Regulation

Hyperliquid’s new D.C. Policy Center and lobbying arm mark a shift from grassroots decentralization rhetoric toward professional, targeted advocacy — with important consequences for perpetual derivatives, custody rules, and infrastructure policy. This analysis breaks down regulatory targets, token-market reactions for HYPE, comparisons to earlier advocacy, and practical next steps for DeFi teams and investors.

The CLARITY Act’s march toward implementation is redefining regulator roles and ETF engineering, while Abu Dhabi sovereign-linked funds quietly building IBIT stakes signal a new layer of institutional demand. Together these forces reshape allocation, liquidity risk, and cross‑border flows for long‑term BTC investors.

Nexo has relaunched a U.S.-compliant suite (Yield, Exchange, Loyalty, Credit Lines). Its return signals a shift toward compliance-first crypto lending and raises new questions for retail and institutional counterparties.

The Federal Reserve’s inclusion of XRP in its crypto risk calibration elevates the token from litigation-era outlier to a policy-relevant instrument. Traders and IR teams must now balance macro-driven price moves (CPI, ETF inflows) with an emerging regulatory lens that alters liquidity and tradability.

XRP is seeing notable spot ETF demand even as on-chain and technical signals look deeply oversold and regulatory frictions between TradFi and DeFi keep rallies capped. This analysis reconciles flows, metrics, and regulation into scenario-based outcomes for traders and investors.

January 2026 saw on‑chain stablecoin payments explode, led by USDC processing an estimated $8.4 trillion in a single month—an event that recalibrates payments, competition, custody, and regulation. This article breaks down the scale, why USDC dominated, how rivals like Tether are responding, and what regulators will likely focus on next.

A pragmatic case for initiating or adding to an ETH position before July 2026, driven by potential regulatory catalysts and on‑chain accumulation by long‑term holders — plus a risk appendix and practical buy/sizing and tax checklists for U.S. and EU investors.

Tether's reported $10+ billion 2025 profit reshapes the stablecoin conversation — from market share and commercial strategy to regulatory scrutiny and reserve transparency. This analysis breaks down drivers of the profit, systemic leverage implications, and scenarios for competitors and RWA integration.

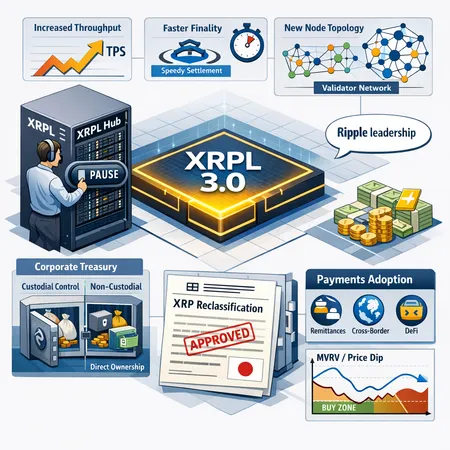

Ripple’s recurring escrow unlocks, XRPL’s 2026 upgrades and a pending US market‑structure bill create a dense set of near‑term catalysts for XRP. This guide breaks down supply mechanics, regulatory inflection points, leverage risks and an actionable watchlist for traders and long‑term holders.

David Schwartz pausing his personal XRPL hub to upgrade to XRPL 3.0 is more than a developer note — it exposes technical tradeoffs and commercial opportunities that could accelerate XRP rails for corporates. Combined with Japan’s regulatory push and Ripple leadership commentary, this upgrade has practical implications for treasury, compliance and node operators.