Bitcoin

Recent large spot-BTC ETF outflows have pressured prices and driven heavy unrealized losses in self-custody wallets. This article explains the mechanics, why slipping below $70k matters for market structure, and actionable hedges and liquidity rules for allocators and traders.

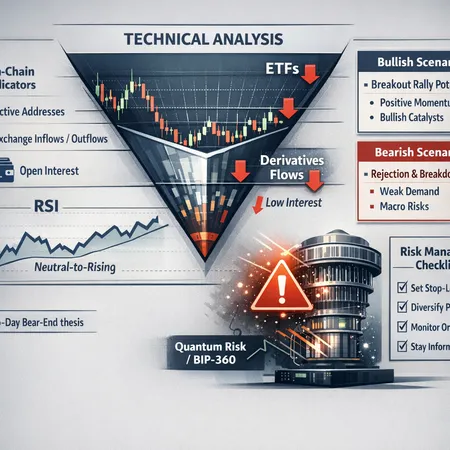

A run-through of macro, on‑chain and derivatives signals that could drive BTC toward the $50K zone, with a balanced checklist for traders on triggers, stops and re‑entry areas.

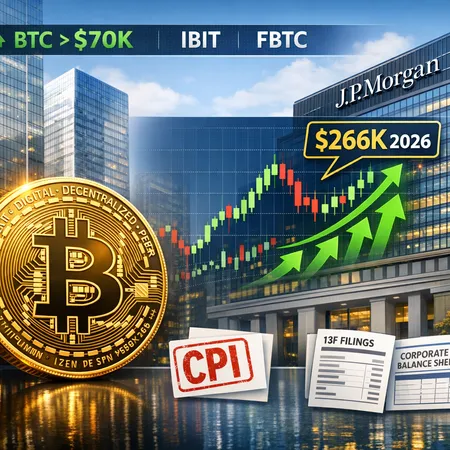

The CLARITY Act’s march toward implementation is redefining regulator roles and ETF engineering, while Abu Dhabi sovereign-linked funds quietly building IBIT stakes signal a new layer of institutional demand. Together these forces reshape allocation, liquidity risk, and cross‑border flows for long‑term BTC investors.

Bitcoin is compressing into a clear triangle while on-chain, derivatives and ETF flows show mixed demand; add quantum-computing concerns and you have a complex risk set for traders and allocators. This article synthesizes the technical setup, expert timelines, on-chain/derivatives context, emerging protocol risk, and concrete scenario planning.

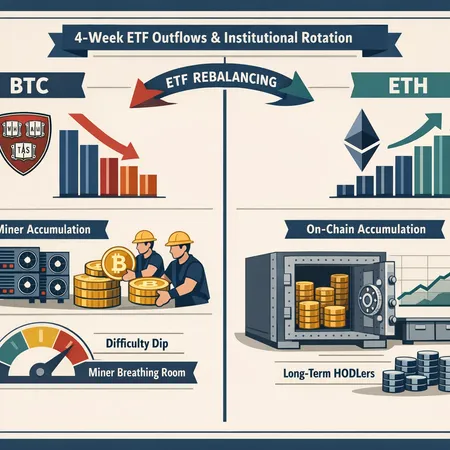

Universities and funds appear to be rebalancing away from BTC while miners and long‑term holders accumulate on‑chain. That divergence changes the effective supply curve — and should influence how allocators weight BTC vs ETH.

Recent ETF outflows and renewed debate about cryptographic risk (the so‑called 'quantum discount') raise a practical question for allocators: is the market already embedding a long‑term premium for quantum threats? This article dissects ETF flows, Willy Woo’s thesis on lost‑coins assumptions, miner/hodler behavior and offers a framework for position sizing if a quantum risk premium is material.

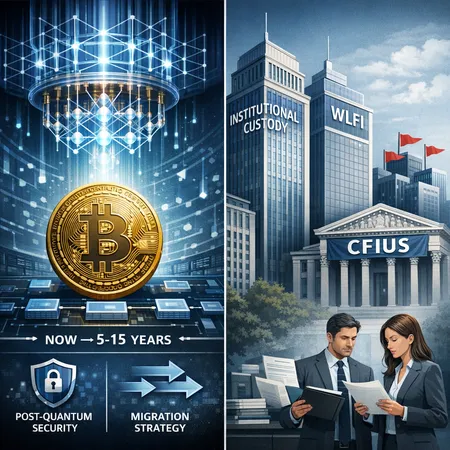

Quantum computers and geopolitical scrutiny of politically linked crypto investments together create a compound threat to Bitcoin. This article synthesizes developer warnings, institutional exposures, and policy risks — and lays out pragmatic mitigation steps for engineers and security leads.

Major institutions maintain a bullish stance on Bitcoin despite choppy price action — driven by structural supply dynamics, growing ETF adoption, and macro tailwinds such as cooling CPI. This article unpacks JPMorgan’s $266K projection, the CPI-ETF rebound above $70K, 13F evidence of shifting allocations, and practical portfolio takeaways.

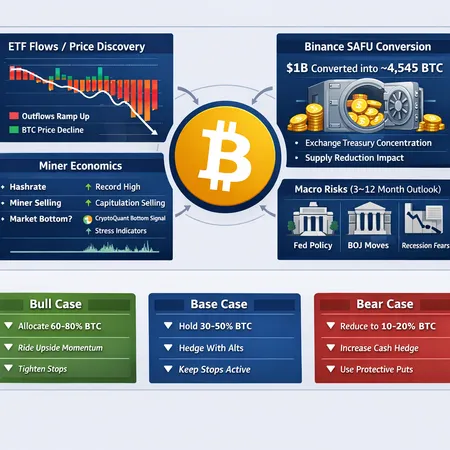

A synthesis of ETF flow data, exchange treasury behavior, miner economics and macro signals to assess whether BTC is close to a cycle bottom and what allocators should do over the next 3–12 months.

On‑chain loss metrics are flashing levels comparable to the 2022 Luna collapse, but macro headwinds and market structure nuances complicate the picture. This analysis reconciles the signals from Net Realized P/L, CryptoQuant commentary, and a strong jobs report to give traders concrete risk management steps.