Macro

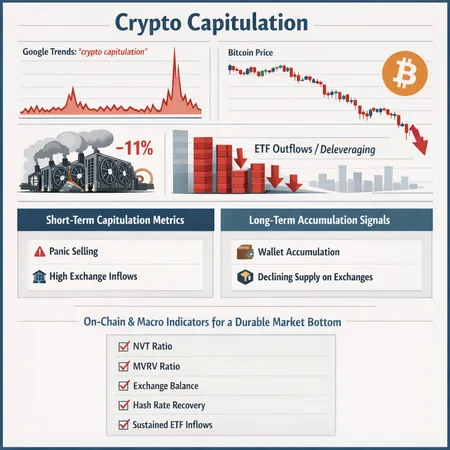

Capitulation signs are flashing across crypto — from Google Trends to an abrupt drop in mining difficulty and ETF-driven deleveraging. This piece diagnoses what those signals mean for a sustainable BTC market bottom and lays out a practical checklist of on-chain and macro indicators to watch.

During recent market stress gold staged a six‑month rally that echoed parts of the 2019 cycle while Bitcoin experienced heavy outflows and rotation. This piece explains the drivers behind the shift and offers practical portfolio allocation frameworks for balancing BTC and precious metals in 2026.

A strategic explainer for macro-focused investors on why capital rotated into gold and silver recently, and which macro and on-chain catalysts could reverse the narrative in favor of BTC.

A balanced guide for intermediate traders and risk managers weighing Bitcoin’s upside momentum toward $100K against credible crash scenarios and the indicators that could validate each path.

Hashrate has slipped while improbable solo-mining windfalls still happen — and corporate Bitcoin buys are reshaping miner economics. This piece explains why these trends co-exist and what mining operators and analysts should do next.

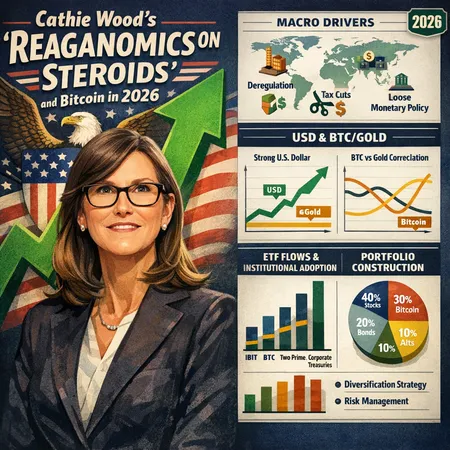

Cathie Wood's thesis of a deregulatory, tax-cut, risk-on US macro regime could rewrite Bitcoin's portfolio role in 2026. This article breaks down the macro argument, on-chain and ETF signals, and practical allocation and risk-management approaches for investors treating BTC as a diversifier.

A data-driven look at how spot BTC ETF flows, corporate treasuries and exchange deposits pushed Bitcoin through $94.5–96k and what that means for a move toward $100k. Includes flow numbers, short-liquidation dynamics, futures positioning and macro risks for portfolio managers.

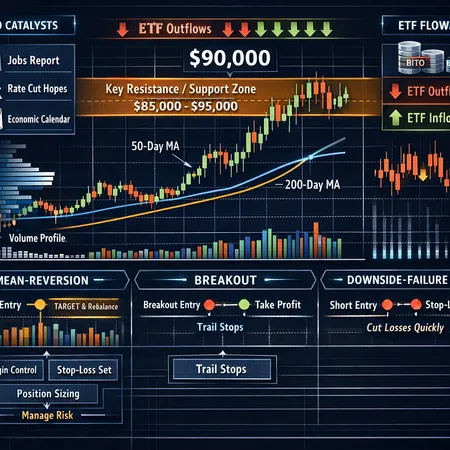

Bitcoin is trapped in a critical $85k–$95k band in early 2026, where technical structure, ETF flow dynamics and macro signals will dictate the next major leg. This piece synthesizes levels, orderflow implications of ETF outflows, macro drivers and actionable scenario-based trade plans for intermediate-to-advanced traders.

A pragmatic guide for wealth managers weighing extreme long-term Bitcoin forecasts against present market stressors. It lays out the assumptions behind hyper‑bull cases, the near‑term signals that matter, and a framework for multi‑horizon positioning.

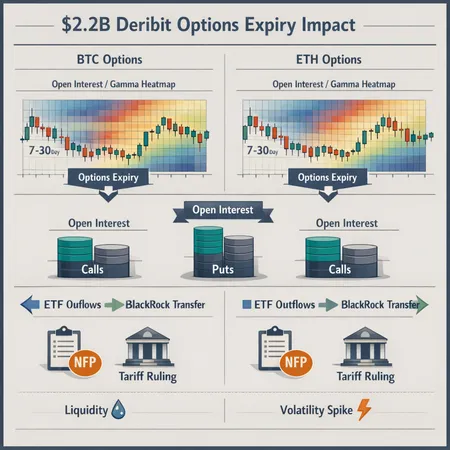

A detailed look at the $2.2B Deribit options expiry, the open interest backdrop, and how looming U.S. NFP and a Supreme Court tariff ruling amplify gamma, liquidity risk, and ETF flows in BTC and ETH. Practical trade and desk-level risk-management scenarios for the next 7–30 days.