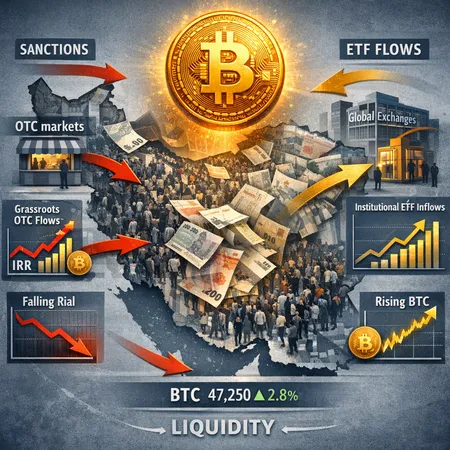

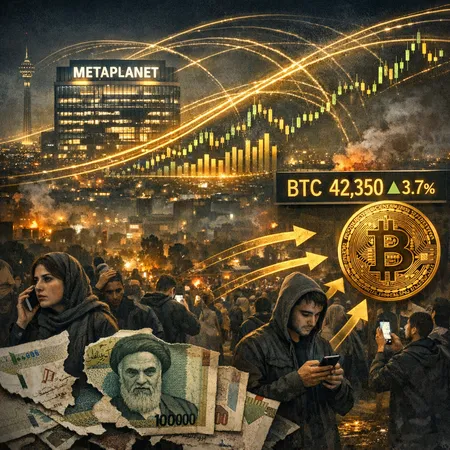

Capital Flight

Bitcoin in Crisis: Iran’s Case and the Tug of Geopolitics vs. Institutional Flows

When fiat collapses and borders close, Bitcoin can act as both an instrument of survival and a market signal. This feature examines how Iranians are turning to BTC amid protests and a plunging rial, contrasts grassroots demand with ETF-driven flows, and outlines what analysts should monitor to gauge geopolitical liquidity shocks.

Published at 2026-01-16 15:32:47

Bitcoin as an Emerging‑Market Hedge: Iran’s Rial, On‑Chain Flows, and Institutional Bids (2025–26)

This piece traces how BTC is evolving into a currency hedge in 2025–26, using Iran’s rial collapse and growing institutional accumulation as linked case studies. It weighs anecdotal and on‑chain evidence against policy and regulatory risks that complicate the hedge thesis for emerging‑market investors.

Published at 2025-12-30 15:45:52