DeFi

Stablecoins function as crypto’s deployable cash — a small shrink in supply or a regional issuance change can meaningfully reduce on‑ramp liquidity and amplify Bitcoin volatility. This piece investigates the mechanics behind a 1% stablecoin slip and Tether’s CNH phaseout, and models plausible stress scenarios for BTC markets.

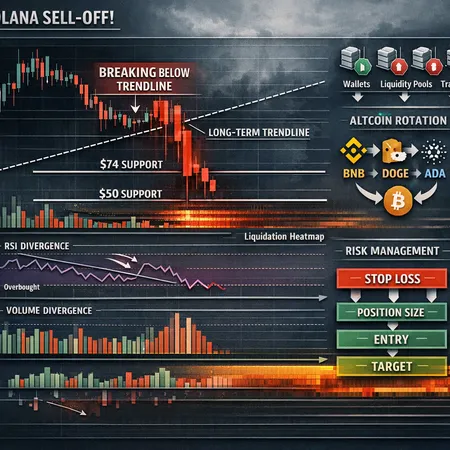

SOL recently broke a multi-month trendline and is testing critical support around $74 — failure could open a path toward $50. This piece diagnoses the break, explains on-chain and liquidity drivers, places SOL inside an ongoing altcoin rotation, and gives actionable trade frameworks for active traders.

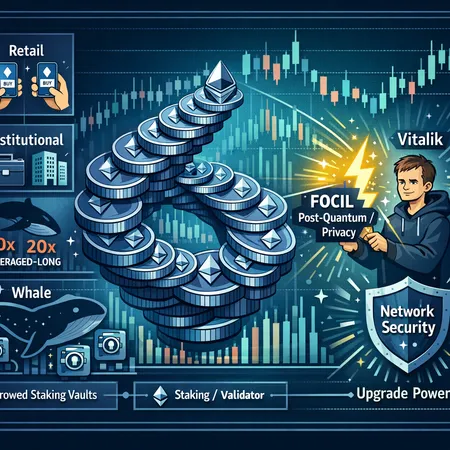

Despite a weak ETH price, on‑chain data shows record accumulation — a potentially bullish fractal that hides nuance around who’s buying and why. This deep dive parses the signal, staking concentration risks, and how Vitalik’s bolt‑on upgrade push could reshape the 2026 narrative.

FXRP topping 100M and ~70% deployed into the XRPFi DeFi stack signals a new chapter for tokenized XRP in on‑chain markets. This article breaks down how FXRP works, its implications for liquidity and price discovery, composability risks, and tactical ideas for yield farmers and LPs.

A pragmatic market narrative assessing whether SUI’s recent price compression and growing institutional ETF activity could spark a new macro wave—plus a technical and on‑chain guide to sizing positions and managing risk.

Aave surpassing $1 billion in tokenized real‑world asset deposits signals a structural shift for DeFi, moving lending markets toward hybrid on‑chain/off‑chain capital and new counterparty models. This analysis explains tokenization mechanics, the risk and liquidity implications, regulatory considerations, AAVE token dynamics, and plausible 3–5 year adoption scenarios.

A rapid, record-setting jump in Bitcoin mining difficulty and a V‑shaped hashrate rebound signal shifting miner economics and stronger network security — but consequences for short‑term supply and price dynamics are nuanced. This explainer breaks down technical causes, miner behavior, on‑chain signals to watch, and practical trading/hedging takeaways.

Ripple CEO Brad Garlinghouse’s 90% probability call on the CLARITY Act by April is a potential regulatory catalyst for XRP and Ripple’s stablecoin strategy. This piece breaks down the legislative timeline, market and legal consequences, RLUSD liquidity effects, and practical trade and risk-management frameworks.

A recent linked-wallet dump of PUMP tokens exposed how concentrated tokenomics and coordinated wallets create asymmetric exit risk. This article explains how to spot linked-wallet behavior, practical safeguards for traders and projects, and market lessons as capital rotates toward Bitcoin.

Hyperliquid’s new D.C. Policy Center and lobbying arm mark a shift from grassroots decentralization rhetoric toward professional, targeted advocacy — with important consequences for perpetual derivatives, custody rules, and infrastructure policy. This analysis breaks down regulatory targets, token-market reactions for HYPE, comparisons to earlier advocacy, and practical next steps for DeFi teams and investors.