XRPL

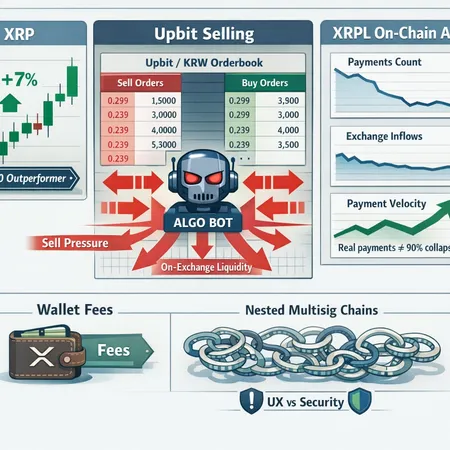

XRP has been a top‑10 price outperformer, yet XRPL payment volume, exchange flow data and community disputes paint a stressed picture. This article unpacks the technicals, on‑chain metrics, Upbit selling reports, the Xaman wallet fee row and scenarios that reconcile the rally with degraded on‑chain activity.

The XRP Ledger has become the primary rails for tokenized U.S. Treasuries and is posting rapid short‑term RWA growth, but issuance metrics mask weaker on‑chain activity and price pressure. Institutional product teams should separate custody and issuance flows from secondary liquidity when evaluating XRPL as an RWA backbone.

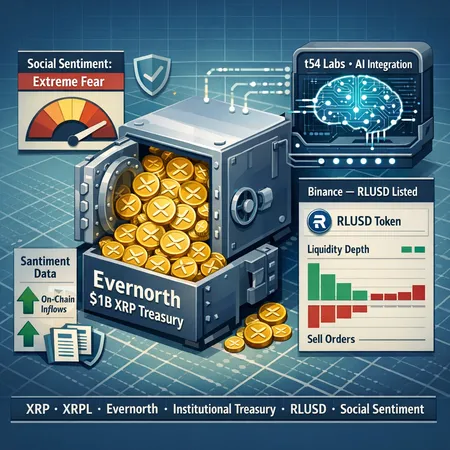

Ripple’s RLUSD landing on Binance’s XRP Ledger is a strategic milestone that enhances stablecoin utility and on‑chain liquidity. Large on‑chain XRP movements tied to exchanges may reflect deeper liquidity operations that investors should monitor.

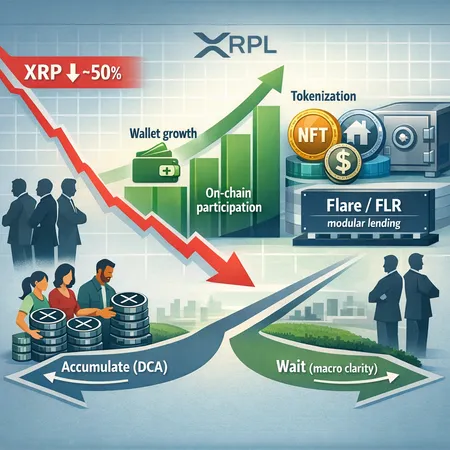

XRP wallet addresses and on‑chain activity are climbing even as price drops close to 50%, creating a tricky signal for investors. This article unpacks the metrics, institutional context, new XRPL yield rails, and practical accumulation frameworks.

A $280M batch of certified polished diamonds is being tokenized on the XRP Ledger with Billiton Diamond, Ctrl Alt and Ripple involved. This project and related strategic moves could pivot XRPL from payments rails toward a broader real‑world asset (RWA) platform.

Ripple’s recurring escrow unlocks, XRPL’s 2026 upgrades and a pending US market‑structure bill create a dense set of near‑term catalysts for XRP. This guide breaks down supply mechanics, regulatory inflection points, leverage risks and an actionable watchlist for traders and long‑term holders.

David Schwartz pausing his personal XRPL hub to upgrade to XRPL 3.0 is more than a developer note — it exposes technical tradeoffs and commercial opportunities that could accelerate XRP rails for corporates. Combined with Japan’s regulatory push and Ripple leadership commentary, this upgrade has practical implications for treasury, compliance and node operators.

Evernorth’s plan to build a >$1 billion XRP treasury on XRPL and RLUSD’s Binance listing mark a step-change in institutional plumbing for XRP. A divergence between on-chain institutional flows and retail social sentiment could create asymmetric return opportunities for long-term allocators.

Ripple’s institutional push — from UC Berkeley’s UDAX developer pipeline to Evernorth’s Wall Street framing — is dovetailing with rising on‑chain activity and restrained whale flows. Together these signals recast XRPL as a settlement‑layer candidate worthy of institutional evaluation.

An investigative look at RLUSD’s $40M transfer via a Gemini-labelled address, what Evernorth–Doppler means for institutional XRP liquidity on the XRPL, and why debunked Amazon rumors still shift market perception.