Staking

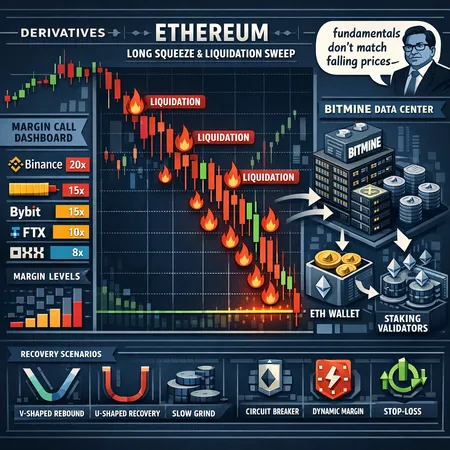

A deep dive into the recent sharp Ethereum derivatives long‑squeeze, the margin mechanics that amplified it, and the counter‑narrative of institutional accumulation by BitMine and Tom Lee’s bullish view. Scenario planning and risk controls for active ETH traders and derivatives desks are included.

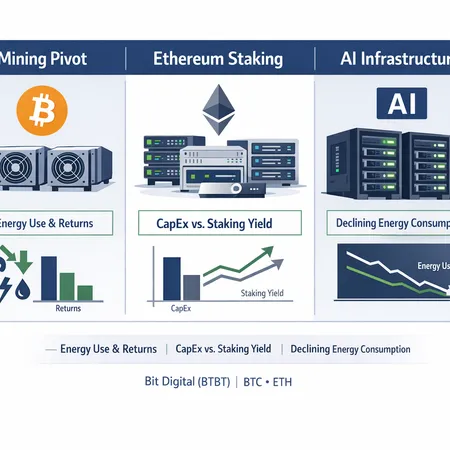

Bit Digital is repositioning away from Bitcoin mining toward Ethereum staking and AI infrastructure — a move that reshapes its capital profile, revenue drivers, and energy footprint. This brief unpacks the strategic rationale, compares PoW mining economics with staking, and outlines what public‑market investors should monitor.

Sei’s combination of fast finality and EVM compatibility re-frames how yield-seeking investors should value staking returns in 2026. This article weighs staking yield against network security, validator economics, liquid staking options, and real-world USD-denominated products arriving on-chain.

Jan 26 ETF data showed $116.9M net inflows into spot Ethereum ETFs led by Fidelity’s FETH while BlackRock’s ETHA experienced outflows. Coupled with large corporate buys and growing staking demand, these flows are reshaping short- and medium-term ETH price dynamics and portfolio tactics.

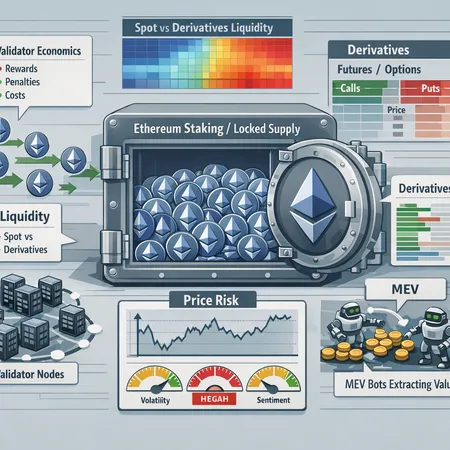

Tokenized staking is reshaping Ethereum’s market structure — but new borrowing use cases, concentrated large stakers and questions about the Fusaka upgrade create complex systemic tradeoffs. This feature maps mechanics, risks, monitoring metrics and realistic price scenarios for portfolio managers and advanced DeFi users.

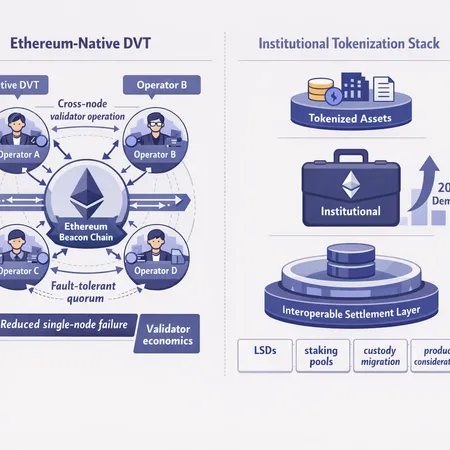

Vitalik Buterin’s native DVT proposal promises to make Ethereum staking more resilient by embedding Distributed Validator Technology in the protocol. Coupled with institutional tokenization tailwinds, this could reshape validator economics, liquid staking product design, and custody risk models.

The validator exit queue dropping to zero is more than a technical milestone — it signals stronger staking demand and tighter liquid supply for ETH. This article explains the mechanics behind validator flows, how staking inflows tighten available ETH, and three price scenarios investors should consider.

By 2026 a near-half of ETH supply sits locked in the staking contract, reshaping liquidity, derivatives pricing, and validator incentives. This analysis unpacks the mechanics, trader positioning, MEV dynamics, and scenarios that could trigger a liquidity-driven pullback versus durable structural support.

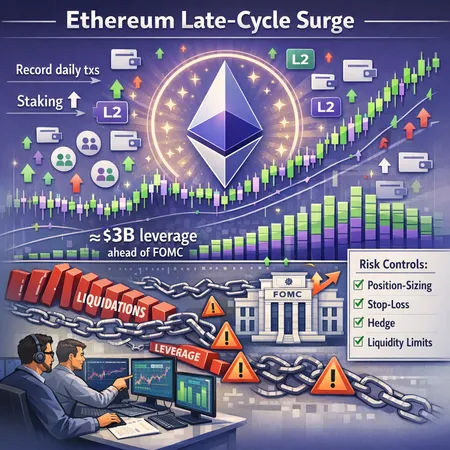

Ethereum is seeing a late‑cycle burst — new wallets, L2 adoption and record daily transactions — even as staking tops out and roughly $3B of leverage builds into the FOMC. Traders and risk managers should balance bullish fundamentals with clearly defined leverage controls and hedges.

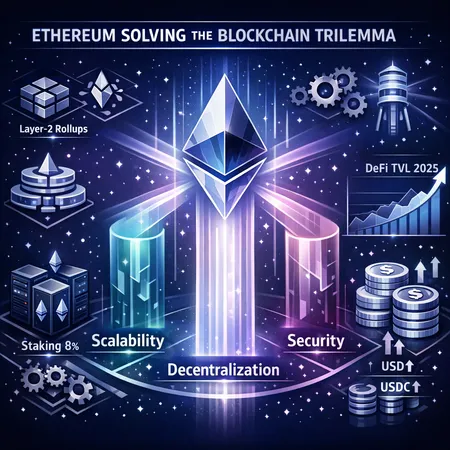

Ethereum’s recent protocol upgrades and 2025 ecosystem growth have narrowed trade-offs between security, scalability, and decentralization — but the trilemma isn’t entirely 'solved'. This explainer assesses Vitalik Buterin’s claims, DeFi and stablecoin activity, institutional staking trends, and what investors should watch heading into 2026.