XRP Rally Explained: Distributions, ETF Demand, and Ripple’s Strategic Shift

Summary

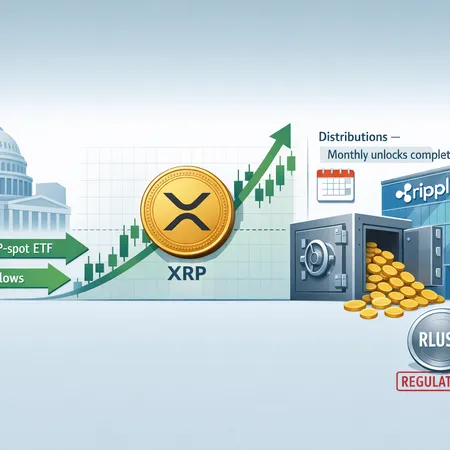

Quick take: why this rally feels different

XRP’s recent rally looks less like a fleeting meme-driven spike and more like the convergence of supply discipline, institutional demand, and corporate signals. On the supply side, Ripple’s monthly distributions — which historically release XRP from escrow — are more predictable than many tokens’ unlocks, and traders pay attention. Demand is shifting too: conversations around an XRP-spot ETF and broader market-structure reform at the Senate level are changing how institutions view XRP exposure. Finally, Ripple’s product and messaging tweaks (including moves tied to a regulated stablecoin, RLUSD) are nudging narrative risk lower and credibility higher.

For context, retail traders still watch Bitcoin as a macro bellwether, but XRP’s dynamics are increasingly driven by token-specific flows and regulatory developments.

Distributions: why monthly unlocks matter for supply dynamics

Ripple releases XRP from escrow on a monthly schedule; those monthly distributions are a core part of the token’s supply story. Markets treat these releases as both a known supply injection and a potential selling pressure event — especially when recipients or exchanges move large tranches.

Recent on-chain analysis indicates Ripple completed the January monthly distribution, meaning that one predictable source of supply has already been accounted for by market participants. The on-chain breakdown and tracking of that release were summarized in reporting that showed January’s distribution was finalized, which helps explain why price activity tightened around that timeframe and why larger buyers were willing to step in afterward (on-chain distribution report).

Why the market cares:

- Predictability reduces surprise selling. When traders know exactly how much is unlocked and when, they can price it in earlier rather than panic-selling on an unexpected flow.

- Escrow mechanics mean future months remain visible. If Ripple reduces or reallocates distribution patterns, that’s a structural change markets will reward or penalize accordingly.

- Distribution recipients matter. If funds move directly to exchanges, immediate liquidity rises; if funds are transferred to OTC desks or long-term partners, the selling pressure may be muted.

On balance, completing January’s release removed one near-term overhang and let demand-side narratives piggyback on the move.

ETF demand and macro / regulatory tailwinds

Institutional narratives matter more now than they did a few years ago. Conversations around spot-ETF adoption for crypto have a spillover effect: as managers and allocators become comfortable buying spot tokens in regulated vehicles, they look for liquid, compliant products beyond BTC and ETH. That dynamic is part of why analysts and market participants are debating whether an XRP-spot ETF (or simply easier institutional access to XRP) could materially increase demand.

A separate but related angle is U.S. market-structure reform. Recent reporting tied a Senate-level market-structure bill to broader ETF appetite and pricing implications, suggesting legislative moves could indirectly make institutional flows into tokens like XRP more viable (analysis of Senate bill and ETF implications).

Taken together, these demand-side themes — ETF narratives and regulatory clarity or market-structure changes — create a higher floor for institutional interest. That’s not a guaranteed inflow, but it turns a speculative asset into one that fits more neatly into compliance-minded portfolios, especially when a company like Ripple signals alignment with regulated products.

Technical picture: resistance, targets, and what to watch short-term

Technical traders looking at XRP are calling out clear horizontal resistance zones and a plausible path higher if volume confirms the breakout. Some price models and technical commentaries point to a near-term target around $2.30 if momentum and ETF-driven flows persist (short-term price target coverage).

Key technical levels to monitor:

- Immediate resistance band: where recent peaks clustered — a failure there could re-test lower supports.

- Confirmation metric: sustained volume above the breakout level and shrinking exchange outflows (indicating holders aren’t rushing to sell).

- Risk level: a decisive close below the short-term moving averages or a sudden spike in exchange balances could flip the trade negative.

Volume and order-flow tell the story more than price alone. For this reason, many traders watch ETFs and custody announcements tightly; a confirmed institutional product or major custodian onboarding XRP would be a technical and fundamental catalyst rolled into one. Meanwhile, retail platforms and services (including P2P and installment options on platforms like Bitlet.app) can amplify accessibility, but they aren’t the primary driver of institutional tape.

Ripple’s corporate strategy: RLUSD, CTO signals, and tilting toward regulation

Beyond supply and demand lies corporate intent. Ripple appears to be leaning into regulated product development: RLUSD, Ripple’s proposed stablecoin initiative, is one such example. A regulated stablecoin tied to Ripple’s ecosystem could create new rails for on- and off-ramp activity, institutional settlement, and product innovation — all of which would increase native demand for XRP over time if integrated into Ripple’s network or custody flows.

Corporate signals are subtle but notable. Coverage of changes to Ripple CTO David Schwartz’s X bio — and how Ripple is presenting itself publicly — has been interpreted as a sign the company is signaling a compliance-first, product-focused posture to regulators and institutional partners (CTO bio update reporting). That may seem cosmetic, but messaging matters: institutions vet counterparty risk and corporate governance, and visible alignment with regulatory expectations lowers onboarding friction.

Put together, RLUSD and messaging shifts suggest Ripple is building the plumbing and the narrative required to attract regulated flows — an important consideration for investors weighing the durability of any rally.

Market reaction and sentiment: why prices moved this time

Media and market write-ups highlighted several proximate reasons for the recent spike: the completion of the January distribution, positive headlines about institutional interest, and technical breakouts that drew momentum traders. Real-time market commentary noted the price reaching multi-week peaks with traders pointing to both on-chain mechanics and ETF/regulatory optimism as causes (price-move analysis).

This combination — a supply event that was already known and digested, plus growing demand narratives — tends to produce cleaner rallies than those purely driven by speculative chatter.

Risks and what could reverse the trend

No rally is bulletproof. Key risks to watch:

- Future distribution patterns. If Ripple changes escrow rules or a large tranche hits exchanges, that would reintroduce selling pressure.

- Regulatory shocks. A negative regulatory ruling or adverse legislation could rapidly unwind institutional appetite despite product signals.

- Liquidity and sentiment shifts. Crypto markets are correlated; macro deleveraging or a Bitcoin crash tends to drag correlated tokens down even if local fundamentals remain intact.

- Overreliance on narrative. ETF talk can accelerate flows, but until regulated products and custody arrangements are implemented at scale, the story can fade.

Practical risk management: track exchange balances, watch monthly escrow transparency reports, and use position sizing that respects the possibility of sharp drawdowns.

A pragmatic checklist for investors: what to monitor next

- Escrow and distribution schedule: are future monthly releases smaller, larger, or unchanged? On-chain trackers and official Ripple disclosures will show this.

- ETF and custody headlines: filings, approvals, and major custodian announcements materially change demand forecasts.

- RLUSD and Ripple product updates: successful pilots, regulatory filings, or commercial partnerships would be long-term positives.

- On-chain flows and exchange balances: decreasing exchange reserves and rising long-term wallet concentrations suggest demand is taking supply off the market.

- Senate and regulatory developments: bills or guidance that change market structure or institutional appetite will affect the mid-term thesis.

Also keep an eye on technical confirmation (volume, breakout closes) rather than chasing moves purely on headlines.

Bottom line: sustainable or a short-lived pop?

The recent XRP rally has stronger structural underpinnings than a headline-only move. Completing the January distribution removed a known supply overhang, ETF/regulatory narratives are increasing institutional optionality, and Ripple’s product and messaging changes (including RLUSD emphasis and CTO bio tweaks) are consistent with a compliance-first approach that institutions prefer.

That said, sustainability depends on execution and evidence: actual institutional flows, custody integrations, and continued responsible distribution management. Watch the checklist above — particularly ETF and custody developments, escrow flows, and RLUSD progress — to separate a durable trend from a temporary re-rating.

If you’re monitoring XRP closely, mix technical discipline with an eye on these fundamental signals rather than relying on any single headline.

Sources

- Why XRP price rose to a multi-week peak and market reaction: CryptoPotato

- On-chain data on Ripple finalizing January’s monthly XRP release: U.Today (January distribution)

- Technical price target and short-term bullish thesis: Blockchain.News (XRP $2.31 target)

- Senate market-structure bill and ETF demand discussion: FXEmpire

- Ripple CTO bio updates and corporate emphasis on 2026 changes: U.Today (CTO bio update)