Derivatives

This deep dive examines evidence of capital leaving Solana, deteriorating on‑chain activity, derivatives positioning and the liquidation clusters that could spark a SOL short squeeze. It concludes with tactical setups and risk controls for traders and desks.

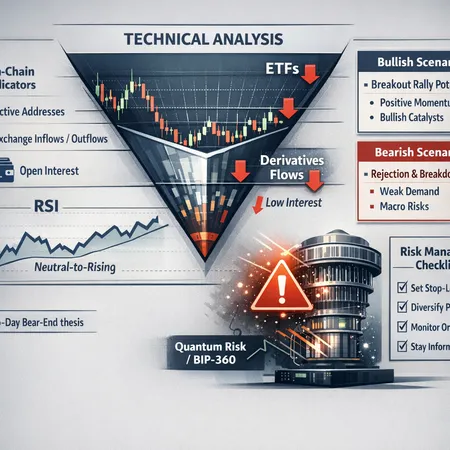

Bitcoin is compressing into a clear triangle while on-chain, derivatives and ETF flows show mixed demand; add quantum-computing concerns and you have a complex risk set for traders and allocators. This article synthesizes the technical setup, expert timelines, on-chain/derivatives context, emerging protocol risk, and concrete scenario planning.

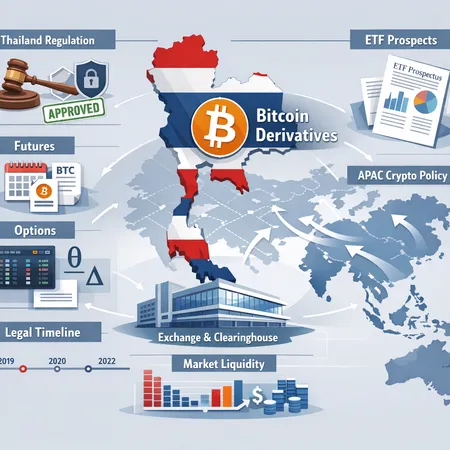

Thailand’s Cabinet has approved Bitcoin as an underlying asset for regulated futures and options, opening a new corridor for institutional trading and product development in APAC. This explainer breaks down the legal change, what derivatives will be possible, ETF prospects, liquidity expectations and compliance guardrails.

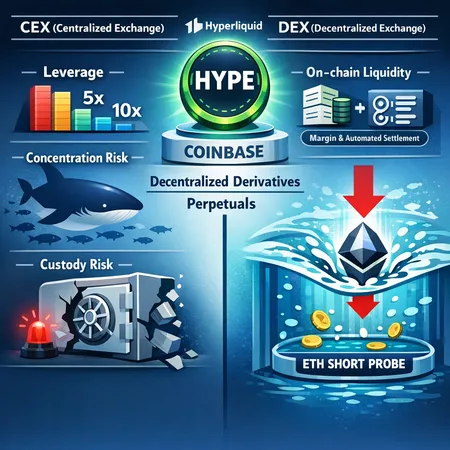

Hyperliquid recently overtook Coinbase in notional perpetual trading volume, marking a watershed moment for decentralized derivatives. This article explains the mechanics that enabled that shift, examines systemic risks through an ETH short probe, and outlines what traders and protocol designers should weigh when moving perp flow on‑chain.

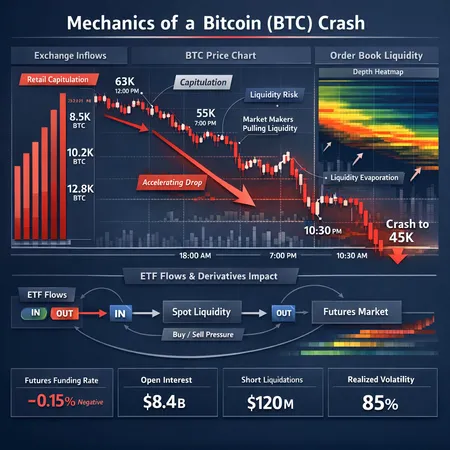

A deep analysis of the drivers behind Bitcoin’s recent crash and volatile swings, synthesizing on-chain inflows, market-maker behavior, ETF flows, and macro liquidity risks with actionable signals for traders.

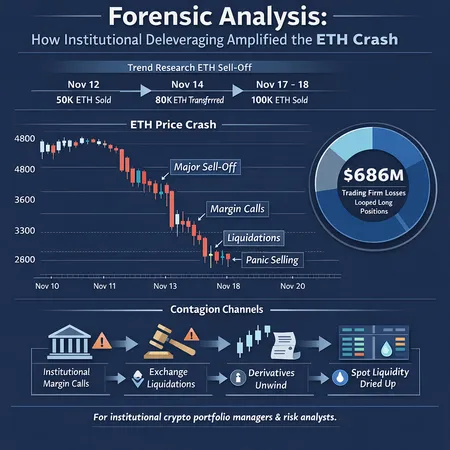

A forensic review of how institutional selling, margin calls, and looped long positions turned an ETH drawdown into a cascading market event. Using Trend Research and a related trading-firm collapse as a case study, this report maps the timeline, contagion channels, and practical lessons for risk teams.

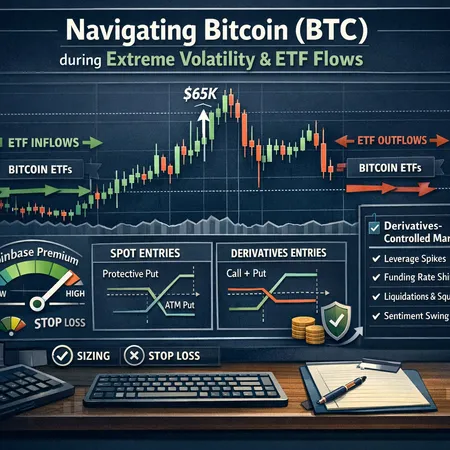

Practical rules, setups and risk controls for trading BTC when ETF flows and derivatives dominate price action. Learn how to read ETF and Coinbase premium signals, size trades in high volatility, use options hedges, and trade whipsaws effectively.

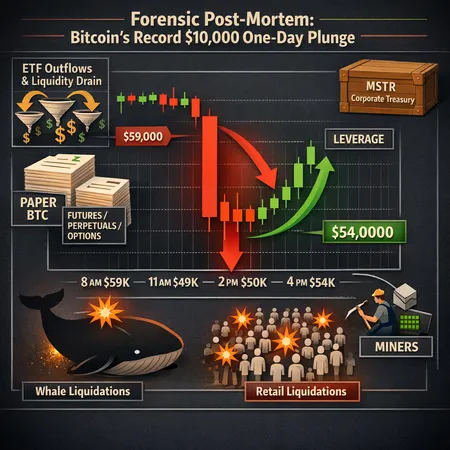

A forensic post-mortem of Bitcoin’s record one-day drop, examining the timeline, ETF outflows, derivatives-driven synthetic supply, liquidation dynamics, and practical risk-management lessons for institutions and retail.

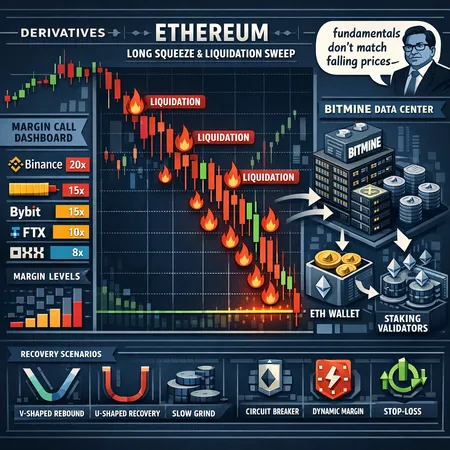

A deep dive into the recent sharp Ethereum derivatives long‑squeeze, the margin mechanics that amplified it, and the counter‑narrative of institutional accumulation by BitMine and Tom Lee’s bullish view. Scenario planning and risk controls for active ETH traders and derivatives desks are included.

A tactical guide for active traders and PMs to convert the Feb 2 liquidation event into repeatable risk rules. Learn the anatomy of the crash, how exchange and corporate moves change liquidity, derivative signals to watch, and five concrete risk-management playbooks.