XRP

XRP is moving from retail speculation toward institutional utility as ETFs, treasury models like Evernorth’s, and lending products deepen market plumbing. Treasurers and allocators must weigh yield and liquidity gains against custody and regulatory risks.

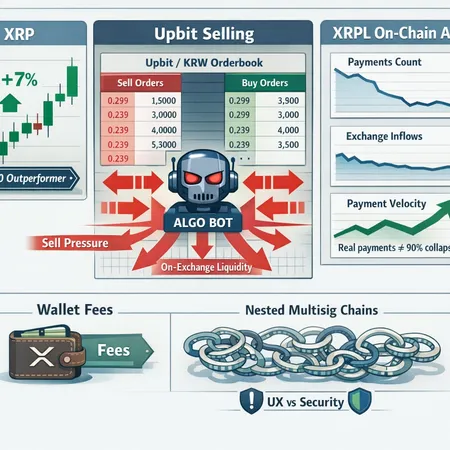

XRP has been a top‑10 price outperformer, yet XRPL payment volume, exchange flow data and community disputes paint a stressed picture. This article unpacks the technicals, on‑chain metrics, Upbit selling reports, the Xaman wallet fee row and scenarios that reconcile the rally with degraded on‑chain activity.

The XRP Ledger has become the primary rails for tokenized U.S. Treasuries and is posting rapid short‑term RWA growth, but issuance metrics mask weaker on‑chain activity and price pressure. Institutional product teams should separate custody and issuance flows from secondary liquidity when evaluating XRPL as an RWA backbone.

The Federal Reserve’s inclusion of XRP in its crypto risk calibration elevates the token from litigation-era outlier to a policy-relevant instrument. Traders and IR teams must now balance macro-driven price moves (CPI, ETF inflows) with an emerging regulatory lens that alters liquidity and tradability.

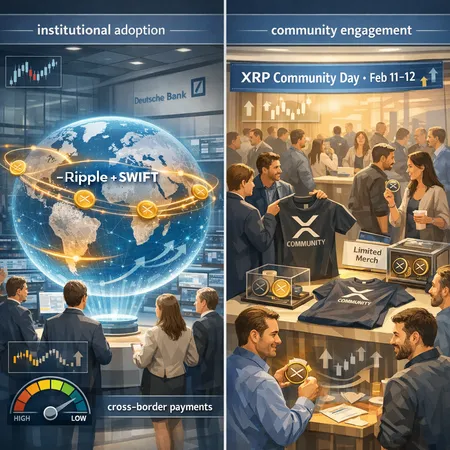

Deutsche Bank’s tests with Ripple+SWIFT and Ripple’s community push highlight a tension: institutional rails are advancing, but XRP’s price and on-chain flows often react to community events and market fear. This article separates partnership headlines from product exposure and offers a practical checklist for payments strategists.

A $63.1M weekly jump into XRP ETPs amid BTC weakness has traders asking whether smart money is reallocating or simply hunting a beaten-down alt. This piece breaks down who’s likely behind the flows, on‑chain warning signs like SOPR declines, and a practical risk/reward framework for allocators.

XRP has re-emerged as a retail favorite, backed by a meaningful private valuation update for Ripple and a technical pivot at $1.40. This piece maps the bullish scenarios traders watch, the catalysts that could validate a breakout to $3.00+, and the risks that would snuff the momentum.

XRP is seeing notable spot ETF demand even as on-chain and technical signals look deeply oversold and regulatory frictions between TradFi and DeFi keep rallies capped. This analysis reconciles flows, metrics, and regulation into scenario-based outcomes for traders and investors.

A data-led take on XRP’s sharp rebound, what $11B of inflows tells us about liquidity and market structure, and whether Ripple’s push toward real-world payments can sustain institutional on‑ramps.

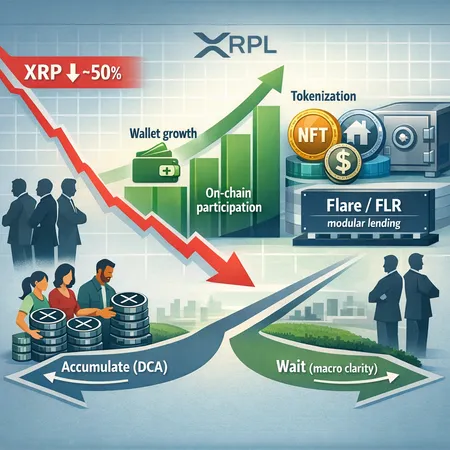

XRP wallet addresses and on‑chain activity are climbing even as price drops close to 50%, creating a tricky signal for investors. This article unpacks the metrics, institutional context, new XRPL yield rails, and practical accumulation frameworks.