How the CLARITY Act and Abu Dhabi’s Quiet IBIT Accumulation Are Rewriting the Bitcoin ETF Playbook

Summary

Executive summary

Policy clarity and private accumulation are converging to reshape the institutional Bitcoin landscape. The CLARITY Act — moving toward enactment — is beginning to draw clearer lines between SEC and CFTC authority and that will influence product design, custody and market structure. At the same time, reporting shows Abu Dhabi sovereign and sovereign‑linked investors, including Mubadala, increasing exposure to BlackRock’s IBIT, suggesting a deliberate, low‑profile accumulation strategy. These developments matter for portfolio allocators assessing allocation size, liquidity risk, and the implications of cross‑border flows for price formation.

Why the CLARITY Act matters for ETF structure and oversight

The CLARITY Act is not just legal plumbing; it changes how market participants design crypto products. Recent reporting outlines how the bill maps oversight between the SEC and the CFTC and what that could mean for spot Bitcoin ETFs and related instruments (CLARITY Act oversight mapping).

SEC vs CFTC: practical consequences

Market manipulation and securities tests. Where the SEC retains jurisdiction, issuers will face traditional securities‑style disclosure and registration regimes. Where the CFTC is primary, oversight tilts toward futures‑style market integrity and commodity exchange rules. That split changes the compliance burden and the monitoring model for ETF sponsors.

Product design choices. If custody, pricing and settlement fall under a CFTC framework for commodities, sponsors may favor models that lean on futures basis and cleared swaps. If SEC control is stronger for certain wrappers, sponsors must design around investor protection rules, potentially increasing reporting and limiting certain in‑kind redemption mechanics.

Custody & audit standards. One practical read of the CLARITY Act reporting is that custody practices and third‑party audits will be harmonized to whichever regulator supervises the product. That can change how sponsors select custodians and structure multi‑jurisdictional custody chains, with knock‑on effects for redemption speed and operational risk.

These are not abstract points for allocators; product design influences liquidity, tracking error, counterparty exposure and tax treatment — all inputs to portfolio construction.

Abu Dhabi’s stealthy accumulation: reading the crumbs

Two recent articles provide overlapping evidence that Abu Dhabi funds have been quietly increasing positions in BlackRock’s IBIT spot Bitcoin ETF. Reporting notes Mubadala and other Abu Dhabi‑linked investors disclosed significant holdings in IBIT, and follow‑up coverage shows additional flows through intermediary vehicles (Abu Dhabi disclosures; follow‑up on accumulation).

What “quiet accumulation” looks like

Disclosure timing and concentration. Sovereign or sovereign‑linked entities often disclose holdings on a lag; when filings appear they can show sizable, concentrated positions that were likely built over weeks or months.

Use of intermediated ETF share‑classes. The reports indicate Abu Dhabi investors expanded exposure through IBIT — a mainstream, liquid wrapper — which enables large purchases without resorting to OTC spot markets that could attract attention or move prices.

Strategic intent vs tactical trading. This pattern looks less like short‑term trading and more like strategic allocation: accessing a regulated, familiar vehicle (IBIT) to warehouse BTC exposure on a balance sheet.

For allocators, the key implication is that sovereign actors are comfortable using regulated ETF wrappers to accumulate Bitcoin, which raises the institutional credibility of these products and can stabilize demand over a multi‑quarter horizon.

Reconciling US ETF outflows with longer‑term accumulation

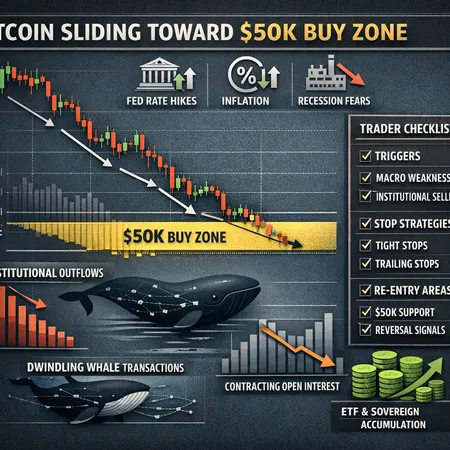

Headlines have flagged outflows from U.S. spot Bitcoin ETFs — for example, recent reporting on a roughly $105 million net outflow episode and broader data showing multi‑billion dollar institutional outflows from crypto products in a month (mystery IBIT outflow context; CoinShares data on institutional selling).

Why outflows aren’t the whole story

Gross vs net flows. Net outflows can mask heavy rotation: large buys in one bucket offset by sales elsewhere. An institutional seller rebalancing private exposures can trigger ETF redemptions even as new buyers (including sovereign funds) are accumulating elsewhere.

Cross‑border rotation. The rise in disclosed Abu Dhabi IBIT holdings suggests some flows are simply moving from OTC custody and private spot to regulated ETF wrappers. That is accumulation, but it can look like churning in U.S. custody statistics.

Liquidity and rebalancing mechanics. ETFs adapt to flows via creation/redemption. Short windows of outflows can pressure spreads and prompt market‑maker activity, but high‑quality sponsors and large custodians tend to absorb episodic demand without lasting impairment — provided stress tests and arbitrage channels are intact.

In short: a $105 million outflow day or a month of aggregate institutional redemptions does not preclude large‑scale, patient accumulation by other institutional classes. Rather, it highlights reallocation risk and the heterogeneity of institutional motives.

Tactical takeaways for allocators

Below are practical considerations for portfolio managers and strategic allocators thinking about BTC exposure via ETFs such as IBIT.

Position sizing and diversification

Treat Bitcoin allocation as a strategic exposure with a plan for volatility. If sovereigns like Mubadala are accumulating, that supports a baseline view of structural demand, but it does not immunize BTC from macro‑led drawdowns.

Consider a staggered entry: dollar‑cost averaging into ETF shares or using option structures to manage drawdown risk. ETF wrappers simplify execution, but position sizing still needs the usual risk limits and stop‑loss frameworks.

Liquidity risk and stress scenarios

Model redemptions under a stressed price path. ETF mechanics generally provide liquidity, but large, correlated redemptions can widen spreads and increase slippage.

Consider access pathways: spot executions vs ETF on‑exchange. ETFs reduce custody complexity but introduce sponsor/custodian counterparty exposures. Check the ETF’s creation/redemption process and authorized participant ecosystem.

Cross‑border flow monitoring

Watch filings and geographic disclosure windows — they can reveal stealth accumulation cycles. Abu Dhabi activity in IBIT shows how sovereign buyers can quietly scale through regulated vehicles.

Use flow‑based signals as a complement to on‑chain metrics. Traditional allocators often under‑weight cross‑border ETF flow analysis; this is changing as sovereign and institutional adoption grows.

Custody, tax and operational considerations

Understand custody chain: regulated ETFs provide operational simplicity, but tax treatment and settlement features vary by jurisdiction. Consult tax and legal advisors before scaling.

Sponsors with deep custody and audit capabilities will likely be preferred counterparties for large allocators. Monitor sponsor disclosures and audit reports.

Where to watch next

Legislative momentum: follow the CLARITY Act movement and subsequent regulator guidance; classification changes will inform which product designs are feasible and which litigation risks remain. See succinct reporting on the current bill mapping to regulators for context (CLARITY Act reporting).

Sovereign filings and fund disclosures: periodic updates on holdings can reveal accumulation cadence. Recent coverage of Abu Dhabi investors increasing IBIT exposure is a reminder to track these filings (Abu Dhabi disclosures; follow‑up accumulation).

Flow anomalies: large, short‑term outflows are worth investigating (for example, coverage of a $105M outflow day) to discern whether they’re tactical rotation or signs of structural shifts (ETF outflow context; CoinShares institutional flows).

Conclusion

The intersection of regulatory clarity and discreet sovereign accumulation is shifting the center of gravity for institutional Bitcoin exposure. The CLARITY Act is likely to force clearer product design tradeoffs between SEC and CFTC paradigms, while Abu Dhabi’s measured purchases of IBIT highlight a maturity in how large allocators access BTC. For portfolio managers, the immediate priority is pragmatic: size allocations deliberately, stress‑test liquidity scenarios, and keep an eye on cross‑border flow signals that can presage larger structural shifts. Platforms that monitor flows and filings — including services like Bitlet.app that track ETF movement — will be increasingly useful as this market evolves.

Sources

- https://coincu.com/news/bitcoin-holds-as-clarity-act-maps-sec-cftc-oversight/?utm_source=snapi

- https://en.cryptonomist.ch/2026/02/18/bitcoin-etf-holdings-abu-dhabi/

- https://thenewscrypto.com/abu-dhabi-funds-expand-bitcoin-etf-holdings-through-ibit/?utm_source=snapi

- https://cointelegraph.com/news/bitcoin-etfs-105-million-outflows-mystery-ibit-buyer?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- https://dailyhodl.com/2026/02/18/institutional-investors-sell-3740000000-in-bitcoin-and-crypto-in-just-one-month-as-btc-price-craters-coinshares/