Why the XRP Ledger May Be Entering a New Cycle of Institutional Adoption

Summary

Executive snapshot

The XRP Ledger (XRPL) is no longer just a payments narrative. Recent feature upgrades announced by Ripple, plus public reporting of interest from major financial firms, suggest XRPL could be entering a fresh cycle of institutional adoption and developer‑led activity. That matters for teams building settlement rails, tokenized‑asset products or yield strategies: on‑ledger settlement and tokenized treasuries are promising, but liquidity and concentration issues create real operational and compliance questions.

This article explains what's changing, what the signals from Wall Street mean, why clear counterparty disclosure matters (SBI’s clarification is a case study), and how tokenized T‑bill concentration on XRPL could limit utility unless addressed.

What Ripple’s upgrades aim to unlock — and why activity should lift

Ripple has signaled a renewed product push to make XRPL easier for tokenization and payments workflows. Coverage of those upgrades frames them as features designed to increase programmability and settlement utility on ledger, which in turn could attract developers and institutional flows looking for fast, low‑cost rails. See a practical write‑up of the roadmap and why analysts expect activity to pick up in the near term here.

Why that matters: institutions building on‑ledger settlement need deterministic execution (finality and predictable cost), standard token semantics and tooling for custody, reporting and KYC. If protocol upgrades reduce friction for token issuance, on‑chain settlement becomes a more realistic option for asset managers, custodians and fintechs. Developer interest tends to compound: better primitives attract builders, which create liquidity and use cases that attract more institutional partners.

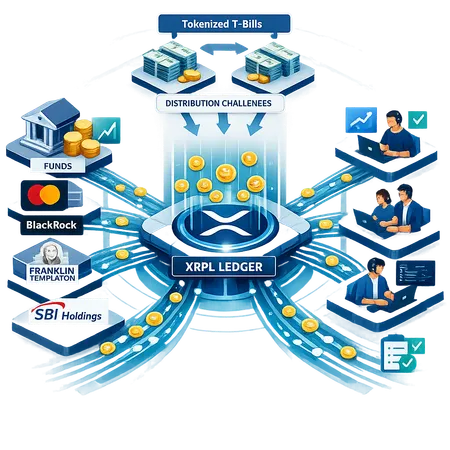

Rising institutional interest — signal vs. proof

Recent reporting shows growing attention to XRPL from large incumbents. A round of articles highlighted exploratory work and interest from groups including Mastercard, BlackRock and Franklin Templeton, among others — a sign that XRPL is now on the vendor map for enterprise pilots and product teams evaluating on‑ledger settlement options (see reporting summarizing these moves here).

What this interest implies in practice:

- Pilot programs: Expect proof‑of‑concepts focused on settlement, tokenized cash management and cross‑border liquidity nets. Institutional pilots often prioritize controlled, permissioned flows before broader market exposure.

- On‑ledger settlement potential: When banks or payment networks integrate directly with XRPL rails, they can settle tokenized assets atomically and reduce reconciliation overhead — a core promise for real‑world adoption.

- Requirements bar rises: Institutional entrants bring demands for custody, auditability, regulatory reporting, and counterparty transparency. Protocol upgrades alone are not enough; the surrounding infrastructure must be enterprise‑grade.

However, attention is not the same as adoption. Firms may explore multiple ledgers in parallel while they evaluate tradeoffs — the move from pilot to production requires operational maturity and regulatory clarity.

Why accurate disclosure and counterparty transparency matter: the SBI test case

A practical lesson for compliance teams: public claims about institutional exposures can be misleading and materially affect trust. When a report suggested SBI Holdings held $10 billion of XRP, SBI publicly pushed back, calling that figure false and clarifying its actual exposure. Coverage of that clarification is a reminder that prospective partners and fund managers must verify counterparty positions directly rather than rely on secondary sourcing (read the clarification here).

Why this matters for institutional onboarding:

- Risk assessment: Institutions need accurate counterparty positions to model concentration risk, settlement exposure and collateral adequacy.

- Compliance and audits: False or exaggerated claims complicate KYC/AML and regulatory reporting. On‑chain holdings alone do not tell the full story (custody, lending and off‑chain arrangements matter).

- Market confidence: Transparent disclosure encourages market‑making and underwriting; opacity deters liquidity providers who are legally constrained in their risk appetite.

For product and compliance teams, the takeaway is straightforward: demand direct, auditable proof of reserves/exposures, understand custodial arrangements, and require counterparties to map on‑chain holdings to off‑chain obligations.

Tokenized T‑bills on XRPL: distribution concentration and liquidity implications

Tokenized U.S. Treasuries are one of the clearest use cases for on‑ledger settlement: familiar collateral, transparent supply, and potential integration with short‑term liquidity products. Yet analysis shows a major wrinkle on XRPL: a large proportion — reportedly 63% — of a particular tokenized T‑bill supply lives on XRPL but accounts for very little of the trading activity (analysis here).

Operational consequences:

- Concentration risk: When a few wallets or entities hold most supply, markets are illiquid by design. Large trades move price, and counterparties are exposed to a small set of holders who may be slow to distribute.

- Limited utility as collateral: Tokenized treasuries only serve liquidity and settlement use cases when they can be rehypothecated or traded easily. Concentration undermines that mobility.

- Market‑making challenge: Market makers will be hesitant to quote narrow spreads if depth is shallow or if transfer restrictions exist. That increases effective trading costs and reduces the appeal of on‑ledger settlement for high‑frequency operational needs.

Addressing this requires active distribution strategies — e.g., broad issuance to multiple custodians, incentivized liquidity provisioning, or staggered onboarding of market makers — and transparent reporting of holder distribution.

What product and compliance teams should evaluate before building on XRPL

If your fund or fintech is assessing XRPL for settlement or yield products, consider a checklist of technical, market and regulatory due diligence items:

- Protocol readiness: Confirm the specific XRPL features your use case needs (atomic settlement, token standards, upgrade timeline) and test them in a controlled environment.

- Liquidity metrics: Monitor on‑chain depth, DEX order book liquidity for both XRP and tokenized assets, spread behavior and slippage under realistic trade sizes.

- Concentration analysis: Require counterparty distribution data — top‑holder percentages, transfer restrictions, and lockups — for any token you intend to accept as collateral.

- Custody and proof practices: Insist on institutional custody solutions that provide auditable proof of reserves, transfer control, segregation and insurance where applicable.

- Counterparty disclosure: Use direct attestations and independent audits to verify partner claims (SBI’s clarification shows second‑hand reports can be wrong).

- Regulatory mapping: Map on‑ledger flows to local securities and custody regulations. Tokenized treasuries may trigger securities, banking or custody rules depending on jurisdiction.

- Market‑making plan: Define who will provide two‑sided liquidity initially and how incentive programs will bootstrap depth without creating outsized centralization.

These checks bridge technical feasibility and legal/regulatory safety, allowing a staged approach from pilot to production.

Practical steps to improve distribution and liquidity on XRPL

To make XRPL tokenized assets genuinely useful for settlement and yield products, stakeholders should coordinate on three concrete fronts:

Distribution orchestration: Issuers and custodians should stagger distributions across multiple regulated custodians and exchanges to reduce single‑point concentration.

Liquidity incentives: Short‑term subsidy programs or committed‑quote obligations from market makers can jumpstart order‑book depth. These programs should be time‑bounded and tied to clear KPIs.

Enhanced transparency: Publish regular holder distribution reports and independent attestations. Firms should also disclose locked/escrowed balances and known off‑chain arrangements that affect on‑chain utility.

Taken together these measures turn theoretical token utility into operationally reliable settlement primitives.

How XRPL fits with broader crypto market rails

XRPL has strengths — low fees, fast settlement and a built‑in decentralized exchange — that make it attractive versus some high‑fee, congested networks. For teams used to building on DeFi rails, XRPL can be an efficient alternative for high‑volume, low‑cost settlement use cases. But integration plans should consider cross‑chain liquidity, interoperability with major custodians, and the practicalities of integrating on‑ledger flows with bank rails and accounting systems.

Bitlet.app and other product teams evaluating XRPL will need to balance these tradeoffs: the ledger's technical capabilities are promising, but usability for institutional settlement depends on surrounding infrastructure and market structure.

Key metrics to monitor during pilots

- Order book depth and realized slippage for target trade sizes

- Top‑n holder concentration for each tokenized asset

- Time‑to‑settlement (end‑to‑end, including custodian ops)

- Number of active market makers and committed‑quote volumes

- KYC/AML auditability and proof of reserves cadence

Track these closely during pilot phases and require predefined exit criteria if liquidity or transparency metrics are not met.

Conclusion — opportunity and guardrails

XRPL looks positioned for renewed institutional and developer activity: protocol upgrades lower friction, and rising Wall Street interest puts XRPL on enterprise radars. But moving from pilots to production will hinge on two things — clear, auditable counterparty disclosures, and meaningful improvements in distribution and liquidity for tokenized assets like T‑bills. Product and compliance teams evaluating XRPL should pair technical tests with strict market‑structure and disclosure requirements. If those guardrails are enforced, on‑ledger settlement can move from a promising concept to a practical tool in institutional toolkits.

Sources

- "3 Big New Reasons To Be Bullish About XRP, Ripple" — The Motley Fool: https://www.fool.com/investing/2026/02/16/3-big-new-reasons-to-be-bullish-about-xrp-ripple-i/

- "Wall Street giants led by Black Rock and Mastercard eye XRP Ledger in new crypto wave" — Coinpaper: https://coinpaper.com/14635/wall-street-giants-led-by-black-rock-and-mastercard-eye-xrp-ledger-in-new-crypto-wave?utm_source=snapi

- "SBI Holdings says $10B XRP talk is false" — Crypto.News: https://crypto.news/sbi-holdings-says-10b-xrp-talk-is-false/

- "XRPL holds 63% of this T‑bill token supply but barely any of the trading — and that's a problem" — CryptoSlate: https://cryptoslate.com/xrpl-holds-63-of-this-t-bill-token-supply-but-barely-any-of-the-trading-and-thats-a-problem/