure, and institutional balance‑sheet design. This article examines mechanics, market reaction, custody risks, and likely knock‑on effects for SOL price and staking yields.

Large off‑exchange accumulation by BitMine (40,000 ETH) and Strategy/Michael Saylor’s BTC buys are reshaping available supply and the narrative around institutional conviction. This piece unpacks OTC mechanics, miner coverage shifts, supply‑shock dynamics, and scenarios for medium‑term price floors.

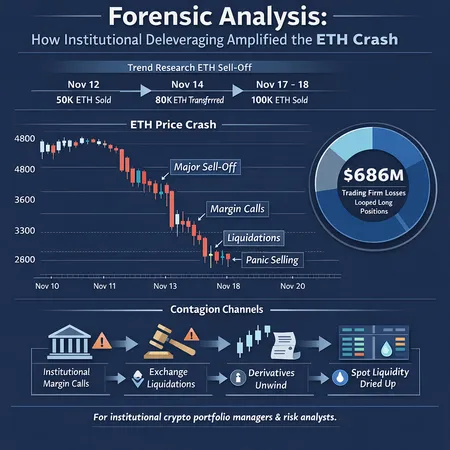

A forensic review of how institutional selling, margin calls, and looped long positions turned an ETH drawdown into a cascading market event. Using Trend Research and a related trading-firm collapse as a case study, this report maps the timeline, contagion channels, and practical lessons for risk teams.

A $1M Lightning Network settlement between Secure Digital Markets and Kraken demonstrates that institutional-scale BTC transfers can be near-instant and low-fee. This article explains the technical, custody, cost, and compliance implications for treasuries and exchange operators.

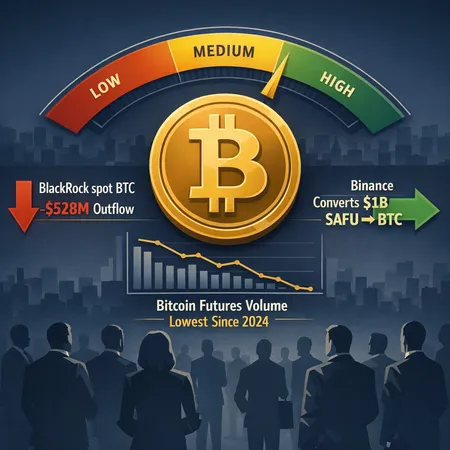

Recent data — a $528M outflow from BlackRock's spot BTC ETF, collapsing futures volumes and corporate BTC purchases — paint a mixed picture for institutional demand. This feature unpacks which metrics act as early-warning signals and outlines scenarios for BTC price dynamics under different institutional-return assumptions.

Institutional-linked stablecoins and equity-funded bitcoin purchases are reshaping corporate treasuries and on-ramps. CFOs and treasury teams must weigh liquidity, custody, accounting, and regulatory trade-offs as bond market repricing nudges allocations toward BTC, ETH and SOL.