Custody

XRP is moving from retail speculation toward institutional utility as ETFs, treasury models like Evernorth’s, and lending products deepen market plumbing. Treasurers and allocators must weigh yield and liquidity gains against custody and regulatory risks.

Elemental Royalty’s decision to offer dividends in Tether Gold (XAUt) spotlights an emerging model: tokenized commodity payouts. This article explains the mechanics, market context, legal and tax questions, strategic implications for resource companies, and a practical investor checklist on custody, redemption and counterparty risk.

Nexo has relaunched a U.S.-compliant suite (Yield, Exchange, Loyalty, Credit Lines). Its return signals a shift toward compliance-first crypto lending and raises new questions for retail and institutional counterparties.

Institutional interest in tokenized real-world assets (RWA) is accelerating—from an $18.87M tokenized-gold purchase to rising demand for Sui and Hedera tokenization. This article examines what these events mean for product teams and asset managers evaluating custody, settlement and regulatory risk.

Tokenized gold and broader RWA tokenization have surged to record flows as investors seek both on‑chain yield and a safer asset base. This article explains what's driving the $6.1B expansion, how crypto‑native and traditional investors are positioning, and a due‑diligence framework to evaluate PAXG, XAUT and other tokenized commodities.

Ripple expanded its Zand Bank partnership to create RLUSD ↔ AEDZ rails on the XRP Ledger, aiming to turn stablecoins into practical cross‑border plumbing for Gulf and regional corridors. This piece breaks down what the integration enables, why the UAE is the launchpad, and the practical decisions payments teams must make.

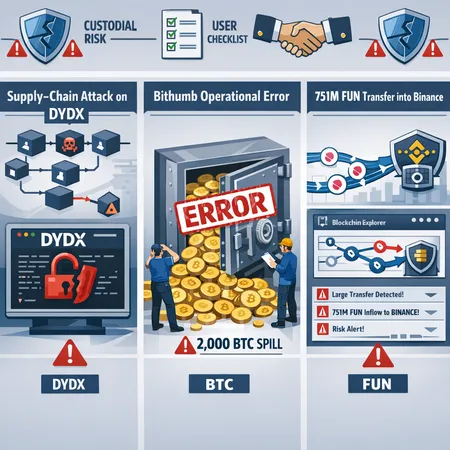

Three recent security incidents — malicious packages targeting dYdX users, Bithumb’s accidental 2,000 BTC distribution, and a 751M FUN transfer to Binance — illustrate different faces of custody and protocol risk. This feature breaks down technical mechanics, trader signals from large on‑chain deposits, mitigation checklists, and policy implications for regulators and exchanges.

A $1M Lightning Network settlement between Secure Digital Markets and Kraken demonstrates that institutional-scale BTC transfers can be near-instant and low-fee. This article explains the technical, custody, cost, and compliance implications for treasuries and exchange operators.

XDC Network’s integration with BitGo brings regulated custody and institutional-grade controls to token issuers; Brazil’s Liqi $100M RWA deal shows how that plumbing enables large-scale, regional tokenization. This guide explains what custody enables, how USDC/USDT custody shifts counterparty risk, and an operational/legal checklist for launching tokenized assets on XDC.

January 2026 saw on‑chain stablecoin payments explode, led by USDC processing an estimated $8.4 trillion in a single month—an event that recalibrates payments, competition, custody, and regulation. This article breaks down the scale, why USDC dominated, how rivals like Tether are responding, and what regulators will likely focus on next.