Blog posts

Injective’s recent governance-approved upgrade and roughly 2 million INJ of on-chain accumulation create a favorable setup. This case study reconciles the upgrade mechanics, accumulation dynamics, analyst technicals, and risk-adjusted trade scenarios for speculative allocators.

Stablecoins function as crypto’s deployable cash — a small shrink in supply or a regional issuance change can meaningfully reduce on‑ramp liquidity and amplify Bitcoin volatility. This piece investigates the mechanics behind a 1% stablecoin slip and Tether’s CNH phaseout, and models plausible stress scenarios for BTC markets.

A practical guide for DeFi users, community managers, and security teams on defending against fake ads and phishing, dissecting recent Uniswap-targeted scams and confusing breach claims like the IoTeX kerfuffle.

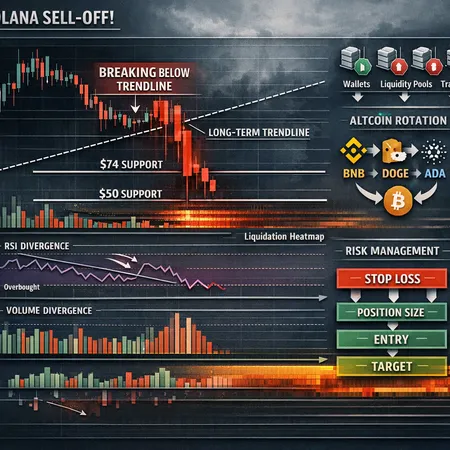

SOL recently broke a multi-month trendline and is testing critical support around $74 — failure could open a path toward $50. This piece diagnoses the break, explains on-chain and liquidity drivers, places SOL inside an ongoing altcoin rotation, and gives actionable trade frameworks for active traders.

SBI Holdings’ new $64.5M on‑chain bond that pays investors in XRP adds a credible institutional use-case even as Ripple’s routine 1B monthly escrow unlocks introduce recurring supply risk. Asset managers should weigh settlement efficiency against short‑term technical pressure and plan hedges accordingly.

Sustained US spot Bitcoin ETF outflows are coinciding with macro shocks and network-level volatility (hashrate swings and a 15% difficulty jump), raising new liquidity and price-support risks for BTC. This piece integrates ETF flow data, on-chain signals, miner operational stress, and sentiment indicators into an actionable risk framework for institutional allocators.

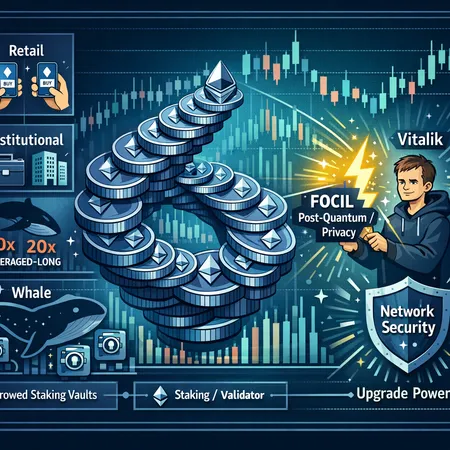

Despite a weak ETH price, on‑chain data shows record accumulation — a potentially bullish fractal that hides nuance around who’s buying and why. This deep dive parses the signal, staking concentration risks, and how Vitalik’s bolt‑on upgrade push could reshape the 2026 narrative.

FXRP topping 100M and ~70% deployed into the XRPFi DeFi stack signals a new chapter for tokenized XRP in on‑chain markets. This article breaks down how FXRP works, its implications for liquidity and price discovery, composability risks, and tactical ideas for yield farmers and LPs.

A practical guide for builders and growth teams to harness TON and Telegram’s massive user base to scale consumer Web3 apps—covering product hooks, onboarding UX, monetization, developer tools, compliance pitfalls and a month-by-month growth playbook.

A pragmatic market narrative assessing whether SUI’s recent price compression and growing institutional ETF activity could spark a new macro wave—plus a technical and on‑chain guide to sizing positions and managing risk.

U.S. spot Bitcoin ETFs show roughly $53B in cumulative net inflows even as funds experienced meaningful short‑term outflows. This article explains the chronology, ETF mechanics, and practical sizing rules for portfolio managers and swing traders navigating ETF‑driven liquidity events.

Metaplanet’s recent run-in over its BTC buying and options program has exposed weak spots in disclosure practices and board oversight for companies with large crypto treasuries. This investigation breaks down the timeline, the mechanics of the strategy, comparable failures, regulatory lessons, and a practical governance checklist for public firms holding crypto.