Solana

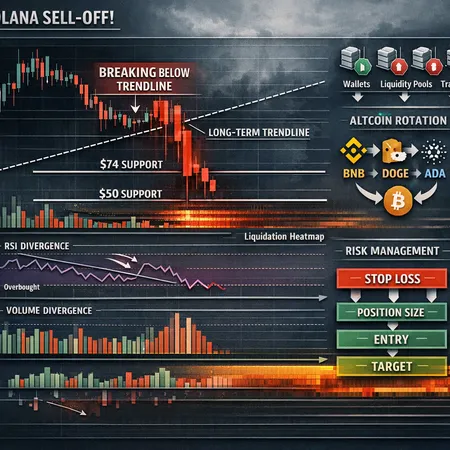

SOL recently broke a multi-month trendline and is testing critical support around $74 — failure could open a path toward $50. This piece diagnoses the break, explains on-chain and liquidity drivers, places SOL inside an ongoing altcoin rotation, and gives actionable trade frameworks for active traders.

This deep dive examines evidence of capital leaving Solana, deteriorating on‑chain activity, derivatives positioning and the liquidation clusters that could spark a SOL short squeeze. It concludes with tactical setups and risk controls for traders and desks.

As roughly $30B of SOL sits staked, liquid staking and derivative tokens could free huge on‑chain liquidity — even as SOL ETFs register notable outflows. Builders should weigh the mechanics, timelines, and product opportunities to capture that capital.

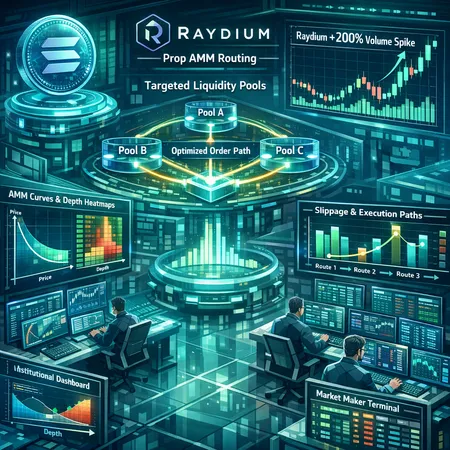

Solana’s Prop AMM designs and targeted liquidity engineering are reshaping execution quality for large on‑chain orders, and Raydium’s recent ~200% volume spike illustrates both the promise and fragility of those gains. This article breaks down how specialized AMMs reduce slippage, what Raydium’s breakout reveals about short‑term market structure, and the risks market makers and institutions must weigh.

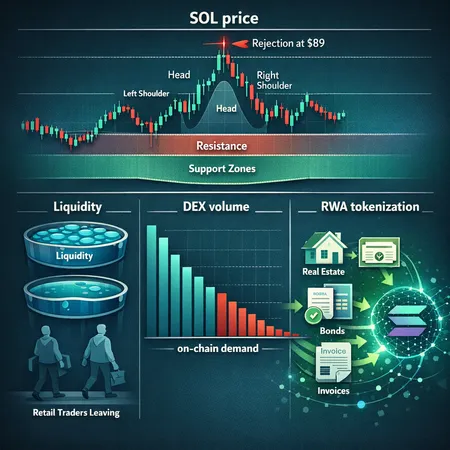

Solana's recent rejection near $89 and a drop in DEX volume has many asking whether this is a market top or an entry. This article weighs technical setups, on‑chain volume, and growing RWA tokenization to offer a balanced view for traders and DeFi builders.

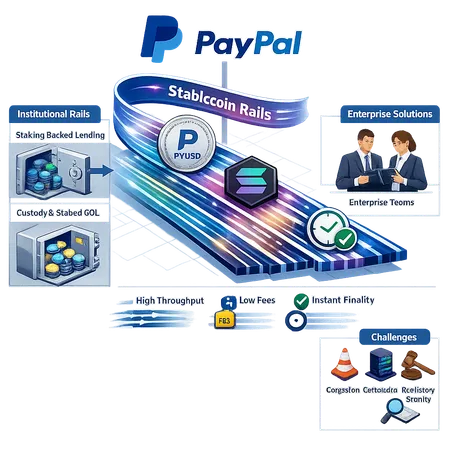

PayPal naming Solana as its default network for stablecoin processing is a watershed for blockchain payments. This piece examines the technical drivers, UX and institutional implications, risks, and practical recommendations for teams evaluating Solana as a stablecoin settlement layer.

Helius (HSDT) recently launched loans against staked SOL without unstaking — a step that could change staking economics, liquid‑staking pressure, and institutional balance‑sheet design. This article examines mechanics, market reaction, custody risks, and likely knock‑on effects for SOL price and staking yields.

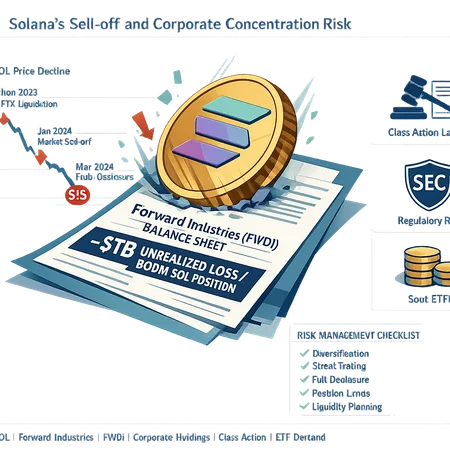

Solana’s recent price dive and a class-action suit have been amplified by Forward Industries’ roughly $1B unrealized SOL loss — yet the firm still holds a 600M SOL position. This analysis unpacks the timeline, systemic risks from concentrated corporate holdings, and whether ETF demand can realistically create a structural bid.

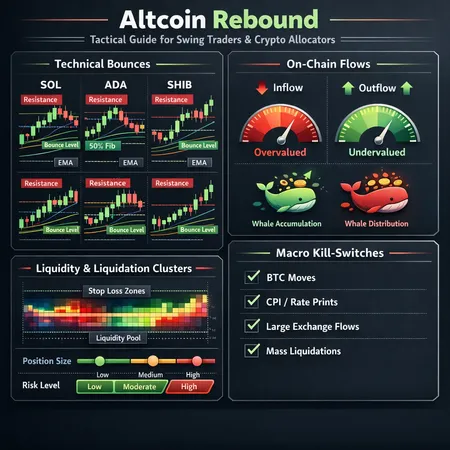

A tactical playbook for swing traders and allocators to navigate recent altcoin rebounds, blending technical levels, on-chain flow, whale signals and liquidation-cluster risk. Practical sizing rules and a macro watchlist identify what will sustain — or kill — these short-term rallies.

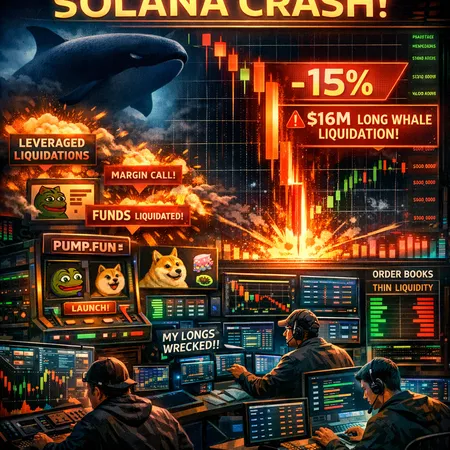

Solana’s sudden 15% slide—catalyzed by a reported $16M long-whale liquidation—exposes structural risk for high-throughput L1s that rely on concentrated liquidity and margin. This post unpacks the mechanics, contagion vectors (including memecoin launchpads and execution stacks like Pump.fun), and practical mitigation steps for developers, risk teams, and traders.