Bitcoin as an Emerging‑Market Hedge: Iran’s Rial, On‑Chain Flows, and Institutional Bids (2025–26)

Summary

A trader in Tehran, a wallet on the chain

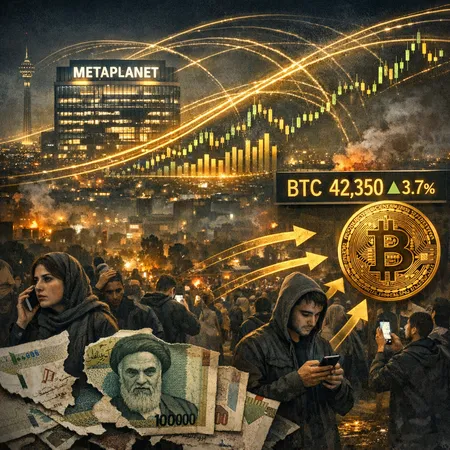

In late 2024 and into 2025, vendors in Tehran started quoting prices in both rials and something else: BTC. That anecdote — a merchant choosing Bitcoin over dollars for pricing or settlement — is the human face of a larger story. When a national currency collapses, people look for alternatives: dollars, gold, remittances, and increasingly, Bitcoin.

For macro investors and EM analysts, this is not about replacing FX reserves. It’s about diversifying exposures to rapid depreciation, capital flight, and payment frictions. For many traders, Bitcoin is now being priced against national currencies in real time, and those market microstructures matter for whether BTC can truly act as a hedge.

Iran’s rial crisis and the turn to BTC

Iran’s dramatic fall in the rial and the street protests that accompanied it became a focal point in 2025 for discussions about crypto as a hedge. Reporting tied the currency crisis to renewed interest in Bitcoin as citizens sought store‑of‑value alternatives amid rapid depreciation and tighter capital controls. Articles covering the unrest and the swift fall of the rial gave repeated examples of demand surges for BTC during moments of acute FX stress (see reporting from BeInCrypto and Cryptopolitan).

On the ground, the drivers were familiar: loss of confidence in domestic policy, restricted access to foreign currency, and the simple desire to preserve purchasing power. But the route to BTC in Iran differs from that in, say, Latin America or parts of Africa: sanctions, state surveillance, and OTC networks reshape how people obtain and move crypto. Still, the basic dynamic holds — when local currency collapses, some economic actors treat BTC as a partial hedge against capital flight.

Reading the on‑chain signals

To move beyond anecdotes, analysts look to on‑chain flows and exchange activity. Key signals include sustained exchange inflows (selling pressure), exchange outflows (self‑custody accumulation), spikes in P2P volume, and changes in OTC desk demand. In Iran’s case, public blockchains do not show nationality, but proxy metrics matter: increased nominations of smaller denomination P2P trades, larger OTC withdrawals from centralized markets, and a shift in exchange balance trends during the rial’s sharp drawdown.

Concrete on‑chain patterns that support a hedge narrative:

- Sustained exchange outflows coincident with local FX shocks suggest accumulation or self‑custody rather than speculative selling.

- P2P volume and premium spreads in local fiat markets (a persistent premium on BTC priced in rials) indicate strong local demand when other FX channels are restricted.

- Stablecoin on‑ramps and off‑ramps via OTC increase when centralized rails are sanctioned or surveilled.

These indicators aren’t definitive proof of an inflation hedge — volatility matters — but they are consistent with capital flight into BTC as one component of a broader flight to safety.

Institutional accumulation: the Metaplanet example

Institutional accumulation in 2025 deepened Bitcoin’s market plumbing. A prominent example is Metaplanet’s disclosed purchase of 4,279 BTC, lifting its total to 35,102 BTC, a move reported by Coindesk. Large corporate treasuries and corporate‑style accumulation change the supply dynamics available to all participants: they absorb issuance and create a baseline bid that can reduce market liquidity in the tails.

Why does that matter to emerging markets? When a big buyer takes heavy amounts off the market, local buyers face a different order book. Large institutional hoards can compress circulating supply, making it harder for a sovereign or a retail cohort to buy into BTC quickly without price impact. Paradoxically, institutional buying can both bolster confidence in BTC’s long‑term store‑of‑value story and raise short‑term execution costs for those using BTC as an immediate hedge.

How big buyers influence local confidence and liquidity

There are three primary channels by which institutional accumulation affects emerging‑market BTC use:

Signaling: Large, public accumulations send a confidence signal. For citizens watching headlines, corporate adoption implies legitimacy; for banks and OTC desks, it can widen the set of counterparties willing to facilitate FX-to-BTC flows.

Liquidity reallocation: Institutions that custody BTC off‑exchange reduce available liquidity on tradeable order books. That can widen spreads and increase slippage in small markets where P2P or local exchanges already carry elevated premiums.

Market depth and volatility: By changing the float, heavy accumulation can reduce effective market depth at certain price levels. In stress episodes, that can mean larger price moves for the same local demand shock — a crucial concern for those hoping BTC will be a stable short‑term refuge.

These forces work differently across regions. In Iran, where sanctions and capital controls shape market channels, institutional headlines can shift perceptions without necessarily improving real‑world access. Conversely, in markets with robust OTC networks and lighter capital controls, institutions can smooth the transition to BTC by underwriting liquidity and counterparty relationships.

Execution pathways: from P2P to OTC to exchanges

If you’re an Iranian saver in 2025 considering BTC as a hedge, your route matters. P2P platforms, decentralized on‑ramps, OTC desks, and informal dollar markets each offer tradeoffs in privacy, price, and settlement speed.

- P2P: Offers fast local fiat conversions but often at a premium and with counterparty risk. Spikes in P2P volume track moments of riyal weakness.

- OTC desks: Lower slippage for larger trades but require established relationships and can be constrained by sanctions or KYC hurdles.

- Exchanges: Provide deep liquidity in normal times but are exposed to withdrawal freezes and regulatory blocks.

Platforms like Bitlet.app and established OTC networks play an operational role here: they can lower frictions for those moving value across rails, though they cannot eliminate regulatory or sanctions risk.

Policy and regulatory risks — the thread that unravels the hedge

Treating BTC as a hedge in emerging markets is fraught with policy contingencies.

- Capital controls and outright bans: Authorities can restrict crypto exchanges, freeze accounts, or criminalize cross‑border transfers. Those measures can severely curtail the ability to convert or transfer BTC when it’s needed most.

- Sanctions and countermeasures: In jurisdictions under sanctions, on‑ramp availability is limited. Even where BTC itself is permissionless, the off‑chain plumbing (banking, fiat rails, custodians) is not.

- Surveillance and enforcement: Governments can target P2P and OTC facilitators, raising counterparty risk and reducing confidence in local settlement channels.

- Market fragmentation: Divergent local rules create a patchwork of liquidity pockets; price divergence can be large, making the hedge imperfect and costly.

Macro investors must incorporate these tail risks quantitatively. That means stress testing scenarios where on‑chain holdings become illiquid, local exchanges are shuttered, or custodial relationships are severed.

A balanced view for macro investors and EM analysts

Bitcoin can, in certain episodes, act like a partial hedge for citizens and institutions facing rapid currency depreciation. But it is not a drop‑in replacement for dollar liquidity or FX reserves. The hedge value depends on five interlocking factors:

- Accessibility: Can users actually buy, hold, and spend BTC? (rail availability, KYC, sanctions)

- Liquidity: Is there depth in local order books or OTC desks to absorb demand without extreme slippage?

- Execution speed: Can value be moved quickly across borders when needed?

- Regulatory tail risk: How likely are domestic authorities to impede crypto activity during crises?

- Volatility tolerance: BTC’s historic volatility means it can protect purchasing power over months but fluctuate wildly in the short term.

Institutional accumulation — exemplified by Metaplanet — changes the macro landscape by signaling confidence and reducing available float. That helps the narrative of BTC as a longer‑term store of value, but it also raises short‑term frictions for those who need immediate hedging.

Practical steps for analysts

- Model multiple scenarios: baseline hedge, partial hedge with execution cost, and hardened capital‑control scenario where conversion is impossible.

- Monitor on‑chain metrics: exchange balances, P2P volume, OTC flow proxies, and stablecoin mint/burn activity tied to the local currency shock.

- Watch institutional flows: reported accumulation (e.g., corporate treasuries) and their likely impact on market depth and volatility.

- Map local access pathways: which exchanges, OTC desks, and P2P markets remain operational under stress.

Conclusion — a conditional hedge, not a universal panacea

By 2025–26, Bitcoin’s role in emerging markets has matured from niche experiment to a conditional hedge: useful in many but not all crises. Iran’s rial collapse highlights how local populations will turn to any available store of value, and on‑chain flows plus P2P activity provide signals that that is happening. At the same time, institutional accumulation — such as Metaplanet’s sizeable holdings — reshapes liquidity and perception in ways that both help and complicate BTC’s hedge story.

For macro investors and EM analysts, the takeaway is pragmatic: BTC should be modeled as an optional line of defense with clear execution and policy constraints, not a one‑to‑one substitute for foreign currency reserves or safe‑haven assets.

Sources

- BeInCrypto, Iran currency crisis and Bitcoin hedge: https://beincrypto.com/iran-currency-crisis-bitcoin-hedge/

- Cryptopolitan, Iranian protests and demand for BTC: https://www.cryptopolitan.com/iranian-protests-highlight-the-need-for-btc/

- Coindesk, Metaplanet buys 4,279 BTC: https://www.coindesk.com/markets/2025/12/30/metaplanet-buys-4-279-bitcoin-lifts-total-holdings-to-35-102-btc