XRP’s Road to Institutional Revival: Ripple Prime, TJM, Clarity Bill and Exchange Liquidity Shifts

Summary

Executive summary

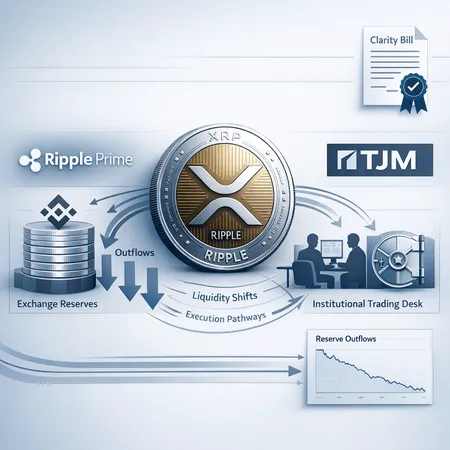

Institutional participation in XRP trading depends less on narrative and more on three practical variables: executable liquidity, custody & settlement rails, and legal clarity. Over the past month Ripple doubled down on the first two by leaning into Ripple Prime and a partnership with TJM aimed at institutional execution, while legislative movement around the Clarity Bill promises possible regulatory relief. At the same time, exchanges — notably Binance — have seen meaningful XRP outflows that compress on-exchange reserves and change where liquidity sits. This note evaluates those developments and lays out scenarios for institutional on-ramps and price action.

Ripple Prime and the TJM partnership: institutional execution in focus

Ripple has been explicit: to get institutions back, you need an institutional-grade product. Ripple Prime is positioned as a custody, settlement and execution stack that aggregates liquidity and offers post-trade services tailored for large counterparties. The recent TJM partnership takes that promise further by adding a distribution and trading channel targeted at professional desks — a move covered in detail by Coindesk outlining Ripple’s expansion of institutional trading capabilities through TJM (see: Coindesk coverage).

Why this matters practically: institutional traders prioritize predictable fills, deep counterparty networks and integrated custody. Ripple Prime aims to reduce settlement friction between OTC desks, prime brokers and custodians so desks can offer XRP with similar operational confidence as other liquid tokens. For many institutional strategists, that reduces a non-trivial operational hurdle even before regulatory or market risk is considered.

Regulatory tailwinds: the Clarity Bill and potential implications for XRP

Legal risk is still the single largest deterrent for U.S. institutional adoption of some digital assets. The proposed Clarity Bill, expected to be introduced in January, includes language that industry commentators argue could distinguish certain tokens from securities, which would be a structural positive for XRP. Coinpaper has an analyst piece arguing the markup could benefit XRP’s regulatory standing (see: Coinpaper analysis on the Clarity Bill).

If the bill narrows the SEC’s enforcement levers or clarifies transactional vs. investment uses of on-chain tokens, institutional compliance costs fall. That doesn't mean automatic inflows — compliance teams will still require legal opinions, custody proofs and operational tests — but it turns a legal maybe into a legal manageable. For desks, the practical sequence looks like: favorable markup → clearer internal policies → pilot trading and custody → scaled access.

Exchange reserves and the Binance outflows: where liquidity is migrating

Exchange reserve metrics offer a near-real-time window into where liquidity sits. Recent reporting shows significant XRP withdrawals from Binance, pushing reserves to multi-month lows and indicating either large off-exchange accumulation or movement into cold custody and alternative venues (see: Coinpaper on Binance reserves crash).

Two interpretations are plausible and not mutually exclusive: 1) institutional or whale accumulation into institutional custody (or OTC-held treasuries), and 2) rebalancing toward non-custodial or regulated custodial solutions ahead of a potential regulatory change. Either way, reduced exchange reserves can increase short-term price sensitivity to flow and widen spreads on retail-facing venues, while deep liquidity may still exist in OTC pools and dark venues accessed via institutional rails like Ripple Prime.

What this means for custody, desk operations and liquidity access

For institutional sales desks the key operational questions are: where is the deepest executable liquidity, who provides settlement guarantee, and what custody options meet compliance needs? With exchange liquidity concentrating off major public order books, desks will increasingly rely on hybrid models: aggregated OTC liquidity, prime execution via platforms such as Ripple Prime, and custody by regulated custodians. Platforms like Bitlet.app and established custodians can play a role in providing rails for recurring settlement and installment programs, but each institutional client will weigh counterparty risk and operational integration costs.

Practical impacts to desk operations:

- Wider visible spreads on exchanges — requiring tighter prime-of-book execution strategies or use of RFQ platforms.

- Increased use of settlement guarantees (atomic or custodial) to mitigate counterparty and settlement risk.

- More rigorous legal and compliance due diligence if the Clarity Bill shifts enforcement expectations.

Operational readiness will become a competitive advantage for desks that can combine fast settlement, compliant custody and reliable access to concentrated liquidity pools.

Scenarios: price trajectories and institutional on-ramps

Below are three working scenarios framed for institutional strategists. Time horizons are 3–12 months unless specified.

Bull (high conviction)

- Trigger: Clear supportive language in the Clarity Bill + smooth onboarding pilots via Ripple Prime/TJM + continued exchange outflows into regulated custody.

- Institutional behavior: Rapid pilot programs convert to allocation increases as legal and execution risk drop.

- Market impact: Tightening liquidity in OTC and prime channels pushes realized price higher; public order books reflect reduced sell-side pressure. Potential material upside if large treasuries or funds allocate meaningfully.

Base (measured adoption)

- Trigger: Partial regulatory clarity (some favorable language, but additional interpretive guidance needed) + steady, but slow, uptake of Ripple Prime services.

- Institutional behavior: Selective onboarding from risk-tolerant institutions; custody and legal teams require more time.

- Market impact: Moderate appreciation in price driven by lower available public float and incremental demand. Volatility remains, but spreads on institutional rails compress as tech proofs accumulate.

Bear (delayed/regulatory friction)

- Trigger: Clarity Bill stalls or comes with ambiguous language; operational integration of Ripple Prime/TJM is slower than expected; large holders re-deploy XRP into non-trading uses.

- Institutional behavior: Caution and limited allocations; desks defer product launches and preserve liquidity across diversified token sets.

- Market impact: Price pressure persists as speculative flows dominate and on-exchange liquidity remains fragmented. Institutional on-ramps delay by quarters.

Tactical considerations for sales desks and strategists

- Re-assess best execution policies: Factor in OTC liquidity depth and access to Ripple Prime-like consolidated pools rather than relying solely on public order books.

- Legal contingency planning: Develop model memos tied to Clarity Bill permutations so KYC/AML onboarding can be fast-tracked if clarity arrives.

- Custody diversification: Maintain multi-custodian setups to balance counterparty concentration risk as exchange reserves shrink.

- Monitor flows, not just price: Exchange reserve metrics, on-chain movement, and prime broker inventory will signal where true liquidity is sitting.

Conclusion

XRP's institutional comeback depends on the confluence of execution infrastructure, regulatory clarity, and where liquidity lives. Ripple Prime and the TJM partnership materially improve the first vector; the Clarity Bill could reshape the second; exchange reserve outflows already appear to be rearranging the third. For sales desks and crypto strategists, the sensible path is operational readiness — align custody, legal and execution playbooks now so you can scale quickly if regulatory and market conditions turn favorable.

Sources

- Ripple expands institutional trading push with TJM partnership — Coindesk: https://www.coindesk.com/markets/2025/12/19/ripple-expands-institutional-trading-push-with-tjm-partnership

- Clarity Bill set to arrive in January — Coinpaper: https://coinpaper.com/13212/clarity-bill-is-set-to-arrive-in-january-why-xrp-stands-to-win-big?utm_source=snapi

- Binance XRP exodus and reserves crash — Coinpaper: https://coinpaper.com/13213/binance-xrp-exodus-reserves-crash-to-multi-month-low?utm_source=snapi

For context on market bellwethers and how macro liquidity can affect cross-asset flows, many desks continue to monitor XRP alongside broader trends in DeFi.