Liquidity

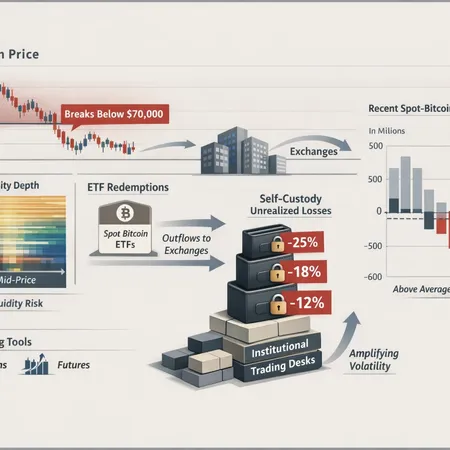

Recent large spot-BTC ETF outflows have pressured prices and driven heavy unrealized losses in self-custody wallets. This article explains the mechanics, why slipping below $70k matters for market structure, and actionable hedges and liquidity rules for allocators and traders.

As roughly $30B of SOL sits staked, liquid staking and derivative tokens could free huge on‑chain liquidity — even as SOL ETFs register notable outflows. Builders should weigh the mechanics, timelines, and product opportunities to capture that capital.

Binance’s roughly $9B drop in exchange-backed stablecoin reserves over three months tightens market liquidity and increases margin and systemic risk across derivatives and spot markets. Professional traders and risk officers should treat shrinking exchange stablecoin balances as an early-warning signal and update collateral, stress-testing, and counterparty policies accordingly.

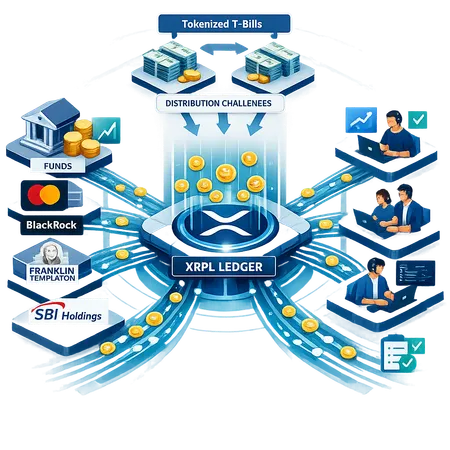

A convergence of protocol upgrades, rising Wall Street interest and renewed token‑economics scrutiny suggests XRPL could see a fresh wave of institutional and developer activity. For product and compliance teams, the shift raises opportunity — and new questions about liquidity, custody and counterparty transparency.

New stablecoin primitives — from Tether’s USDT0-backed perpetuals to Ripple’s RLUSD surge on Ethereum — are changing how perpetuals are collateralized, settled and liquidated. This article breaks down mechanics, liquidity benefits, cross-market risks and regulatory questions for DeFi product leads and derivatives traders.

Ripple’s RLUSD landing on Binance’s XRP Ledger is a strategic milestone that enhances stablecoin utility and on‑chain liquidity. Large on‑chain XRP movements tied to exchanges may reflect deeper liquidity operations that investors should monitor.

Despite steady spot-BTC ETF demand that almost erased last week’s outflows, Bitcoin remains unusually volatile. This piece parses ETF flow data, technical pressure around $69k–$70k, institutional narratives, and how stablecoin and exchange liquidity amplify swings.

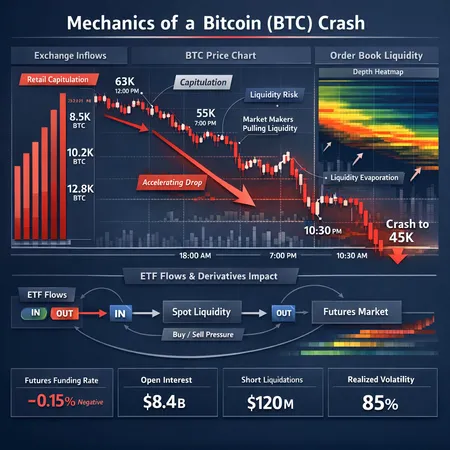

A deep analysis of the drivers behind Bitcoin’s recent crash and volatile swings, synthesizing on-chain inflows, market-maker behavior, ETF flows, and macro liquidity risks with actionable signals for traders.

A data-led take on XRP’s sharp rebound, what $11B of inflows tells us about liquidity and market structure, and whether Ripple’s push toward real-world payments can sustain institutional on‑ramps.

Tether’s Q4 2025 jump to a $187B market cap concentrates USDT liquidity and reshapes on‑chain capital flows — a mixed signal for treasurers weighing liquidity efficiency against concentration and counterparty risks. This article breaks down the implications and practical mitigation steps for institutional risk teams.