How PeerDAS + ZK‑EVMs and $8T Stablecoin Flows Put Ethereum on Track as a Settlement Layer

Summary

Executive framing: why this matters now

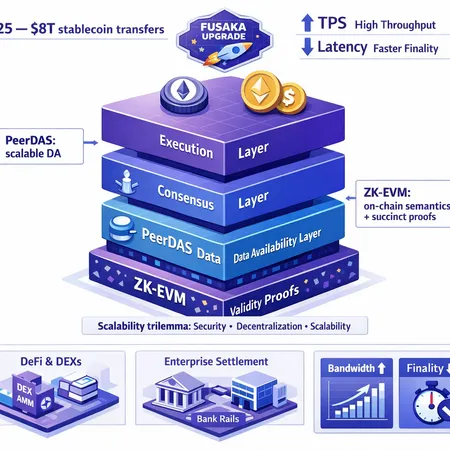

The blockchain scalability trilemma — that you can only optimize two of decentralization, security, and scalability at once — has guided design tradeoffs for years. Recent engineering work aims not to shortcut those tradeoffs but to change how the pieces fit together. Two upgrades, PeerDAS (a more robust, peer‑based data availability sampling layer) and production‑quality ZK‑EVMs (succinct proof systems that verify execution cheaply on‑chain), are the most consequential. Combined with the Fusaka upgrade and a surge in stablecoin activity, these changes make a persuasive case that Ethereum is becoming a viable high‑throughput settlement layer for large‑volume flows.

For many readers evaluating rails, practical questions matter: can you get predictable finality? Can settlement costs and bandwidth scale cheaply? And is the security model compatible with enterprise risk controls? Below I unpack the technical pieces, the empirical signals (including Q4‑2025’s $8T stablecoin transfer metric), and what to watch next.

The pieces in plain English

What is PeerDAS and what problem does it solve?

PeerDAS (peer data‑availability sampling) is a mechanism to let light clients and independent monitors cheaply verify that all transaction data necessary to reconstruct a block has been published — without every participant downloading the entire block. In practice PeerDAS pairs erasure‑coding of posted data with randomized sampling by peers. If enough independent peers can sample small slices and confirm those slices exist, the network can be confident the full data is available.

Why this matters: data availability is a hard limit on throughput. If a rollup sequencer posts huge compressed batches but nodes cannot trust that data is actually available, those batches are unsafe. PeerDAS lowers the cost of trust — rather than relying on a handful of archival nodes, many light actors can sample cheaply and detect misbehavior quickly. That enables larger batches, higher bandwidth, and cheaper per‑transaction settlement without requiring every validator to store or process everything.

(See Vitalik’s recent discussion of PeerDAS and associated architecture shifts that position Ethereum to address the trilemma in a practical way.) Vitalik on PeerDAS and ZK‑EVMs

What are production‑quality ZK‑EVMs in plain terms?

A ZK‑EVM is a zero‑knowledge verifier that can prove the correct execution of EVM‑compatible transactions off‑chain and then publish a succinct proof that the chain can verify quickly. Production‑quality means the prover pipelines, tooling, and cost structure are mature enough for sustained high throughput: fast proof generation, predictable verification costs, and compatibility with existing EVM semantics used by smart contracts and wallets.

Why this matters: instead of executing every transaction on every node, Ethereum can accept a succinct proof that a large batch of transactions was executed correctly. That reduces computation and storage pressure on the base layer and lowers finality latency for batched settlements. The combined result: much higher effective throughput while preserving the same security root (i.e., block headers, validator set) that Ethereum relies on. Independent coverage confirms these architecture changes are reshaping assumptions about what is possible on mainnet. Independent analysis of the architecture shift

Why PeerDAS + ZK‑EVMs are not redundant — they're complementary

ZK‑EVMs solve the verification bottleneck by replacing heavy on‑chain execution with tiny proofs. PeerDAS solves the data availability bottleneck by ensuring the compressed batch data is actually retrievable. One without the other leaves a weakness:

- ZK proofs without robust DA mean a prover could prove execution but conceal data needed to reconstruct state.

- Robust DA without succinct proofs forces the base layer to still process or store too much data, constraining throughput.

Together, they let rollups post much larger, provably correct batches with high confidence those batches are reconstructible by honest observers — which is precisely the combination you need to scale settlement throughput without weakening the security model.

Empirical signal: $8T of stablecoin transfers in Q4 2025

Q4‑2025 produced a striking empirical test: stablecoin transfers routed on Ethereum hit a reported $8 trillion for the quarter, a new record and a clear signal that market participants are using the chain for large‑scale settlement. The reporting ties this uptick to the Fusaka upgrade and associated stack improvements that increased predictability and reduced friction for high‑volume flows. Invezz: $8T stablecoin transfers after Fusaka

What the metric implies technically:

- Real demand exists for a settlement rail that offers native programmability, composability with DeFi primitives, and strong finality guarantees.

- Settlement flows require predictable latency and cost; large market makers and custodians will not route $billions through an unpredictable rail.

- The Fusaka upgrade appears to have improved predictability enough to change routing decisions — not by magic, but by reducing variance in gas dynamics and improving settlement finality behavior.

One caution: raw transfer volume does not equal native on‑chain economic settlement (some transfers are internalized by custodians or off‑chain reconciliations). Still, $8T is a behavioral signal: operators are willing to put operationally large flows into Ethereum's settlement envelope.

Observed improvements in bandwidth and finality (what developers should watch)

Developers and architects should focus on these measurable improvements that follow from the new architecture:

- Higher effective bandwidth per block for provable batches (more settlements per block when ZK proofs verify many transactions at once).

- Lower variance in finality latency for batched settlements because proof verification and DA sampling make confirmations predictable.

- Reduced on‑chain storage growth per settlement, since proofs and erasure‑coded DA reduce the need for full data replication by everyone.

Operationally that translates into lower reconciliation costs, faster end‑to‑end settlement times for clearing flows, and easier compliance for auditors — because succinct proofs and widely verifiable DA create compact, cryptographic audit trails.

Implications for DeFi architects and enterprise settlement teams

If you design payment rails, custody flows, or high‑frequency settlement systems, the combined stack unlocks several practical use cases:

- High‑volume off‑exchange settlement: exchanges and custodians can post batched instruction sets and prove their execution, shortening reconciliation windows.

- Atomic settlement across DeFi primitives: with predictable finality you can build atomic legs that would previously require trusted intermediaries or layered timeouts.

- On‑chain clearing and netting: market makers can net thousands of trades into a single provable batch, reducing on‑chain fees and operational overhead.

- Compliance and auditability: succinct proofs plus DA sampling provide compact artifacts auditors can use to verify settlement integrity without re‑executing everything.

These use cases are not hypothetical — the $8T figure suggests market actors are already experimenting with or migrating flows. Tools and middleware will matter: custodians need easy ways to generate proofs or interact with sequencers; DeFi protocols need patterns that tolerate batch finality semantics; reconciliation tools must be able to validate proofs and DA samples programmatically. Bitlet.app and other entrants in the payments/settlement layer ecosystem will likely build tooling that sits on this stack.

Remaining gaps and risks

No upgrade is a switch that flips overnight. Key remaining concerns include:

- Prover costs and time: production ZK proof generation is improving but still requires capital and optimized pipelines. High throughput requires cheap, parallelized proving.

- Sequencer centralization and SLAs: many rollups still rely on single sequencers; enterprises need clear service‑level assurances and decentralization roadmaps.

- Interoperability and standards: DA sampling and proof formats need common standards so enterprise stacks can integrate multiple rollups and verifiers easily.

- Regulatory and custody considerations: legal frameworks for on‑chain settlement, custody of funds while proofs are generated, and dispute resolution still need maturation.

These are solvable engineering and governance problems, but they matter for production adoption.

Next milestones to watch (practical checklist)

- Widespread, audited PeerDAS deployments across major L2 sequencers and testnets.

- Proof‑generation latency and cost milestones: multi‑minute → sub‑minute full batch proofs at low cost per tx.

- Standard DA sampling libraries and reference implementations that light clients and auditors adopt.

- Enterprise‑grade sequencer SLAs, with decentralization timelines and hot/cold failover procedures.

- Stablecoin issuer and custodian integrations that rely on proofs + DA sampling for final settlement guarantees.

Each milestone changes the adoption calculus for architects deciding whether to route primary settlement flows to Ethereum.

Bottom line for architects and developers

Technically, the combination of PeerDAS and production‑quality ZK‑EVMs reframes the scalability trilemma by decoupling data availability and verification costs from node‑level replication. Practically, Q4‑2025’s $8T stablecoin transfers after the Fusaka upgrade show there is both demand and a tolerably stable environment for high‑volume settlement experiments today.

For teams evaluating Ethereum for enterprise settlement: start with non‑critical pilots that exercise the full proof + DA pipeline, instrument latency and reconciliation costs carefully, and require sequencer/custodian SLAs. Watch the milestones above — as they fall into place, Ethereum’s base‑layer security combined with rollup throughput will make a strong, defensible case for on‑chain settlement as a first‑class option.

Sources

- Vitalik on PeerDAS and ZK‑EVMs: https://thenewscrypto.com/vitalik-buterin-says-ethereum-has-solved-the-blockchain-trilemma/?utm_source=snapi

- Independent coverage of Ethereum architecture changes: https://news.bitcoin.com/vitalik-buterin-ethereums-new-architecture-solves-scalability-trilemma/

- Q4‑2025 stablecoin transfer volume and Fusaka upgrade context: https://invezz.com/news/2026/01/05/ethereum-stablecoin-transfers-hit-8t-in-q4-as-fusaka-upgrade-lifts-activity/?utm_source=snapi