Real-World Assets

The XRP Ledger has captured a surprising lead in tokenized U.S. Treasuries and is being chosen for retail and institutional RWA products. This article examines the data behind that 63% share, real-world product examples, regulatory and custody implications, and how XRP stacks up against ETH and SOL for enterprise builders.

Aave surpassing $1 billion in tokenized real‑world asset deposits signals a structural shift for DeFi, moving lending markets toward hybrid on‑chain/off‑chain capital and new counterparty models. This analysis explains tokenization mechanics, the risk and liquidity implications, regulatory considerations, AAVE token dynamics, and plausible 3–5 year adoption scenarios.

The XRP Ledger has become the primary rails for tokenized U.S. Treasuries and is posting rapid short‑term RWA growth, but issuance metrics mask weaker on‑chain activity and price pressure. Institutional product teams should separate custody and issuance flows from secondary liquidity when evaluating XRPL as an RWA backbone.

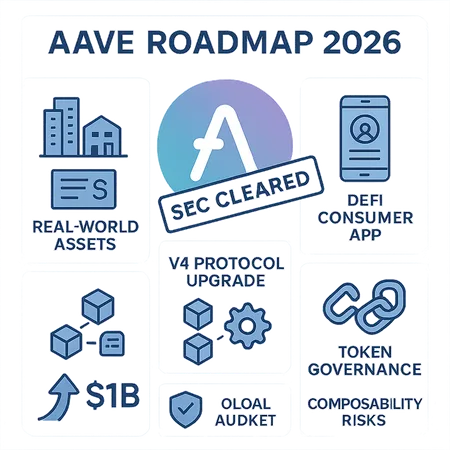

Aave’s SEC probe closure and its 2026 master plan—targeting real‑world assets, v4 upgrades and a consumer mobile app—mark a turning point for DeFi legitimacy and capital flows. This analysis assesses the regulatory signal, protocol mechanics, governance implications and the practical risks that remain.