Market Structure

A data-led take on XRP’s sharp rebound, what $11B of inflows tells us about liquidity and market structure, and whether Ripple’s push toward real-world payments can sustain institutional on‑ramps.

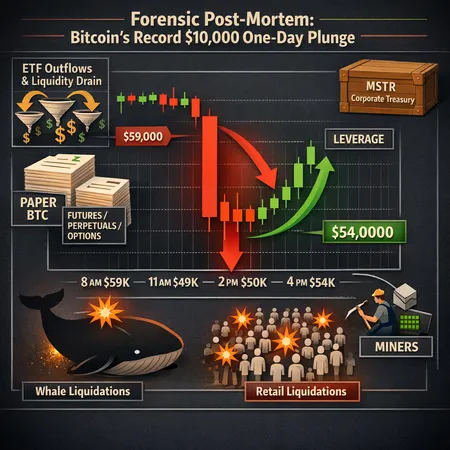

A forensic post-mortem of Bitcoin’s record one-day drop, examining the timeline, ETF outflows, derivatives-driven synthetic supply, liquidation dynamics, and practical risk-management lessons for institutions and retail.

Massive daily outflows from US spot Bitcoin ETFs coincided with a liquidation wave and miner stress as BTC approached $70k. This article unpacks drivers, on-chain signals, and pragmatic trade and portfolio rules for intermediate traders and allocators.

SOL slipping under $100 is a wake-up call: the altcoin selloff is exposing fragile market structure and liquidity mismatches. This piece breaks down technical setups for SOL and other large-cap altcoins, diagnoses contagion drivers, and offers actionable risk-management and recovery scenarios for traders.

Jupiter’s integration of Polymarket brings native, no-bridge prediction markets to Solana — a change that reshapes product-market fit, trader workflows, and the primitives DeFi teams should build next.

Exchange-level pruning, stalling USDT minting and ETF outflows are converging to tighten on-exchange liquidity and raise execution risk. Traders and market makers must adapt hedges, routing and risk controls to navigate amplified volatility.

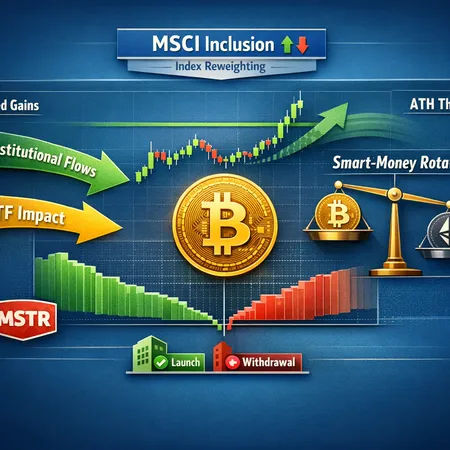

A wave of institutional flows, MSCI index tweaks and smart-money rotation are reshaping 2026’s price discovery for BTC and ETH. This article unpacks the mechanics, risks, and signals portfolio managers should watch.

XRP’s early‑2026 jump — driven by spot ETF inflows and regulatory shifts — raises a key question: can ETF capital and a friendlier policy mix deliver a lasting market‑share gain? This article breaks down mechanics, on‑chain supply, and scenarios for sustainability.

A tactical look at macro and market-structure signals — Fed repo injections, record spot‑ETF outflows, >$2.2B options expiry and recent on‑chain bearish flips — that will shape BTC’s short-to-medium term path.

Lighter reported nearly $200 billion in 30‑day trading volume and briefly overtook Hyperliquid, forcing a reassessment of derivatives liquidity and market structure in 2026. This piece unpacks the numbers, drivers, risks, and practical implications for traders and market makers.