Payments

Ripple expanded its Zand Bank partnership to create RLUSD ↔ AEDZ rails on the XRP Ledger, aiming to turn stablecoins into practical cross‑border plumbing for Gulf and regional corridors. This piece breaks down what the integration enables, why the UAE is the launchpad, and the practical decisions payments teams must make.

Tether is shifting from a pure liquidity provider to an active participant in enforcement cooperation and institutional settlement. This primer reviews its role in a $544M Turkish seizure, record USDT on-chain flows in Q4 2025, and its bet on the t-0 settlement network — and what that means for stablecoin adoption, banks, and regulators.

A data-led take on XRP’s sharp rebound, what $11B of inflows tells us about liquidity and market structure, and whether Ripple’s push toward real-world payments can sustain institutional on‑ramps.

January 2026 saw on‑chain stablecoin payments explode, led by USDC processing an estimated $8.4 trillion in a single month—an event that recalibrates payments, competition, custody, and regulation. This article breaks down the scale, why USDC dominated, how rivals like Tether are responding, and what regulators will likely focus on next.

Ripple’s full Luxembourg EMI license changes the regulatory runway for EU payments and on‑ramps; but recurring XRP escrow unlocks complicate the near‑term token picture. This analysis separates legal capability from market mechanics and models three plausible XRP price/volume scenarios if the EU rollout accelerates.

David Schwartz pausing his personal XRPL hub to upgrade to XRPL 3.0 is more than a developer note — it exposes technical tradeoffs and commercial opportunities that could accelerate XRP rails for corporates. Combined with Japan’s regulatory push and Ripple leadership commentary, this upgrade has practical implications for treasury, compliance and node operators.

The next institutional phase of Bitcoin adoption is arriving via two complementary channels: conservative pension fund access and consumer-facing payment rails for games. Together they stitch asset allocation and everyday utility into a clearer path for BTC adoption in 2026.

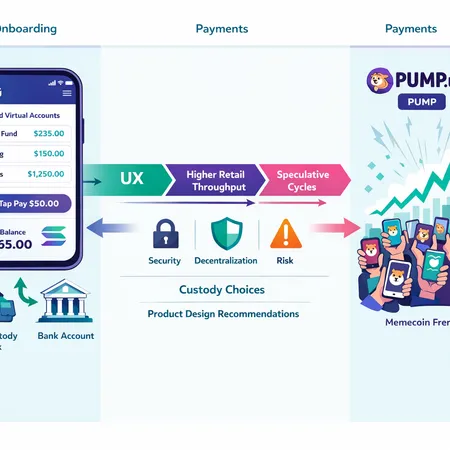

Avici’s named virtual accounts on Solana and a spike in memecoin activity are narrowing the gap between bank‑like UX and self‑custody. This report examines whether UX fixes are driving higher retail throughput and speculative cycles, and what product teams should build next.

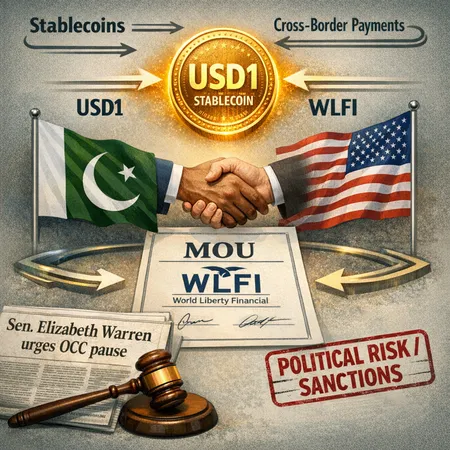

Pakistan's memorandum with World Liberty Financial to explore a USD1 stablecoin raises tangible payments benefits but also acute political, regulatory, and sanctions risks. This explainer breaks down economics, technical feasibility, the MOU terms, Senator Warren's request to the OCC, and practical risk mitigations.

FCA approval has opened a clear regulatory door for Ripple in the U.K., while strong spot ETF inflows are reshaping how institutions view XRP as a liquidity rail for cross‑border payments. This feature breaks down what that approval actually permits, how ETF flows and competing filings affect liquidity and price discovery, and what payments teams should watch when evaluating XRP‑based pilots in 2026.