On-Chain

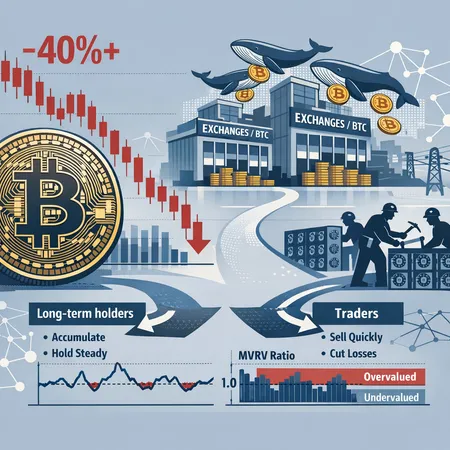

After a rapid 40%+ decline in BTC prices, investors must separate a tactical bounce from structural capitulation. This article analyzes the timeline, on-chain signals, whale selling and exchange inflows, miner and treasury implications, and concrete rules for positioning.

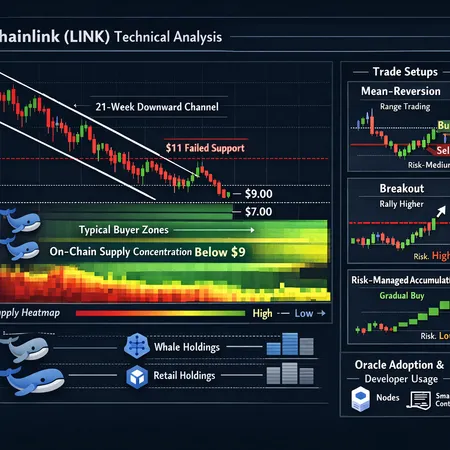

A technical and on‑chain dive into LINK’s sustained sell-off, where supply is clustering, and practical trade plans for different timeframes. Includes support levels, whale behaviour, oracle adoption implications and three disciplined setups to trade or accumulate LINK.

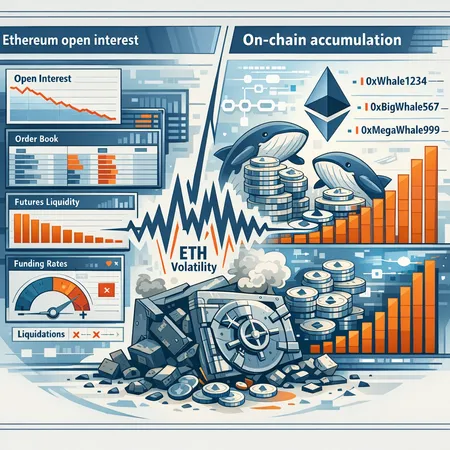

Ethereum’s on-exchange open interest has slipped even as on-chain whale accumulation picks up. This piece reconciles those signals, explains the mechanics (funding rates, liquidations, treasury moves like Ethzilla), and gives a trader’s checklist for risk and entries.

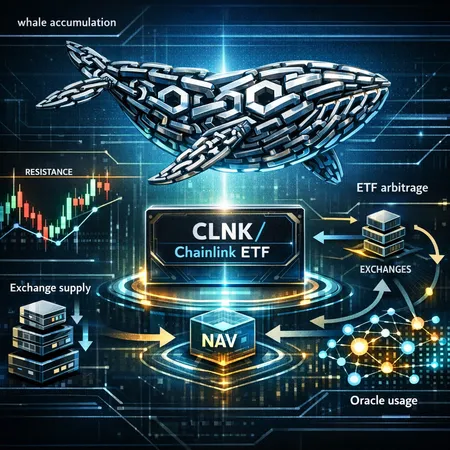

The Bitwise Chainlink ETF (CLNK) opened a new chapter for LINK markets — but whales, on-chain flows and ETF arbitrage mechanics are doing the heavy lifting behind price moves. This guide breaks down what on-chain analysts should track before following whale activity into LINK.

A data-driven look at how spot BTC ETF flows, corporate treasuries and exchange deposits pushed Bitcoin through $94.5–96k and what that means for a move toward $100k. Includes flow numbers, short-liquidation dynamics, futures positioning and macro risks for portfolio managers.

Solana cleared $140 with heavy trading volumes even as on-chain activity shows signs of cooling. This piece reconciles the divergence, examines whether ETF inflows and altcoin rotation can push SOL to $150, and lists the on-chain and technical checks traders should run before treating the move as a tradable breakout.

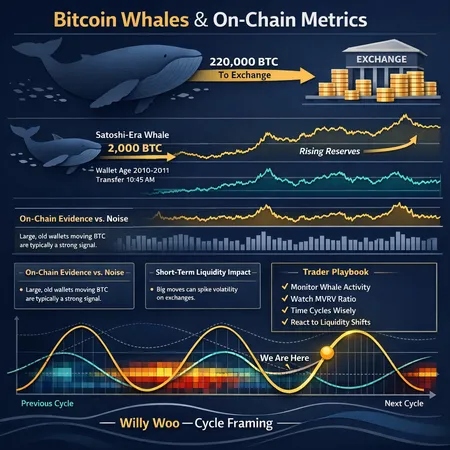

A data‑first analysis reconciling headlines about 220,000 BTC sold, a 2,000 BTC Satoshi‑era transfer, and whether Bitcoin’s four‑year cycle still matters. Actionable signals and a trader playbook to separate noise from on‑chain signal.

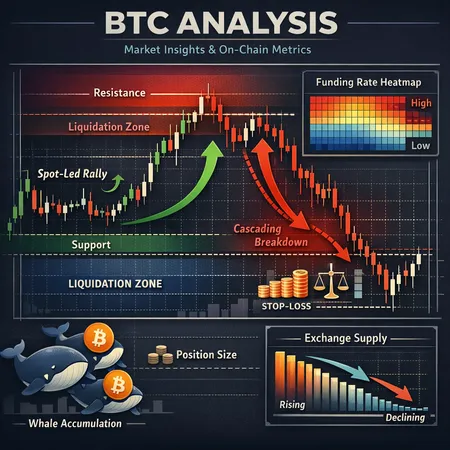

A look at whether BTC's recent price action is set for a sustained spot-led rally or vulnerable to a derivatives-driven breakdown, using funding rates, exchange supply, whale behavior, and liquidation risk to build actionable scenarios.

A data‑driven look at why buyers stepped into STX’s 23% pop, how underwater holders shape follow‑through risk, and a concise checklist for swing traders and allocators to manage the volatility.

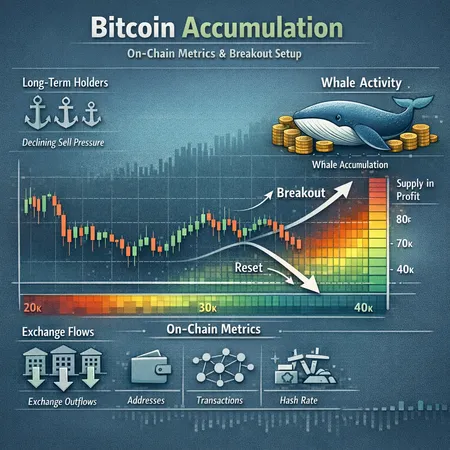

A balanced on‑chain analysis shows valid signals for durable accumulation by long‑term holders, but important counterarguments caution against over‑interpreting whale activity and exchange flows. Traders should convert these signals into scenario-based risk plans ahead of a potential 2026 breakout.