Tokenization

The XRP Ledger has captured a surprising lead in tokenized U.S. Treasuries and is being chosen for retail and institutional RWA products. This article examines the data behind that 63% share, real-world product examples, regulatory and custody implications, and how XRP stacks up against ETH and SOL for enterprise builders.

Aave surpassing $1 billion in tokenized real‑world asset deposits signals a structural shift for DeFi, moving lending markets toward hybrid on‑chain/off‑chain capital and new counterparty models. This analysis explains tokenization mechanics, the risk and liquidity implications, regulatory considerations, AAVE token dynamics, and plausible 3–5 year adoption scenarios.

The XRP Ledger has become the primary rails for tokenized U.S. Treasuries and is posting rapid short‑term RWA growth, but issuance metrics mask weaker on‑chain activity and price pressure. Institutional product teams should separate custody and issuance flows from secondary liquidity when evaluating XRPL as an RWA backbone.

Institutional interest in tokenized real-world assets (RWA) is accelerating—from an $18.87M tokenized-gold purchase to rising demand for Sui and Hedera tokenization. This article examines what these events mean for product teams and asset managers evaluating custody, settlement and regulatory risk.

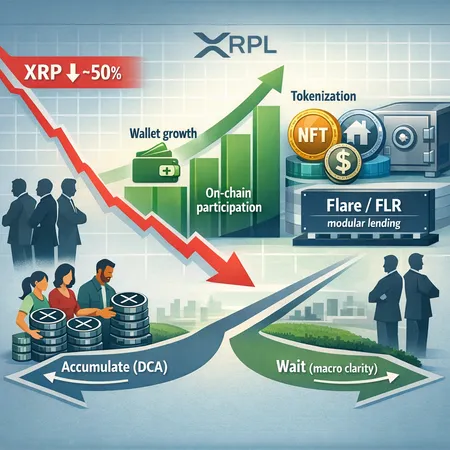

XRP wallet addresses and on‑chain activity are climbing even as price drops close to 50%, creating a tricky signal for investors. This article unpacks the metrics, institutional context, new XRPL yield rails, and practical accumulation frameworks.

XDC Network’s integration with BitGo brings regulated custody and institutional-grade controls to token issuers; Brazil’s Liqi $100M RWA deal shows how that plumbing enables large-scale, regional tokenization. This guide explains what custody enables, how USDC/USDT custody shifts counterparty risk, and an operational/legal checklist for launching tokenized assets on XDC.

A $280M batch of certified polished diamonds is being tokenized on the XRP Ledger with Billiton Diamond, Ctrl Alt and Ripple involved. This project and related strategic moves could pivot XRPL from payments rails toward a broader real‑world asset (RWA) platform.

Ondo Finance’s move to Solana is a practical test of tokenizing real‑world stocks and ETFs on a fast layer‑1. This long‑read examines settlement, custody, retail access (including mobile distribution), technical and regulatory hurdles, and a developer roadmap for on‑chain securities on Solana.

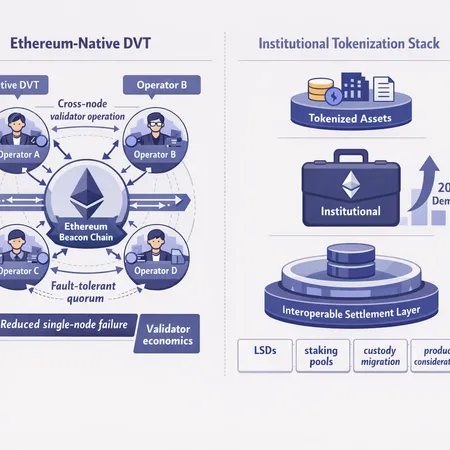

Vitalik Buterin’s native DVT proposal promises to make Ethereum staking more resilient by embedding Distributed Validator Technology in the protocol. Coupled with institutional tokenization tailwinds, this could reshape validator economics, liquid staking product design, and custody risk models.

Solana’s combination of high throughput, sub‑cent fees, and recent upticks in on‑chain activity make it a strong candidate for USD stablecoin issuance and tokenization rails in 2026. Product and treasury teams should weigh technical advantages against regulatory, custody, and market risks before choosing Solana for high‑volume payment rails.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility