Stablecoins

Binance’s roughly $9B drop in exchange-backed stablecoin reserves over three months tightens market liquidity and increases margin and systemic risk across derivatives and spot markets. Professional traders and risk officers should treat shrinking exchange stablecoin balances as an early-warning signal and update collateral, stress-testing, and counterparty policies accordingly.

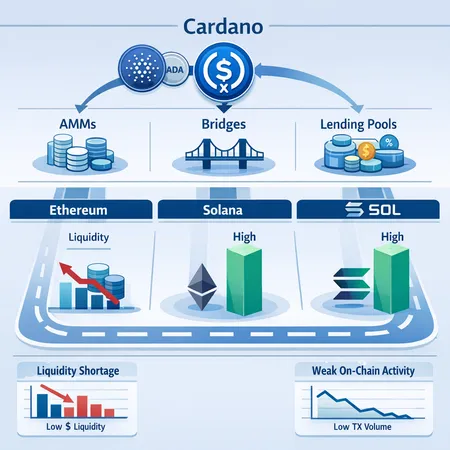

Cardano plans to launch USDCx to address dollar liquidity shortages—this article evaluates the product timeline, mechanics, and whether a native USDC-like stablecoin can materially change DeFi liquidity dynamics for ADA. We compare models on Ethereum and Solana and outline likely short-term effects for projects and holders.

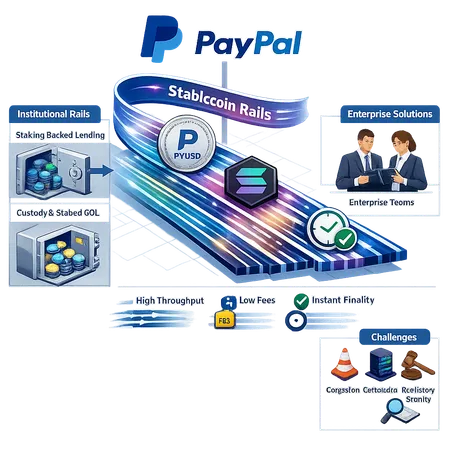

PayPal naming Solana as its default network for stablecoin processing is a watershed for blockchain payments. This piece examines the technical drivers, UX and institutional implications, risks, and practical recommendations for teams evaluating Solana as a stablecoin settlement layer.

New stablecoin primitives — from Tether’s USDT0-backed perpetuals to Ripple’s RLUSD surge on Ethereum — are changing how perpetuals are collateralized, settled and liquidated. This article breaks down mechanics, liquidity benefits, cross-market risks and regulatory questions for DeFi product leads and derivatives traders.

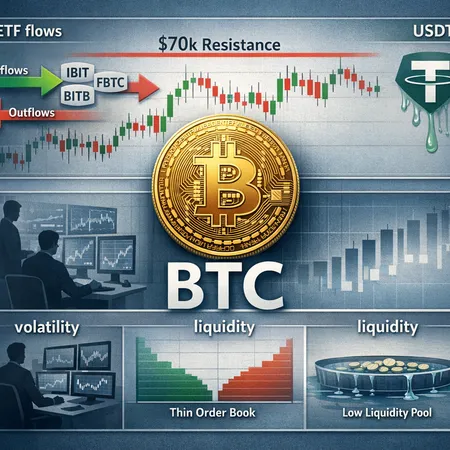

Despite steady spot-BTC ETF demand that almost erased last week’s outflows, Bitcoin remains unusually volatile. This piece parses ETF flow data, technical pressure around $69k–$70k, institutional narratives, and how stablecoin and exchange liquidity amplify swings.

Ripple expanded its Zand Bank partnership to create RLUSD ↔ AEDZ rails on the XRP Ledger, aiming to turn stablecoins into practical cross‑border plumbing for Gulf and regional corridors. This piece breaks down what the integration enables, why the UAE is the launchpad, and the practical decisions payments teams must make.

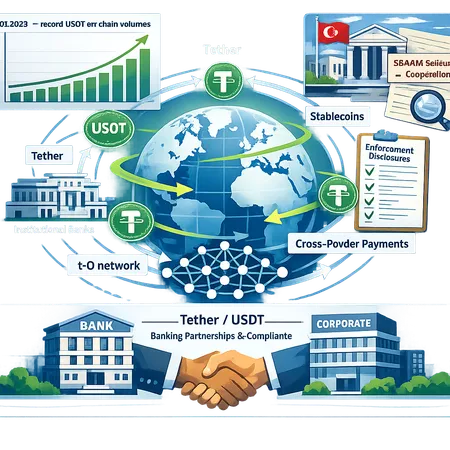

Tether is shifting from a pure liquidity provider to an active participant in enforcement cooperation and institutional settlement. This primer reviews its role in a $544M Turkish seizure, record USDT on-chain flows in Q4 2025, and its bet on the t-0 settlement network — and what that means for stablecoin adoption, banks, and regulators.

Tether's $150M stake in Gold.com signals a strategic shift: major stablecoin issuers are moving into tokenized gold to diversify reserves, deepen liquidity for RWA, and build new revenue lines. That pivot will accelerate tokenized-asset adoption while raising custody, audit and regulatory stakes for the stablecoin sector.

Tether’s Q4 2025 jump to a $187B market cap concentrates USDT liquidity and reshapes on‑chain capital flows — a mixed signal for treasurers weighing liquidity efficiency against concentration and counterparty risks. This article breaks down the implications and practical mitigation steps for institutional risk teams.

Tether’s decision to shrink a planned multi‑billion fundraising round highlights investor concerns about private valuations and stablecoin counterparty risk. The move has implications for USDT’s market confidence and strategic choices across the stablecoin sector.