Technical Analysis

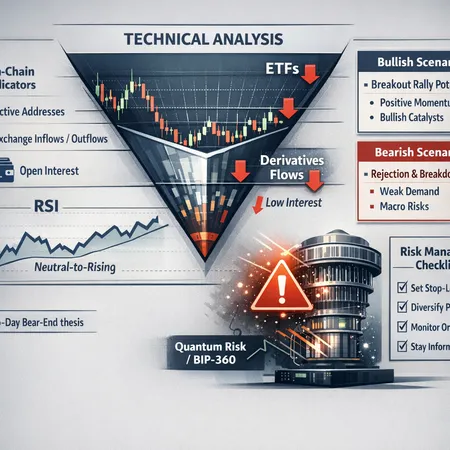

Bitcoin is compressing into a clear triangle while on-chain, derivatives and ETF flows show mixed demand; add quantum-computing concerns and you have a complex risk set for traders and allocators. This article synthesizes the technical setup, expert timelines, on-chain/derivatives context, emerging protocol risk, and concrete scenario planning.

A $543M whale dump has tightened ETH price structure into a bear pennant with $1,950 watching as critical support and a measured downside near $1,200. This article unpacks on-chain liquidity risks, the technical setup, scenario-based trade and hedge plans, and how hedging markets interact with Ethereum's longer-term fundamentals.

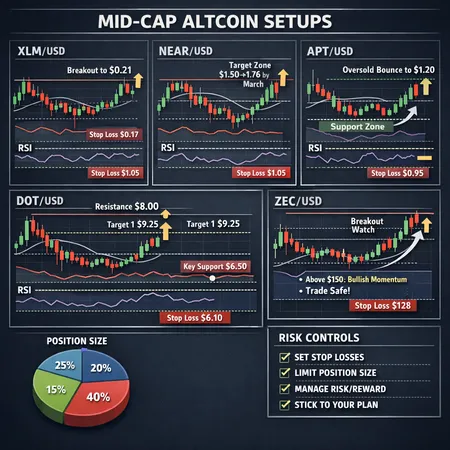

A tactical guide for intermediate traders: five mid‑cap altcoins showing clean technical setups, with price triggers, timeframes and practical risk rules. Includes trade management, position sizing and a portfolio construction framework.

XRP has re-emerged as a retail favorite, backed by a meaningful private valuation update for Ripple and a technical pivot at $1.40. This piece maps the bullish scenarios traders watch, the catalysts that could validate a breakout to $3.00+, and the risks that would snuff the momentum.

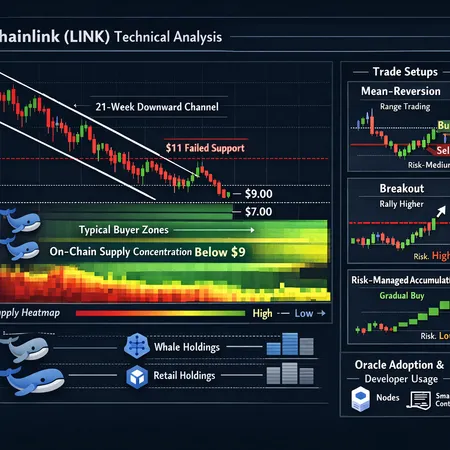

A technical and on‑chain dive into LINK’s sustained sell-off, where supply is clustering, and practical trade plans for different timeframes. Includes support levels, whale behaviour, oracle adoption implications and three disciplined setups to trade or accumulate LINK.

A cluster of $677M+ BTC liquidations, $1.72B in spot ETF outflows and key technical breaks have traders asking whether a larger correction is starting. This article dissects the on‑chain and order‑book signals that preceded the crash, the liquidity impact of ETF withdrawals, critical supports to watch, and a practical risk‑management playbook for spot and derivatives traders.

Traders face a split signal: technicals point to a potential weekly falling wedge breakout for DOGE while early TDOG flows are weak. This piece lays out how to combine ETF flow data with chart setups and practical risk rules.

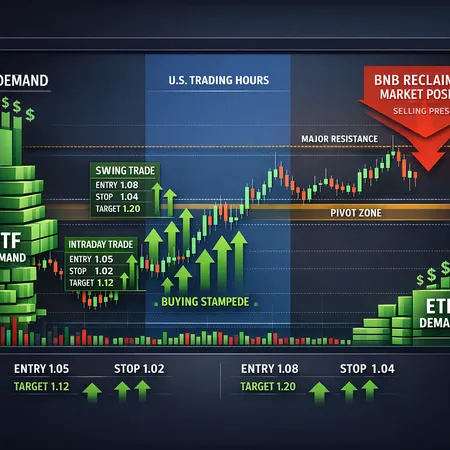

A tactical guide for traders: how concentrated U.S. trading hours, ETF-linked inflows, and shifting liquidity with BNB shape XRP’s near-term upside and downside. This article lays out the technical levels, intraday and swing setups, and scenario-based triggers to trade XRP amid evolving ETF demand.

A consolidated technical forecast for BCH, ATOM, BNB and ADA that lays out bullish and bearish paths, indicator signals, key support/resistance bands, and practical trade and portfolio sizing guidance for the next 2–6 weeks.

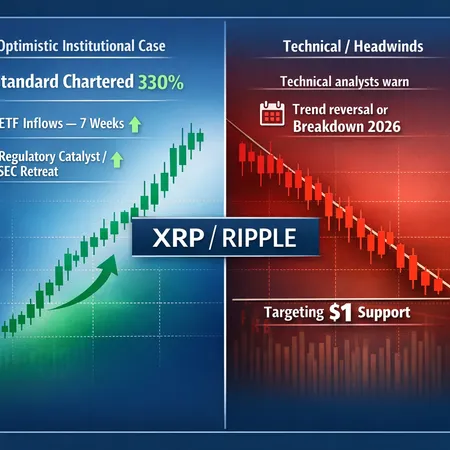

XRP sits at a stark crossroads: institutional forecasts promise asymmetric upside if regulatory clouds clear, while technical analysts and short-term ETF flow data warn of downside risk toward $1. This feature weighs both views and maps scenario-based timing for a trend reversal or breakdown in 2026.