Trading

A run-through of macro, on‑chain and derivatives signals that could drive BTC toward the $50K zone, with a balanced checklist for traders on triggers, stops and re‑entry areas.

DOGE fell ~10% in a one‑day selloff, testing the psychological $0.10 support even as social chatter spiked in mid‑February. This piece weighs technical stress against renewed narrative momentum and offers a practical trading framework for speculative retail positions.

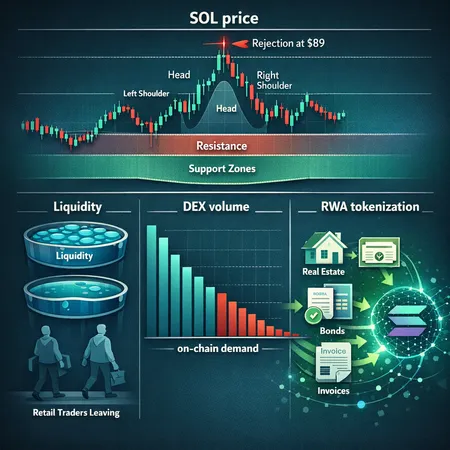

Solana's recent rejection near $89 and a drop in DEX volume has many asking whether this is a market top or an entry. This article weighs technical setups, on‑chain volume, and growing RWA tokenization to offer a balanced view for traders and DeFi builders.

On‑chain loss metrics are flashing levels comparable to the 2022 Luna collapse, but macro headwinds and market structure nuances complicate the picture. This analysis reconciles the signals from Net Realized P/L, CryptoQuant commentary, and a strong jobs report to give traders concrete risk management steps.

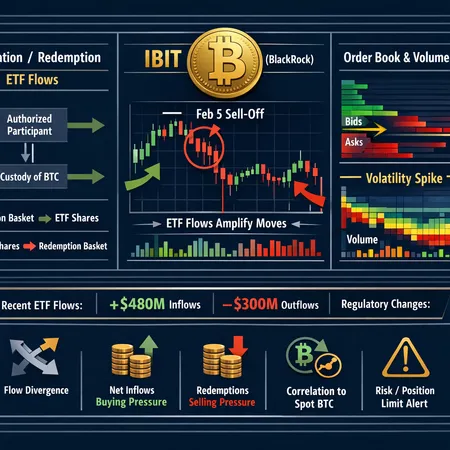

Spot Bitcoin ETFs, especially large products like BlackRock's IBIT, have become a dominant liquidity conduit that can amplify intraday moves through creation/redemption mechanics. This explainer gives intermediate traders and portfolio managers an actionable framework to read ETF-driven BTC price moves.

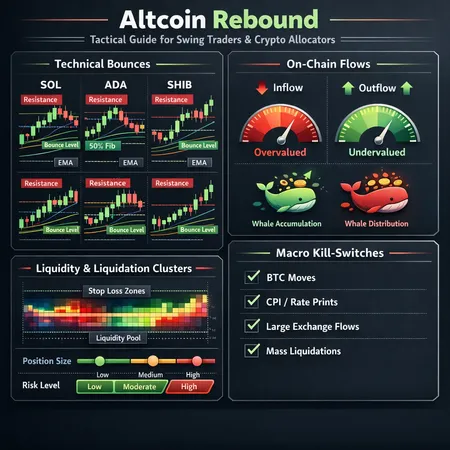

A tactical playbook for swing traders and allocators to navigate recent altcoin rebounds, blending technical levels, on-chain flow, whale signals and liquidation-cluster risk. Practical sizing rules and a macro watchlist identify what will sustain — or kill — these short-term rallies.

US spot Bitcoin ETFs recorded roughly $561–562M of inflows despite renewed BTC volatility. This article explains which issuers led flows, how creation/redemption and arbitrage work under stress, and practical trading responses.

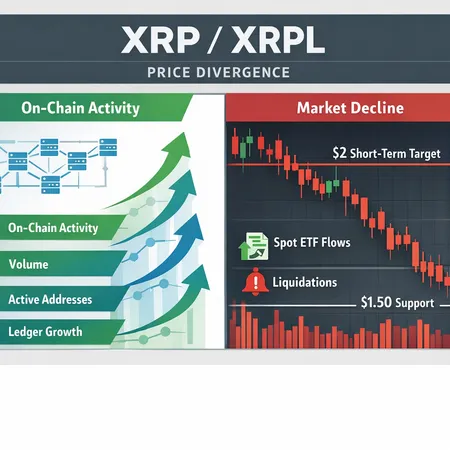

XRP's ledger is seeing record transaction growth even as the token trades near 9–14 month lows. This deep dive explains why on‑chain strength can coexist with price weakness, and what technical and on‑chain signals traders should watch for a potential rebound toward $2.

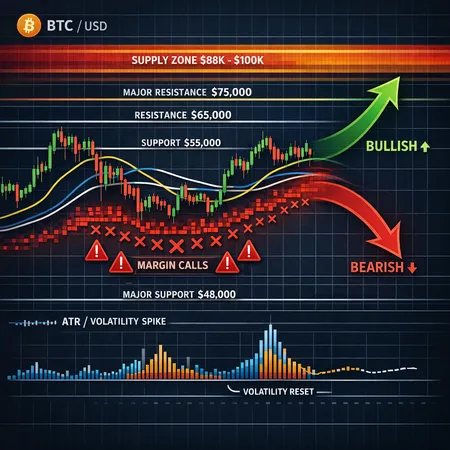

Bitcoin shows fresh signs of fragility: a concentrated invested supply above ~$88k, short-term holder pain, and technical cracks that could trigger a leverage unwind. This article maps the on-chain risks, the technical triggers, and a scenario-driven playbook for traders and allocators.

A practical playbook for trading XRP around Ripple’s XRP Community Day, where Brad Garlinghouse may unveil major news. Covers event themes, technical risk, position sizing and hedges tailored to swing traders and community investors.