RWA

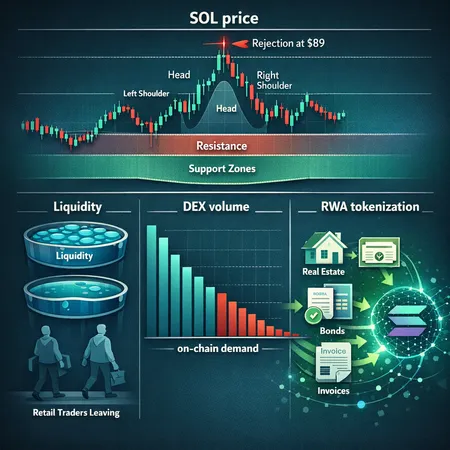

Solana's recent rejection near $89 and a drop in DEX volume has many asking whether this is a market top or an entry. This article weighs technical setups, on‑chain volume, and growing RWA tokenization to offer a balanced view for traders and DeFi builders.

Institutional interest in tokenized real-world assets (RWA) is accelerating—from an $18.87M tokenized-gold purchase to rising demand for Sui and Hedera tokenization. This article examines what these events mean for product teams and asset managers evaluating custody, settlement and regulatory risk.

Tether's $150M stake in Gold.com signals a strategic shift: major stablecoin issuers are moving into tokenized gold to diversify reserves, deepen liquidity for RWA, and build new revenue lines. That pivot will accelerate tokenized-asset adoption while raising custody, audit and regulatory stakes for the stablecoin sector.

XDC Network’s integration with BitGo brings regulated custody and institutional-grade controls to token issuers; Brazil’s Liqi $100M RWA deal shows how that plumbing enables large-scale, regional tokenization. This guide explains what custody enables, how USDC/USDT custody shifts counterparty risk, and an operational/legal checklist for launching tokenized assets on XDC.

A $280M batch of certified polished diamonds is being tokenized on the XRP Ledger with Billiton Diamond, Ctrl Alt and Ripple involved. This project and related strategic moves could pivot XRPL from payments rails toward a broader real‑world asset (RWA) platform.

Anatoly Yakovenko argues that Solana must keep evolving to survive; this article dissects that thesis, contrasts it with Ethereum’s ossification debate, and explains the practical implications for developers, RWA adoption, and SOL holders.

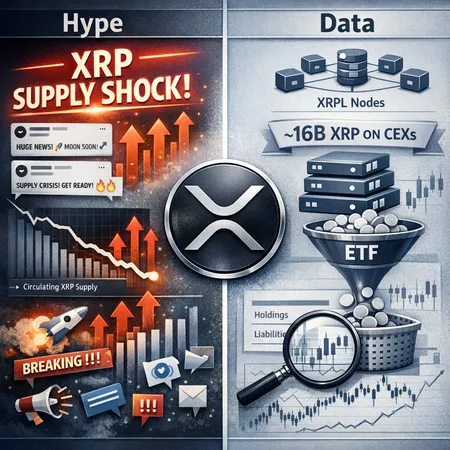

The ‘XRP supply shock’ thesis has gone viral, but on‑chain evidence and ETF mechanics paint a more nuanced picture. This article breaks down the claims, counter‑data, and tradeable scenarios for analysts and traders.

Stablecoin monthly volumes have eclipsed major payment rails even as supply expands; tokenized RWAs and assets like XAUT are turning on‑chain liquidity into institutional-grade cash and collateral. RLUSD’s $1B milestone and B3’s tokenization plans accelerate a new pipeline of capital into DeFi and treasury products.

Tether’s reported €1B/$1.1B all-cash bid for Juventus — and the club’s rejection — illuminates a larger push by stablecoin issuers into sports, tokenized assets and real-world corporate strategies. The episode highlights strategic motives, regulatory exposure and a new front in stablecoin competition.

Injective’s integration of Chainlink sub-second data streams brings professional-grade, low-latency market data to Helix, enabling tighter derivatives pricing, faster low-latency AMMs, and more credible RWA primitives. Institutional desks and builders should reassess data pipelines, risk engines, and decentralization assumptions to capture the benefits while managing trade-offs.