ETFs

XRP is moving from retail speculation toward institutional utility as ETFs, treasury models like Evernorth’s, and lending products deepen market plumbing. Treasurers and allocators must weigh yield and liquidity gains against custody and regulatory risks.

Recent large spot-BTC ETF outflows have pressured prices and driven heavy unrealized losses in self-custody wallets. This article explains the mechanics, why slipping below $70k matters for market structure, and actionable hedges and liquidity rules for allocators and traders.

As roughly $30B of SOL sits staked, liquid staking and derivative tokens could free huge on‑chain liquidity — even as SOL ETFs register notable outflows. Builders should weigh the mechanics, timelines, and product opportunities to capture that capital.

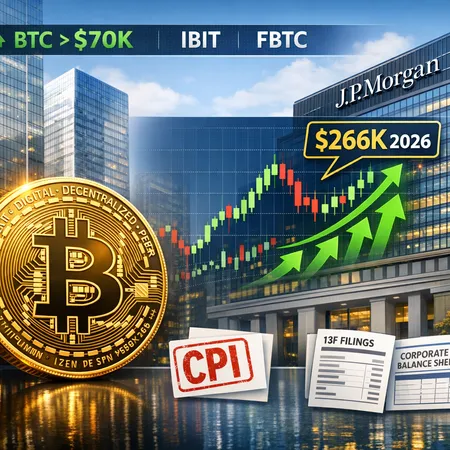

Major institutions maintain a bullish stance on Bitcoin despite choppy price action — driven by structural supply dynamics, growing ETF adoption, and macro tailwinds such as cooling CPI. This article unpacks JPMorgan’s $266K projection, the CPI-ETF rebound above $70K, 13F evidence of shifting allocations, and practical portfolio takeaways.

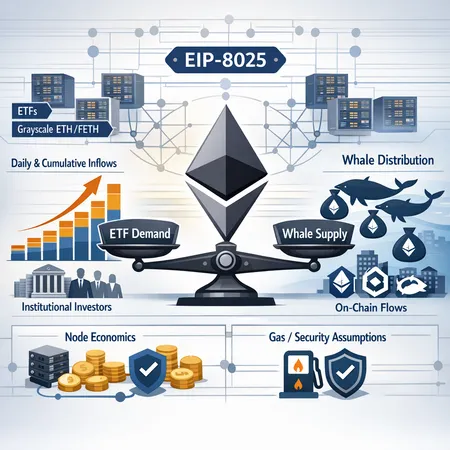

ETF inflows into ETH are rising even as many large wallets trim holdings. This piece unpacks that disconnect, weighs institutional accumulation versus whale sell-offs, and explains how EIP-8025’s shift to proof-based validation changes node economics and investor strategy.

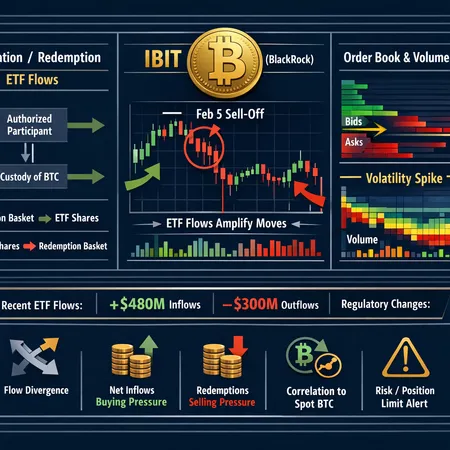

Spot Bitcoin ETFs, especially large products like BlackRock's IBIT, have become a dominant liquidity conduit that can amplify intraday moves through creation/redemption mechanics. This explainer gives intermediate traders and portfolio managers an actionable framework to read ETF-driven BTC price moves.

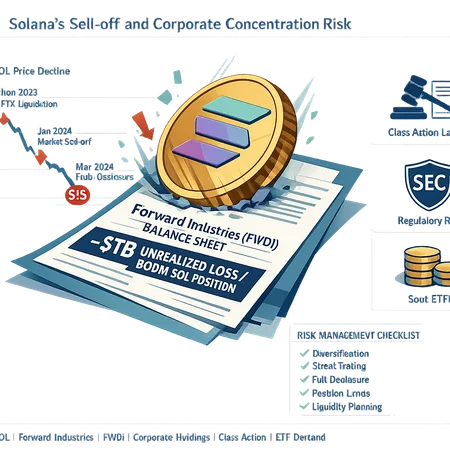

Solana’s recent price dive and a class-action suit have been amplified by Forward Industries’ roughly $1B unrealized SOL loss — yet the firm still holds a 600M SOL position. This analysis unpacks the timeline, systemic risks from concentrated corporate holdings, and whether ETF demand can realistically create a structural bid.

US spot Bitcoin ETFs recorded roughly $561–562M of inflows despite renewed BTC volatility. This article explains which issuers led flows, how creation/redemption and arbitrage work under stress, and practical trading responses.

A fresh market stress test combines large daily ETF outflows with on-chain warnings of fragile structure, while headline whales reportedly accumulate near $90k. This piece synthesizes flow data, on-chain signals, and institutional appetite to map plausible near-term BTC scenarios.

A closer look at why Bitcoin options open interest has eclipsed futures, how that shifts liquidity and gamma dynamics, and why macro shocks like tariff escalations can still ignite outsized BTC moves despite ETF flows.