Ripple

Ripple’s RLUSD landing on Binance’s XRP Ledger is a strategic milestone that enhances stablecoin utility and on‑chain liquidity. Large on‑chain XRP movements tied to exchanges may reflect deeper liquidity operations that investors should monitor.

Deutsche Bank’s tests with Ripple+SWIFT and Ripple’s community push highlight a tension: institutional rails are advancing, but XRP’s price and on-chain flows often react to community events and market fear. This article separates partnership headlines from product exposure and offers a practical checklist for payments strategists.

XRP has re-emerged as a retail favorite, backed by a meaningful private valuation update for Ripple and a technical pivot at $1.40. This piece maps the bullish scenarios traders watch, the catalysts that could validate a breakout to $3.00+, and the risks that would snuff the momentum.

A data-led take on XRP’s sharp rebound, what $11B of inflows tells us about liquidity and market structure, and whether Ripple’s push toward real-world payments can sustain institutional on‑ramps.

A $280M batch of certified polished diamonds is being tokenized on the XRP Ledger with Billiton Diamond, Ctrl Alt and Ripple involved. This project and related strategic moves could pivot XRPL from payments rails toward a broader real‑world asset (RWA) platform.

Ripple’s full Luxembourg EMI license changes the regulatory runway for EU payments and on‑ramps; but recurring XRP escrow unlocks complicate the near‑term token picture. This analysis separates legal capability from market mechanics and models three plausible XRP price/volume scenarios if the EU rollout accelerates.

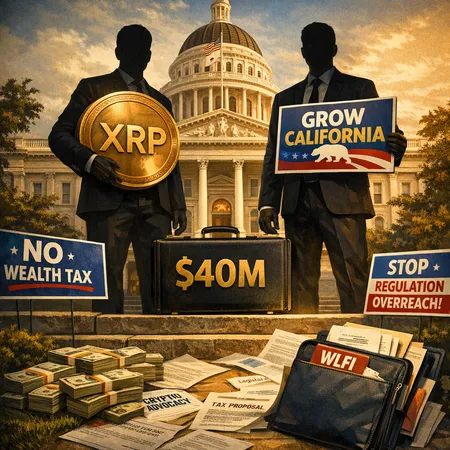

A close look at Chris Larsen and Tim Draper’s $40M Grow California push to stop a proposed wealth tax — what it reveals about crypto political power, strategy, and regulatory risk for tokens like XRP and WLFI.

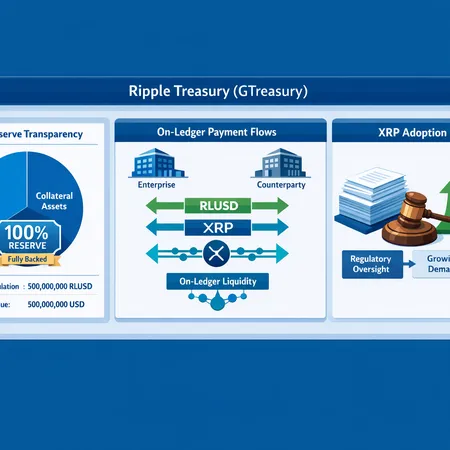

Ripple's GTreasury-powered Treasury offering and RLUSD stablecoin aim to give corporate treasuries a ledger-native option for institutional payments and liquidity management. This analysis examines what the product actually delivers, how RLUSD's reserve signals affect credibility, and the potential knock-on for on-ledger liquidity and XRP adoption amid improving regulatory clarity.

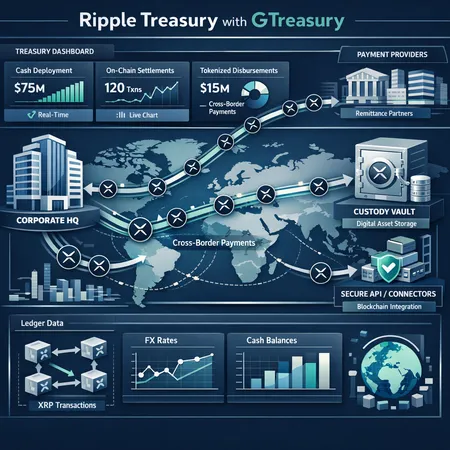

Ripple Treasury combines GTreasury’s enterprise FX and cash-management tooling with Ripple’s payment rails to offer real‑time cash deployment, on‑chain settlement and tokenized disbursements for corporates and banks. This feature explains the product, why Ripple bought GTreasury and what it means for institutional demand for XRP and blockchain-native treasury stacks.

A practical playbook for trading XRP around Ripple’s XRP Community Day, where Brad Garlinghouse may unveil major news. Covers event themes, technical risk, position sizing and hedges tailored to swing traders and community investors.