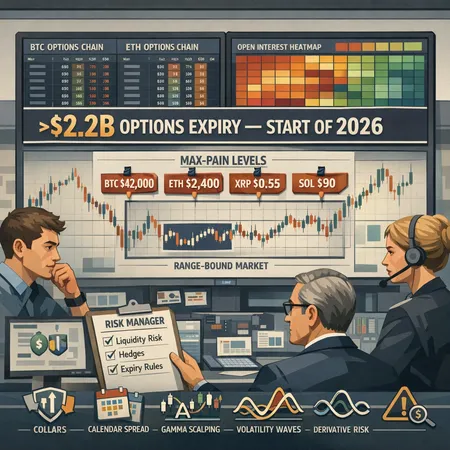

How the >$2.2B BTC/ETH Options Expiry Shapes Hedging: Max‑Pain, Open Interest and Trade Tactics

Summary

Why the early‑2026 >$2.2B BTC/ETH expiry matters

At the start of 2026 more than $2.2 billion of BTC and ETH options were set to expire — a cluster large enough to change where market makers hedge and where spot price gravitates. Large expiries act like gravitational wells: the combination of open interest (OI) concentration, dealers’ delta hedging and short‑term rebalancing flows can pull price toward max‑pain strikes or amplify intraday swings. As reported recently, traders were particularly cautious ahead of that expiry, given the size and the market’s range‑bound structure going into it source.

This matters for anyone trading BTC options, ETH options or managing derivatives risk: understanding the structural dynamics — not just directional bias — is how you avoid being on the wrong side of dealer gamma or funding squeezes.

Max‑pain, open interest distribution and short‑term anchoring

What is max‑pain and how reliable is it?

Max‑pain is the strike price where option holders would collectively lose the most value at expiry. Dealers who are short options may prefer spot to close near that level because it minimizes their hedging costs. In practice, max‑pain acts as a short‑term anchor — not a ceiling. The effect is stronger when OI is highly concentrated around a narrow range and when liquidity is thin.

Recent analysis showed specific max‑pain levels for BTC, ETH, XRP and SOL, and markets often gravitate toward these levels as expiry passes — especially when expiry sizes are large relative to daily notional turnover (analysis of max‑pain levels). For traders, that means anticipating a bias to the strike cluster and planning hedges accordingly.

Open interest distribution: the map of potential hedging flows

Open interest by strike is the practical map of where dealer delta hedging will occur. Two simple patterns matter:

- Concentrated OI around a narrow strike band = stronger max‑pain pull and concentrated gamma hedging.

- Widely dispersed OI = less single‑strike anchoring, but more complex multi‑strike hedging that can widen intraday ranges.

Look at both call and put OI, and the net positioning (calls minus puts) — if calls dominate at a handful of strikes above spot, dealers may sell delta into rallies (shorting spot or futures), producing resistance. Conversely, put clusters below spot can create asymmetric downside pressure as dealers hedge by buying spot on dips.

Range‑bound structure and why traders were cautious ahead of expiry

As multiple sources noted, Bitcoin was trading within a well‑defined range going into the expiry and many participants scaled risk back rather than add directional exposure (range‑bound reporting). Why the caution?

- Expiry day gamma: Large expiries increase dealer gamma exposure, which can flip quickly as strikes move in/out of the money. That raises intraday volatility even when the broader trend is flat.

- Liquidity risk: If the spot moves toward a strike cluster, hedging flows can consume order book liquidity, moving price further and increasing slippage.

- Funding and basis interactions: Futures and perpetual funding react to flow; aggressive hedging can create funding spikes that make carry trades expensive.

For risk managers, that translates to: trim directional sizes, widen stop placements, and avoid one‑way exposure that expiry hedging can overwhelm.

Tactical strategies by risk profile

Below are practical options strategies — with rationale — tailored to conservative, balanced and aggressive traders dealing with expiry risk and elevated gamma.

Conservative: Collars to protect spot holdings

Structure: Long spot or large spot exposure + buy put (protective) + finance with short call (covered call) at a strike above expected max‑pain.

Why it works:

- Limits downside exposure while allowing some upside.

- Reduces vega and gamma exposure compared with naked puts.

- The short call can be placed beyond likely max‑pain to reduce the chance of early exercise (if American‑style) and to keep premium collected modest.

Execution tips:

- Choose put strike for the protection level you need (e.g., -10% to -20%).

- Ideally set the short call at or above a pessimistic max‑pain level if you prefer to be called away rather than realize a loss.

- Monitor order book depth; large expiries can widen bid/ask for the strikes used.

Balanced: Calendar spreads to play time decay and implied vol term structure

Structure: Sell near‑term option at strike near expected max‑pain; buy longer‑dated option at the same strike (or a nearby strike).

Why it works:

- You’re short front‑month theta and long longer‑dated vega — you profit if front‑month premium collapses after expiry or realized vol stays muted.

- It reduces directional exposure compared with a pure short straddle, while still monetizing elevated front‑month implied volatility.

Execution tips:

- Use strikes near where OI is concentrated if you believe price will be anchored there; this captures larger front‑month decay.

- Beware of large spot moves; add a protective wing if you need convexity protection.

Aggressive: Gamma scalping and structured delta hedging

Structure: Buy options (often ATM) and dynamically hedge spot/futures to capture realized vol > implied vol, or sell options and manage gamma carefully if you’re a market maker.

Why it works:

- Gamma scalping profits if you can capitalize on intraday volatility around expiry while keeping net delta near zero.

- In a range‑bound market with dealer flows creating mean‑reverting moves, nimble scalping captures repeated small moves.

Execution tips:

- Requires tight execution, low transaction costs and access to deep liquidity (prefer limit orders or smart order routing). Institutions sometimes use automated hedging bots to manage rebalancing thresholds.

- If gamma is highly concentrated at a strike, be ready for large re‑hedging steps; set rebalancing deltas (e.g., rebalance when net delta exceeds X BTC/ETH) and test slippage assumptions ahead of expiry.

Hybrid ideas: Protective calendar collars and ratio spreads

- Protective calendar collar: combine collar and calendar elements — buy a long‑dated protective put, sell a short‑dated call to fund it, and add a back‑month call/put to limit assignment risk.

- Ratio spreads: sell more calls than longs to finance cheap protection; use only if you have conviction and a plan for margin/funding if price gaps.

Hedging checklist for expiry day liquidity risk

Practical pre‑expiry checklist for traders and risk managers:

- Map the OI: identify top 5 strikes by OI on both call and put sides for BTC and ETH. Those are probable hedging magnets.

- Estimate notional vs daily volume: if expiry notional >> daily turnover, expect outsized moves and thin order books.

- Set pre‑defined rebalance rules: delta thresholds, max trade size per minute, and slippage caps.

- Stress test worst‑case fills: run fills with 2–5x typical spread assumptions to gauge P&L impact.

- Manage funding basis: monitor perpetual funding and be ready to hedge with futures rather than spot to reduce basis cost.

- Reduce one‑way exposure: convert large single‑direction bets into spreads or collars ahead of the expiry window.

- Maintain execution diversity: prefer algorithms, multiple venues and OTC desks for block trades if you must move size.

- Liquidity buffers: hold excess collateral or a liquidity reserve to meet margin calls if volatility spikes.

- Communication plan: institutional desks should pre‑announce large rebalancing intentions to counterparties to avoid surprising the market.

- Post‑expiry unwind plan: have rules for rolling or unwinding positions if price ends far from your hedge assumptions.

Managing volatility and derivatives risk in practice

A few practical points that separate tactical winners from reactive losers:

- Volatility is a relative game: front‑month IV often inflates into expiry. If you expect realized vol to be lower, sell front‑month premium (calendar or spreads). If you expect a volatility event, buy protection.

- Watch gamma sign changes: as spot crosses strike clusters, dealers flip from selling to buying delta (or vice versa). Anticipate these flips and avoid getting caught on the wrong side.

- Keep collateral flexible: margin calls during expiry can force liquidations; pre‑fund margins or arrange committed lines with counterparties.

- Hedging instrument choice matters: sometimes hedging with futures reduces slippage compared with spot, especially when spot order books thin.

Example scenarios and trade frameworks

Scenario A — Price sits inside max‑pain band: Sell front‑month theta via a calendar or iron‑condor sized to your risk tolerance, collect premium and set tight rebalancing rules.

Scenario B — Price drifts toward a large OI put cluster below spot: Dealers will hedge by buying spot as puts move ITM; consider protective collars or reduce long spot exposure.

Scenario C — Sudden breakout away from max‑pain: Volatility spikes; protective puts or widening collars become valuable. Consider switching from premium seller to protection buyer quickly rather than averaging into a breakout.

Final rules of thumb

- Treat max‑pain as a bias, not a prediction. It’s a magnet if OI is concentrated and liquidity is thin.

- Size for slippage: assume wider spreads and lower depth on expiry day; pre‑size or use TWAP/algos.

- Use layered hedges: combine time (calendars), wings (collars) and dynamic delta rules (gamma scalping) to manage both directional and convexity risk.

For many traders, monitoring Bitcoin and Ethereum OI maps alongside funding rates provides an early read on where dealer hedging might push price. Platforms like Bitlet.app and OTC desks can help execute complex multi‑leg trades or source liquidity for large blocks — but execution planning remains the critical edge.