XRP’s Crossroads: Retail Attention, Ripple Valuation, and the $1.40 Support Test

Summary

Introduction

XRP has re-entered center stage in recent weeks: viewership metrics show a surge of retail curiosity, price action has tightened around a pivotal $1.40 area, and headlines about Ripple’s corporate strength are reframing the narrative from litigation scars to institutional durability. For swing traders and investors trying to decide whether this is a durable shift or a short-lived retail squeeze, we need to line up three things — attention, fundamentals, and technicals — and then map the plausible near-term scenarios.

Why retail attention matters now

Retail attention is not the same as conviction, but it's an important fuel source for short- to medium-term rallies. CoinMarketCap viewership data has flagged XRP among the most-watched assets recently, a sign that small traders are monitoring and potentially piling in. Increased eyeballs lead to higher exchange flows, tighter bid-ask spreads in the short run, and a greater likelihood of episodic squeezes when stop clusters are hit.

That said, attention is fickle. Rotations between memecoins and more established altcoins are routine — traders move from Bitcoin dominance into altcoin playbooks when they seek leverage. The key question is whether retail interest is being matched by accumulation from longer-term holders and institutions or whether flows are mostly momentum-driven and easily reversible.

Fundamental update: Ripple’s private valuation and corporate strength

A material update to Ripple’s private valuation has shifted part of the narrative from legal remediation to corporate robustness. Recent reporting indicates Ripple’s private valuation is approaching the elite private-company ranks, with figures near a $50 billion mark — a data point that implies deep-pocketed investors view Ripple’s payments and enterprise blockchain prospects as valuable long-term bets (Coinpaper report on Ripple’s valuation).

Higher private valuations matter for a few reasons: they suggest confidence from VCs and private buyers, improve Ripple’s balance-sheet optics for partnerships, and provide an independent anchor to the token’s narrative. Coupled with CoinMarketCap’s viewership data showing XRP as one of the most-watched assets (Coinpaper on XRP viewership), the fundamental story is that XRP is benefiting from both retail curiosity and upgraded corporate perception.

But fundamentals alone don't move prices in crypto without liquidity and technical confirmation. That brings us to the $1.40 pivot.

The $1.40 flip: why analysts highlight it and the technical map

A number of technical commentators have argued that the $1.40 area has shifted from resistance into critical support, a flip that changes the risk-reward profile for bullish traders (NewsBTC analysis on $1.40 support). If $1.40 holds on meaningful volume, it becomes a base from which larger targets become plausible.

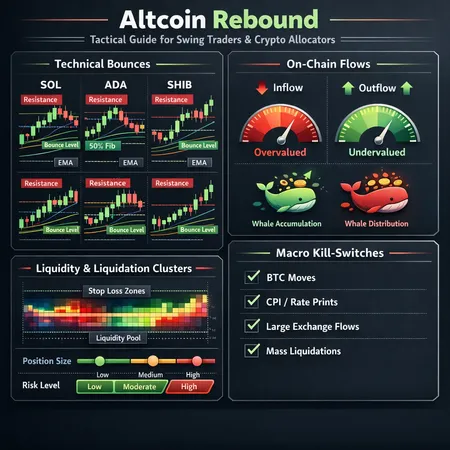

Technical levels to watch (near-term):

- Immediate support: $1.40 — the new fulcrum; loss below this level increases the chance of retesting $1.00–$1.10.

- Short-term resistance: $1.80–$2.00 — a psychological and technical cluster where profit-taking often appears.

- Mid-term target: $3.00+ — requires a breakout through $2.00 with high sustained volume and widening participation.

Key confirmations for a durable breakout:

- Volume expansion on rallies and lighter volume on pullbacks, indicating buyers absorb selling.

- Increasing net inflows to exchanges or accumulation on-chain rather than exchange outflows (depends on how wallets move).

- A rising series of higher lows and highs on the 4H–1D charts.

Conversely, losing $1.40 with accelerating sell volume would invalidate the bullish thesis and likely trigger a deeper retracement into the $1.00 area or lower.

Catalysts that would validate a breakout

- Institutional and strategic flows: News of new Ripple partnerships, enterprise integrations, or institutional buyers adding XRP to their balance sheets would materially change supply-demand expectations. The private-valuation story hints at this possibility.

- Positive regulatory clarity: Any favorable legal developments or explicit guidance that reduces jurisdictional risk would remove a major drag on institutional allocation.

- Volume-backed altcoin rotation: A persistent move of capital out of BTC and into altcoins — driven by macro calm or BTC consolidating — can lift XRP along with other large-cap altcoins.

- On-chain metrics improving: Rising active addresses, lower exchange sell pressure, and increased staking-like usage (where applicable) all support a cleaner price appreciation path.

When two or more of these catalysts align — for example, rising institutional flows coinciding with retail accumulation and improving on-chain demand — a breakout to $3.00+ becomes increasingly likely.

Risks and what could derail momentum

- Regulatory setbacks or renewed litigation headlines. Even rumors can spook quick capital flows, especially from institutional desks sensitive to compliance.

- Failure to hold $1.40. Technical weakness attracts short-sellers and induces stop cascades that accelerate downside.

- Altcoin rotation reversal. If retail attention shifts to memecoins or newly hyped projects, XRP can lose the liquidity bid that powered the initial move.

- Macro volatility and liquidity drain. Broader risk-off conditions (rate surprises, equity sell-offs) can pull capital out of risk assets, and altcoins typically feel the pain first.

- Market structure risks: order book thinness on smaller exchanges can amplify moves, creating sharp but unsustainable spikes that reverse quickly.

Assessing these risks matters because retail-driven squeezes can look convincing on the way up but evaporate when the bid is removed.

A practical trade framework for swing traders

If you're considering a swing position around XRP, here’s a pragmatic checklist:

- Define your thesis: are you trading momentum (short-term retail flow), or do you believe fundamentals (Ripple valuation, partnerships) will underpin a multi-month move?

- Entry strategy: consider staged entries — buy on confirmed hold of $1.40 with volume, or use dollar-cost averaging to reduce timing risk.

- Stops and size: place a stop just below the invalidation level you can tolerate (e.g., below $1.30 if $1.40 is your fulcrum) and size positions so a stop-out won’t harm your portfolio.

- Targets and scaling: set an initial take-profit zone near $2.00; scale further at $2.50–$3.00 if volume and breadth confirm continuation.

- Use order-level vigilance: watch for large exchange inflows or sudden order-book imbalances; these can signal shifts from accumulation to distribution.

Platforms like Bitlet.app can make disciplined entry plans and recurring buys easier to execute, but the decision logic should be yours.

Conclusion — durable trade or short-lived squeeze?

At the intersection of heightened retail attention, an improved corporate narrative for Ripple, and a clear technical pivot at $1.40, XRP presents a compelling set of scenarios. The bullish case is straightforward: if $1.40 holds with broadening volume and positive fundamental headlines (institutional flows, regulatory clarity), the path to $3.00+ is plausible. The bearish case is equally simple: lose $1.40 and momentum collapses.

For traders, the right approach is not to guess the single outcome but to prepare for both: define your invalidation, manage position size, and watch the catalysts and order flow that historically determine whether a rally is built on accumulation or mere attention.

Sources

- Ripple enters elite top 10 private titans; ~$50B valuation: https://coinpaper.com/14406/ripple-enters-elite-top-10-private-titans-50-b-valuation-shakes-up-the-unicorns?utm_source=snapi

- XRP grabs spotlight as CoinMarketCap’s second most-watched crypto: https://coinpaper.com/14399/xrp-grabs-spotlight-as-coin-market-cap-s-second-most-watched-crypto-hinting-at-dip-buying-frenzy?utm_source=snapi

- XRP price analysis on $1.40 flip and bullish targets: https://www.newsbtc.com/news/xrp-price-prediction-back-to-1-40-subbd-token-presale/