Ethereum

BlackRock’s plan to keep most ETH staked via ETHB changes the economics of staking for large holders; it increases yield capture but raises questions about liquidity, reward skims and systemic concentration. Institutional and advanced retail investors need to weigh the 18% reward split, unbonding mechanics and slashing/governance exposure before allocating to staking ETFs.

A $543M whale dump has tightened ETH price structure into a bear pennant with $1,950 watching as critical support and a measured downside near $1,200. This article unpacks on-chain liquidity risks, the technical setup, scenario-based trade and hedge plans, and how hedging markets interact with Ethereum's longer-term fundamentals.

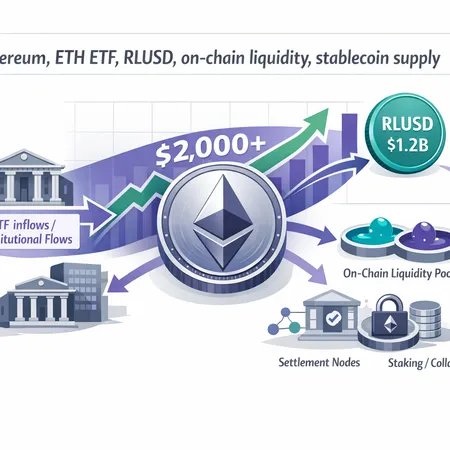

Renewed ETH spot‑ETF inflows helped ETH reclaim $2,000, while Ripple’s RLUSD expansion to ~$1.2B on Ethereum is shifting settlement and collateral dynamics. Together these forces are increasing on‑chain liquidity and altering medium‑term price scenarios for ETH.

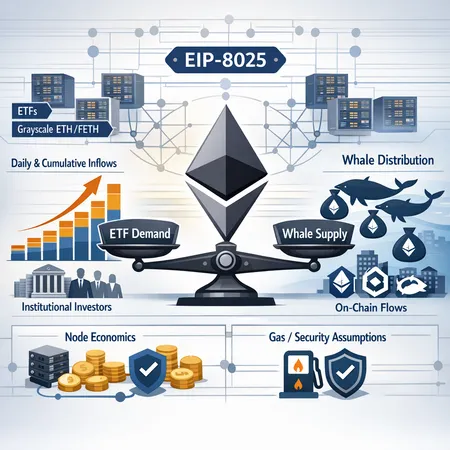

ETF inflows into ETH are rising even as many large wallets trim holdings. This piece unpacks that disconnect, weighs institutional accumulation versus whale sell-offs, and explains how EIP-8025’s shift to proof-based validation changes node economics and investor strategy.

Large off‑exchange accumulation by BitMine (40,000 ETH) and Strategy/Michael Saylor’s BTC buys are reshaping available supply and the narrative around institutional conviction. This piece unpacks OTC mechanics, miner coverage shifts, supply‑shock dynamics, and scenarios for medium‑term price floors.

Ethereum's push to embed zero‑knowledge proofs at the base layer aims to shrink validator workloads, improve scalability and create new trust primitives; the L1‑zkEVM workshop and EIP‑8025 preview show concrete design choices, while SEAL addresses the security tradeoffs. This article breaks down the technical case, validator economics, workshop takeaways and implications for decentralization and AI on Ethereum.

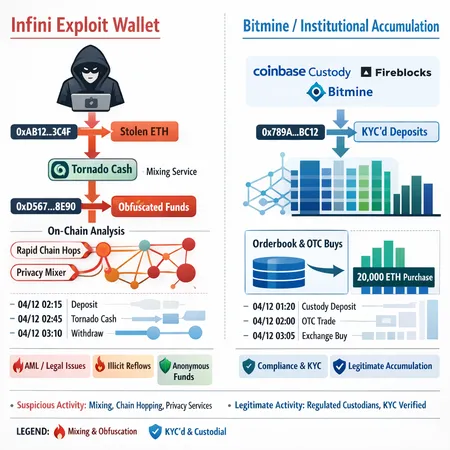

A forensic comparison of an exploit-linked wallet that reactivated to buy ETH (and routed funds through Tornado Cash) against institutional accumulation such as Bitmine’s 20k ETH purchase. This piece provides a practical on-chain provenance and AML framework for reporters and compliance teams to separate illicit reflows from legitimate buying.

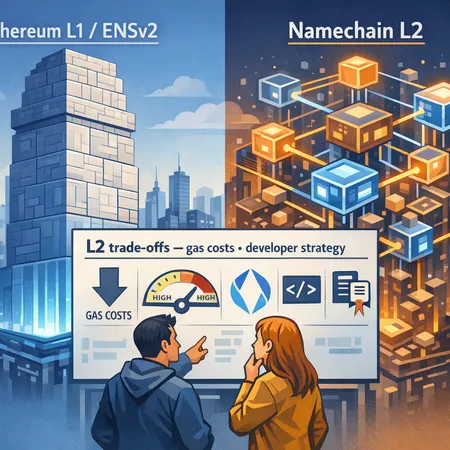

ENS’s move to pause Namechain L2 development and deploy ENSv2 on Ethereum L1 reflects shifting economics and scaling dynamics on Ethereum. This piece breaks down the technical and economic rationale, what it means for L1 vs L2 strategies, and an action checklist for product leads and Web3 architects.

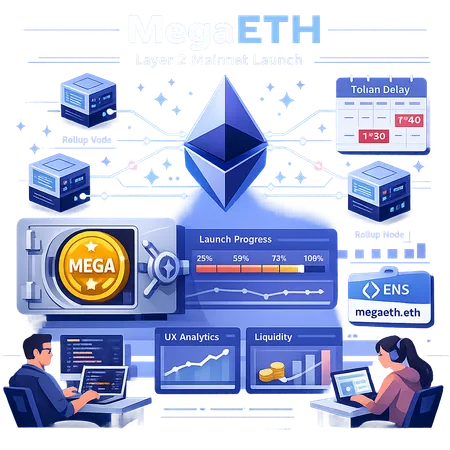

MegaETH’s mainnet is live in a product-first rollout while the MEGA token distribution is paused until milestones are met. That choice reshapes short-term UX, liquidity dynamics, and how builders should evaluate integrating with this new Layer 2.

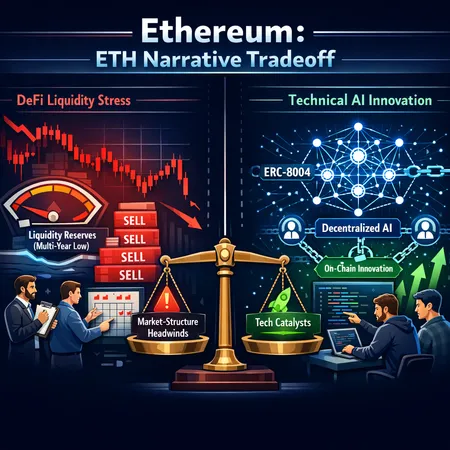

Ethereum faces a tug-of-war between DeFi liquidity stress and technical innovation from on‑chain AI standards like ERC‑8004. This deep-dive assesses reserve trends, price dynamics, and how decentralized AI could reshape Ethereum’s developer and economic moat.