How Modern Bitcoin Mining Can Stabilize Grids and Lower Electricity Costs

Summary

Executive summary

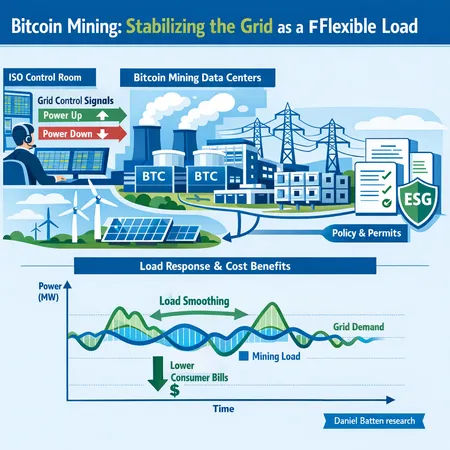

New analyses and market moves make a case that Bitcoin mining — when run intentionally as a flexible electricity load — can help stabilize grids and lower consumer costs. Daniel Batten’s research highlights the technical and economic channels through which mining can function like a controllable demand resource, and recent market reactions show miners’ economics are sensitive to those grid dynamics. This article explains the research findings, walks through practical demand‑flexibility use cases, addresses carbon and energy‑use criticisms, and lays out the policy and investor implications.

What the new research shows: mining as a grid asset

Daniel Batten’s analysis argues that, contrary to the popular narrative of miners as profligate energy consumers, modern mining operations have the capacity to strengthen electrical systems and lower system costs when deployed with grid coordination and smart controls. The core idea is simple: Bitcoin miners are highly controllable loads that can ramp down or up in seconds, soak up surplus generation that would otherwise be curtailed, and provide predictable, bidirectional responses to grid stress.

Batten’s research describes how miners can reduce net system costs by: (1) consuming otherwise curtailed renewable energy, improving project economics for renewables; (2) providing rapid demand response that reduces the need for expensive peaker plants and reserves; and (3) smoothing net load profiles which lowers hourly spot price volatility and average consumer bills in some market designs. Those mechanisms are consistent with market behavior: when Bitcoin rallies and market participants expect higher miner revenue, related equities and miners themselves react quickly — a recent market piece showed miners and crypto‑linked equities rallying alongside Bitcoin’s breakout, reflecting how sensitive miner economics are to price and grid conditions miners and crypto‑linked equities rallied.

How miners act as demand‑flexible resources: practical mechanisms

Not all miners are built or operated the same. The stabilizing potential comes from operational design and contractual arrangements.

1) Absorbing curtailed or stranded generation

In many grids with high renewable penetration, wind and solar output is sometimes curtailed because supply exceeds local demand or constrained transmission capacity. Miners co‑located near generation can soak up that energy, improving project revenue and reducing the effective curtailment rate. This is especially valuable in markets where renewable projects are paid via contracts or produce negative locational value during oversupply.

2) Automated, sub‑minute demand response

Modern mining rigs and control stacks can throttle thousands of machines in parallel within seconds. That capability allows miners to participate in frequency response and fast reserve markets — technically similar to how battery systems provide services but with the key difference that miners convert curtailed electricity into an economic output (BTC). When miners bid into ancillary markets or operate behind automated contracts with grid operators they become a dispatchable, predictable sink.

3) Price‑sensitive or market‑signal operation

Mining operations can be configured to run only when wholesale prices are below a threshold, or to follow negative price signals that indicate oversupply. That price‑responsive behavior reduces peak demand and collapses price spikes, which over time can lower consumer bills in markets with dynamic wholesale settlement.

4) Grid services and locational benefits

Beyond energy consumption, coordinated miner fleets can offer capacity, inertia substitutes via fast load shedding, and congestion relief by locating where marginal generation is cheap. These locational benefits matter to transmission planners and can defer expensive upgrades.

For institutional readers: consider miners not merely as electricity sinks but as programmable loads capable of participating in energy markets and delivering ancillary services alongside more conventional resources. For traders and asset allocators, the derivatives market’s growing optimism about BTC price paths also feeds back into miner investment choices and expansion plans; traders kicked off 2026 with bets on a Bitcoin rally above USD 100,000, a dynamic that can increase risk appetite and capital flows into mining derivatives-driven bullishness.

Case studies and emerging examples (high level)

Several operational models already illustrate the concept without claiming universal applicability. In regions with high curtailment, independent miners have signed short‑term offtake or tolling arrangements that let renewables monetize output that otherwise would be lost; in market regions with active demand response programs miners have bid into capacity or reserve auctions where allowed. These examples show how technical controls plus flexible commercial contracts produce value for both generators and system operators.

Counterarguments: energy usage and carbon footprint

Skeptics are right to highlight total electricity consumption and lifecycle emissions. Key objections include the scale of consumption, the potential to crowd out beneficial electrification (EV charging, industrial load), and the difficulty of claiming low carbon intensity when miners locate near fossil generation.

Those concerns are legitimate, but not dispositive. They break into three policy‑relevant points:

- Location matters: miners clustered near carbon‑light, curtailed renewables or paired with firming assets have far lower grid carbon intensity than miners relying on coal‑dominated baseload. Choosing locations and contracts is an active policy lever.

- Operational design matters: time‑synchronized operation (running during oversupply, pausing during scarcity) and participation in emissions‑aware tariffs can materially reduce carbon intensity compared with constant, unmanaged consumption.

- Additionality matters: if miners enable construction of new renewables by improving project revenue through offtake, they can accelerate decarbonization rather than hinder it — though this depends on contract design and regulatory oversight.

In short, the environmental critique forces operational and contractual discipline rather than invalidating the stabilizing potential. ESG‑minded investors should demand transparent locational emissions accounting, contractual commitments to flexible operation, and third‑party verification.

Policy implications: permitting, tariffs, and market rules

If regulators accept miners as potential grid assets, several policy shifts follow.

Reform permitting and interconnection: streamline pathways for flexible loads while enforcing rules that prevent undue transmission congestion. Fast, predictable permitting is key so miners can be sited where they provide the most system value.

Create incentives for flexibility: design tariffs or programs that reward price‑sensitive consumption, negative‑price absorption, and verified demand response performance. Time‑of‑use or real‑time retail offers can make miner flexibility visible in markets.

Integrate miners into resource planning: system operators should model large, controllable loads as resources in capacity planning and locational marginal pricing calculations. That reduces surprises and reveals where miners can substitute for peaker plants or defer transmission upgrades.

Emissions accounting and additionality rules: governments and voluntary frameworks should define how to credit miners that reliably consume curtailed renewable energy or enable new clean generation; avoid double counting and require transparency.

Well‑crafted policy can harness miner flexibility while protecting consumers and the environment. Conversely, a lack of oversight will let bad actors extract value without system benefits.

What this means for mining companies and ESG investors

For miners, the opportunity is to evolve from a pure compute play into an integrated energy‑market participant. That means investing in control software, telemetry, and contractual structures that allow rapid response to grid signals. Revenue diversification — selling ancillary services, collecting capacity payments, or monetizing negative prices — will improve margins and reduce exposure to BTC spot volatility.

For institutional investors and ESG allocators, the calculus changes too. Rather than excluding mining categorically, it becomes possible to underwrite miners that meet strict operational and locational criteria: demonstrable participation in demand response, transparent emissions reporting, and contracts that link miner operation to grid benefits. Platforms that track miner economics and energy performance, including tools used across crypto markets and services like Bitlet.app, will be increasingly useful for due diligence.

Importantly, investors should treat miner ESG claims like those of any energy project: ask for measurable outcomes (curtailment reduced, peak price reductions, emissions intensity per MWh consumed) and align incentives contractually.

Practical steps for analysts and policymakers

- Require miners to submit operational plans showing flexibility and response times during interconnection reviews.

- Offer pilot programs so miners can demonstrate ancillary service delivery without full market integration risk.

- Standardize reporting metrics for miner carbon intensity and avoided curtailment to let investors compare projects objectively.

- Consider temporary tariff designs or credits that compensate miners for verifiable grid services while protecting retail consumers.

These steps help reconcile the tension between energy usage concerns and the system value that flexible loads can provide.

Conclusion

Modern Bitcoin mining — properly sited, controlled, and regulated — can be more than an energy consumer: it can be a grid stabilizer that lowers system costs and enables higher renewable penetration. Daniel Batten’s research and recent market activity underscore that miners’ operational design and market participation are decisive. The path forward is not hands‑off acceptance nor blanket prohibition; it is targeted policy and investor discipline that channels miner flexibility into public value. For policy analysts and institutional investors, the question should be how to design rules and contracts that turn programmable consumption into verifiable grid services rather than whether mining uses electricity at all.

For more granular market signals and trading context, note how miner economics respond to BTC price action and derivatives markets, which in turn affect capital deployment decisions among operators derivatives-driven bullishness and investor appetite when miners and crypto equities rally alongside on‑chain price moves miners and crypto‑linked equities rallied. For a concise review of the research that frames much of this policy debate, see Batten’s findings on mining’s potential to stabilize grids and lower consumer costs Batten’s analysis.

Bitlet.app and other infrastructure platforms are beginning to integrate energy‑aware analytics into miner economics, which will help investors and regulators monitor performance in real time.

Sources

- https://cryptonews.com/news/bitcoin-mining-actually-stabilizes-grids-and-lowers-costs-researcher-says/

- https://www.coindesk.com/markets/2026/01/05/bitcoin-s-breakout-lifts-crypto-equities-and-miners-in-pre-market-trading

- https://www.coindesk.com/markets/2026/01/05/bitcoin-traders-kick-off-2026-with-bets-on-price-rally-above-usd100-000