Risk Management

This deep dive examines evidence of capital leaving Solana, deteriorating on‑chain activity, derivatives positioning and the liquidation clusters that could spark a SOL short squeeze. It concludes with tactical setups and risk controls for traders and desks.

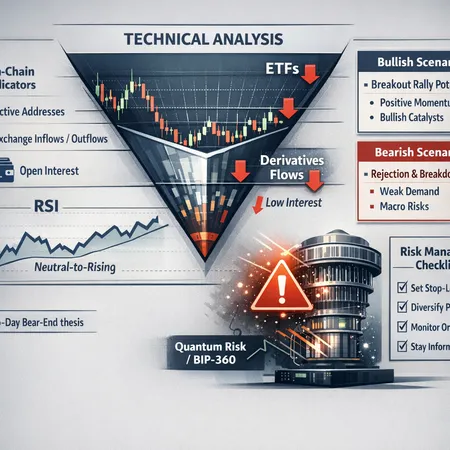

Bitcoin is compressing into a clear triangle while on-chain, derivatives and ETF flows show mixed demand; add quantum-computing concerns and you have a complex risk set for traders and allocators. This article synthesizes the technical setup, expert timelines, on-chain/derivatives context, emerging protocol risk, and concrete scenario planning.

A $543M whale dump has tightened ETH price structure into a bear pennant with $1,950 watching as critical support and a measured downside near $1,200. This article unpacks on-chain liquidity risks, the technical setup, scenario-based trade and hedge plans, and how hedging markets interact with Ethereum's longer-term fundamentals.

Binance’s launch of 5x perpetuals on Aztec marks a turning point for privacy-layer assets, accelerating derivatives liquidity but also exposing sharp market-structure risks seen in coins like Monero. Traders and risk teams must weigh funding dynamics, mark-price sensitivity, order-book depth and surveillance tensions when sizing positions.

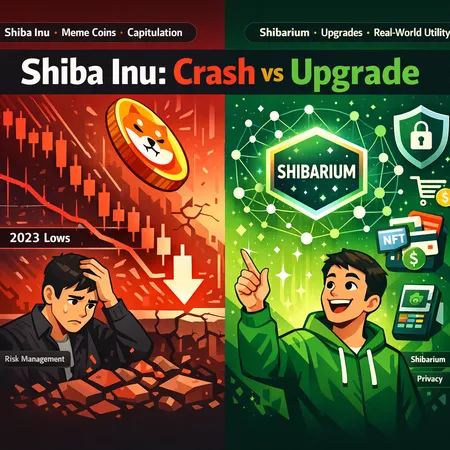

Shiba Inu sits between two narratives: a technical crash to 2023 lows and a bullish roadmap tied to Shibarium upgrades. This piece compares both views, examines market drivers, and gives practical risk-sizing frameworks for retail traders and community managers.

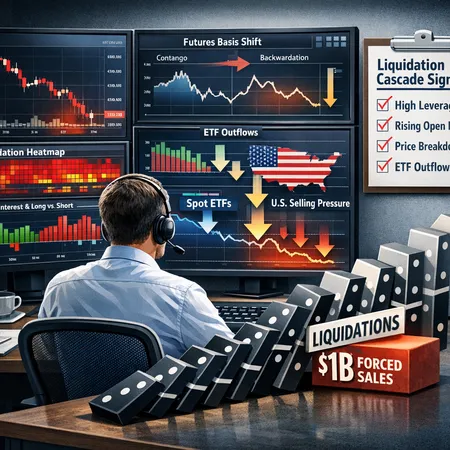

A tactical framework for traders and risk managers to detect mounting liquidation cascade risk in BTC markets — combining on‑chain signals, derivatives metrics and ETF flow context. Practical checklist included.

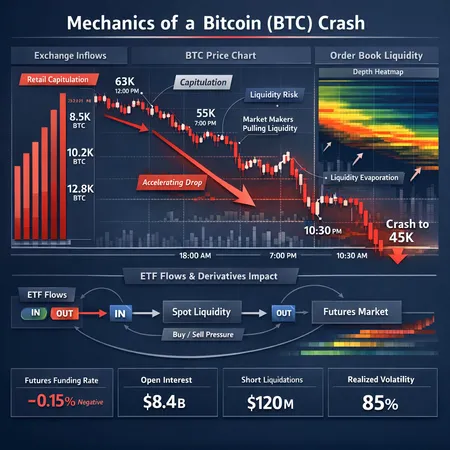

A deep analysis of the drivers behind Bitcoin’s recent crash and volatile swings, synthesizing on-chain inflows, market-maker behavior, ETF flows, and macro liquidity risks with actionable signals for traders.

Buying Bitcoin during a crash can be rewarding but is not automatically the 'right' move for every investor. This guide combines history, on-chain metrics, technical signals like the Mayer Multiple, and risk-management frameworks to help retail and intermediate investors decide when and how to accumulate during sell-offs.

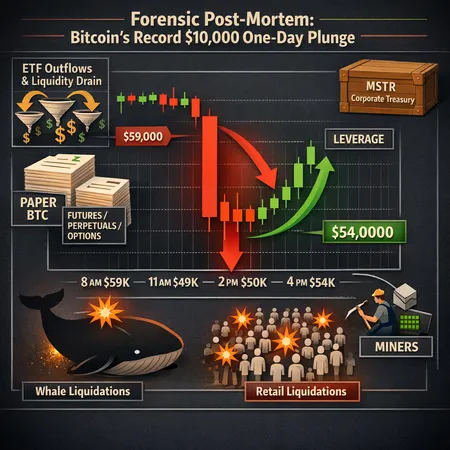

A forensic post-mortem of Bitcoin’s record one-day drop, examining the timeline, ETF outflows, derivatives-driven synthetic supply, liquidation dynamics, and practical risk-management lessons for institutions and retail.

Tether’s Q4 2025 jump to a $187B market cap concentrates USDT liquidity and reshapes on‑chain capital flows — a mixed signal for treasurers weighing liquidity efficiency against concentration and counterparty risks. This article breaks down the implications and practical mitigation steps for institutional risk teams.