RLUSD: A Case Study in Compliance‑First Stablecoin Development

Summary

Executive summary

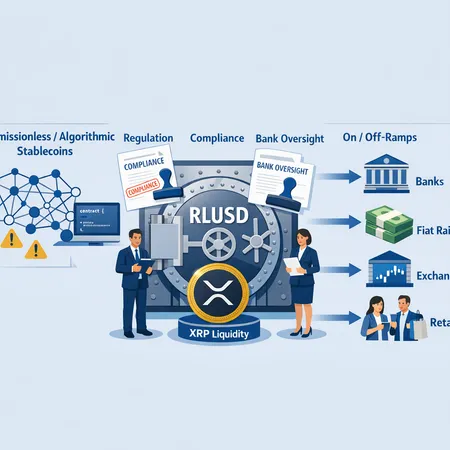

Ripple’s RLUSD is being framed as a compliance‑first stablecoin: a token built to operate with bank oversight, auditable reserves, and clear custodial links rather than the trust‑minimized approach common to many crypto native projects. That positioning is deliberate. It aims to make stablecoins palatable to regulated financial institutions and to reduce friction in on‑ and off‑ramp flows. In this deep‑dive I unpack RLUSD’s architecture and policy rationale, contrast it with algorithmic/permissionless alternatives, explore practical consequences for liquidity and rails, and consider what the strategy means for Ripple’s broader business and regulatory relationships in the US.

What RLUSD is trying to solve

Stablecoins are bridges between crypto rails and fiat. Yet that bridge has been fragile: runs on under‑reserved tokens, opaque reserve management, and regulatory uncertainty have repeatedly eroded trust in the space. RLUSD, as described in reporting on Ripple’s strategy, positions itself explicitly toward bank‑level oversight and regulatory alignment, not toward maximizing trustlessness at the expense of transparency (Coinpedia on RLUSD).

This design philosophy answers three practical problems that matter most to compliance teams and policymakers: custody and reserve guarantees, traceability for AML/KYC, and institutional governance that can be reconciled with banking rules. By embedding these priorities in RLUSD’s product roadmap, Ripple hopes to lower the legal and operational barriers that have kept some banks and payment providers on the sidelines.

Compliance‑first vs algorithmic and permissionless stablecoins

Algorithmic stablecoins and many permissionless models prize on‑chain mechanisms to maintain peg — seigniorage, dynamic supply, or cross‑collateralization with volatile assets. Those approaches can be elegant, but the market has repeatedly shown their fragility under stress (the 2022 Terra collapse is a cautionary touchstone). By contrast, a compliance‑first model like RLUSD trades off some of that on‑chain autonomy for legally enforceable reserve arrangements and third‑party oversight.

Key differences:

- Reserves and backing: RLUSD emphasizes fiat or bank‑grade custody backing and regular attestations, rather than algorithmic balancing. That reduces the probability of peg failure caused by fast market movements.

- Governance and control: Permissioned operational controls allow banks and regulated entities to meet KYC/AML obligations before custody or mint/burn operations occur.

- Transparency and auditability: Rather than relying solely on on‑chain proofs, RLUSD’s model anticipates periodic, regulated disclosures and reconciliations that are meaningful to auditors and regulators.

These differences matter because they change the incentives for banks, payment processors, and compliance officers considering whether to support a token on‑ramp or custody offering.

Practical implications for on‑ramps and off‑ramps

If stablecoins are to be useful to regulated institutions, the mechanics of moving money in and out of crypto must be predictable, auditable, and compliant. RLUSD’s bank‑oversight model targets precisely that predictability. Expect three tangible impacts:

Faster institutional onboarding: Banks and licensed custodians are more willing to integrate a token when the operator has clear custodial relationships and periodic attestations, reducing legal and compliance review cycles. Payment services and gateways — from legacy banks to fintechs — can operate with clearer internal risk limits.

Tighter AML/KYC rails: Permissioned mint/burn flows tied to KYC processes mean that on‑ramp liquidity will be easier to associate with real‑world identities, helping compliance teams meet travel‑rule and suspicious activity reporting obligations.

Liquidity and settlement dynamics: A bank‑backed stablecoin can become a preferred settlement token for corridor payments (especially when the issuer has relationships with local custodians), but it may also be less attractive for purely permissionless DeFi use cases where censorship resistance and composability are priorities.

These tradeoffs will shape adoption: retail and DeFi experiments may still prefer broadly permissionless tokens, while custodial players and institutional flows pivot toward RLUSD‑style assets for predictable legal compliance.

What RLUSD means for Ripple’s business model

Ripple’s commercial model has long combined payments software, on‑ramp/off‑ramp facilitation, and the use of XRP as a liquidity bridge. Adding RLUSD into the product mix signals a subtle strategic diversification: an attempt to build a compliant settlement layer that can sit alongside — or even in front of — XRP liquidity services.

Three points to consider:

- Product complementarity: RLUSD can act as a low‑friction fiat‑stable instrument for fiat‑forward settlement while XRP remains a cross‑border liquidity rail where latency and low fees matter. The two can coexist; they are not mutually exclusive.

- Revenue and partnership model: A compliance‑first stablecoin changes the commercial conversations from purely crypto partners to regulated banks and payments firms. That expands potential counterparties but also increases expectation of custodian relationships and contractual SLAs.

- Regulatory signaling: RLUSD serves as a tangible demonstration of Ripple’s willingness to design products with regulators in mind. This is particularly relevant given ongoing US scrutiny of Ripple’s activities and the broader debate over how stablecoins should be overseen.

Recent reporting has pointed to regulatory and company‑level signals that align with this pivot: coverage of US regulatory dynamics places XRP and Ripple in an evolving legal context, and internal signals from Ripple’s leadership suggest organizational shifts toward future‑facing products and compliance narratives (FXEmpire on XRP and the Senate crypto bill; U.Today on CTO bio updates reflecting 2026 changes).

Risk tradeoffs and market reception

A compliance‑first stablecoin lowers certain systemic risks (reserves, runs, opacity) but introduces others. Centralizing mint/burn controls and relying on custodial relationships concentrates counterparty risk and raises questions about operational resilience and governance transparency. For compliance teams, the choice often comes down to which risks are more manageable: counterparty credit risk backed by regulated contracts, or algorithmic protocol risk that is hard to litigate.

Market reception will split along use‑case lines. Institutional corridors, custodial exchanges, and regulated remitters will likely welcome RLUSD. Conversely, parts of the crypto community that value maximal decentralization, censorship resistance, and open composability may view it as less appealing for DeFi primitives.

Design considerations for compliance‑first stablecoins

For product leads and compliance officers designing similar offerings, RLUSD offers a template and a set of lessons:

- Reserve transparency: Regular, third‑party attestations or audits should be non‑negotiable. Audits must be meaningful to banking partners and regulators.

- Custody architecture: Prefer multi‑jurisdictional custody strategies with clear legal segregation of reserve assets.

- Operational controls: Clear KYC onboarding tied to mint/burn flows, integrated sanctions screening, and tamper‑evident logs for transactions.

- Legal wrapper: Contracts that define responsibilities with custodians, auditors, and liquidity partners — including contingency plans and insolvency protocols.

- Governance and escalation: A defined governance path for emergency actions (freezes, burns, migrations) that reconciles technical capability with legal authority.

These elements reduce regulatory friction and create a predictable environment for institutions to connect real‑world dollars to on‑chain tokens.

Policy considerations for lawmakers and regulators

For policymakers, RLUSD is useful as a working example of how a stablecoin can be structured to meet regulatory objectives without shutting down innovation. A few policy takeaways:

- Define clear custody and reserve rules that make audits meaningful to supervisors.

- Create proportional requirements tied to the scale and use of stablecoins (small‑scale experimental tokens vs systemic settlement tokens).

- Encourage interoperability standards for KYC/AML data sharing that respect privacy but enable effective supervision.

- Provide guidance on permissible custody relationships to avoid legal uncertainty that deters bank participation.

Regulators should balance prudential safeguards with clarity and speed: lengthy uncertainty encourages offshoring and fragmentation of stablecoin rails.

How this fits into the broader crypto ecosystem

RLUSD’s bank‑oversight approach signals a maturing segment of the market where compliance is core to product‑market fit. That evolution does not render permissionless stablecoins obsolete — rather, it carves distinct niches. Institutional corridors, regulated remitters, and businesses that require reconciliation will prefer compliance‑first assets, while permissionless models will continue to serve composability and permission‑less experimentation.

Industry participants — from exchanges to wallet providers and platforms like Bitlet.app — will need to support a multi‑token reality where custody policies, AML controls, and product UX adapt to each token’s governance model.

Recommendations for product leads and compliance executives

- Prioritize auditability and legal clarity early in design; audits are often more important than technical novelty to bank partners.

- Model counterparty failure scenarios and publish contingency plans for custodial breakdowns. Regulators and partners will want to see these playbooks.

- Design KYC/AML flows that enable rapid on‑ramps without sacrificing sanctions screening; automated tooling can reduce friction.

- Engage regulators proactively and document those conversations — RLUSD shows the value of regulatory signaling as a strategic asset.

Those building stablecoins must be explicit about the tradeoffs they accept; clarity helps downstream partners choose the right rails.

Conclusion

RLUSD is a live experiment in making stablecoins acceptable to banks, auditors, and regulators by leaning into oversight and compliance rather than maximizing permissionless attributes. For policymakers and compliance‑focused executives, RLUSD demonstrates a pragmatic path: design for bank certainty, operational auditability, and legal clarity. For Ripple, it’s both a product strategy and a regulatory signal — an attempt to expand market access for on‑chain fiat while reshaping conversations about its role in a regulated payments ecosystem.

For those evaluating regulated stablecoin models, RLUSD is worth watching closely: it crystallizes many debates about custody, reserves, governance, and the commercial incentives that will determine which tokens become the rails for institutional flows.