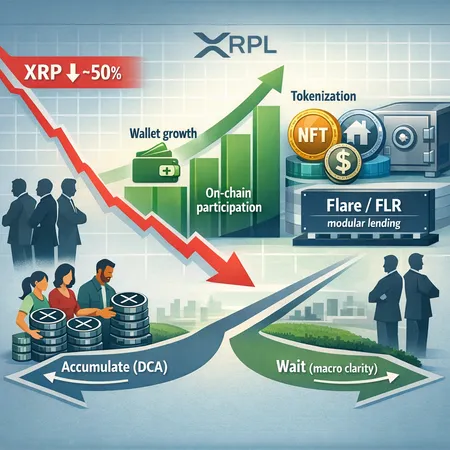

The XRP Paradox: Wallet Growth and Rising Participation While Price Plummets

Summary

The paradox: more wallets, less price

It’s an odd sight: wallet counts and on‑chain participation for XRP tick higher while price collapses — down nearly 50% from recent highs and at a 15‑month low according to market coverage. CoinSpeaker framed the price action as XRP sinking into a long‑term accumulation zone, even as chain data shows growth under the hood. At a glance this looks contradictory, but crypto markets routinely decouple price from real usage, especially during macro drawdowns.

The divergence matters because on‑chain signals are often used to time accumulation. If addresses and activity are rising, does that justify dollar‑cost averaging now? Or is the on‑chain growth a weaker form of momentum that won’t translate into price unless macro and institutional flows return?

Reading the on‑chain data: wallet growth and participation

Recent analysis highlights a noticeable uptick in XRP wallet addresses and network participation even as price dumped. NewsBTC observed the rise in wallets and on‑chain activity despite a sizeable price correction, suggesting that more users are interacting with the ledger than price alone would imply. This growth can show up in multiple metrics: new address creation, active daily addresses, on‑chain transfer volumes, and non‑exchange holdings increasing.

Not all wallet growth is equal. A steady stream of new, small addresses suggests retail accumulation or utility adoption (payments, tokenized assets, dapps). Conversely, a spike in a handful of large wallets points to whale behavior — accumulation or consolidation — which can be more fragile for price discovery if those wallets decide to liquidate. Analysts should layer metrics: watch exchange inflows/outflows, median balance per address, and cluster‑level behavior to separate genuine adoption from speculative wallet churn.

Why price can fall while network use rises

There are several reasons networks can show healthier on‑chain fundamentals while markets punish price.

- Accumulation without spending: Investors may be moving funds off exchanges into cold wallets or creating many deposit addresses for dollar‑cost averaging. That increases address counts and off‑exchange supply but doesn’t create immediate buying pressure that lifts price.

- Utility shift: XRPL might be seeing more operational activity (payments, token issuance, streaming payments) unrelated to speculative trading. Tokenization use cases can increase transactional volume without triggering a corresponding market repricing.

- Institutional stagnation: Even if retail or utility adoption grows, institutional allocation remains the price mover. Coverage on institutional inertia around Ripple’s ecosystem suggests that while legal overhangs have eased, big smart money is still cautious, directing capital toward higher‑beta altcoins instead of large re‑entries into XRP right now.

NewsBTC’s thread on Ripple’s transition from legal survival to a phase of institutional integration points to a narrative mismatch: the network’s readiness doesn’t instantly attract institutional balance‑sheet flows. Meanwhile, CoinSpeaker noted the 15‑month low and framed much of the on‑chain optimism as a potential accumulation zone — but a zone nonetheless, not a guaranteed turn.

New infrastructure and tokenization tailwinds for XRPL

The technical picture is changing in ways that could bridge the gap between usage and price over time. Two developments are particularly pertinent:

Permissionless modular lending on Flare. Flare’s recent launch of modular lending creates on‑chain yield opportunities for XRP as lenders and borrowers can more easily use cross‑chain assets. News.Bitcoin.com covered how Flare’s protocol could usher in a new yield era for XRP by unlocking composability and making XRPL liquidity more productive. That matters because yield transforms idle balances into active capital — raising the economic value of on‑ledger holdings.

A wider tokenization wave. A White House advisor has publicly predicted a tokenization boom that could spotlight ledgers like XRPL for asset issuance and programmatic cash flows. CoinPaper discussed this macro tailwind and why XRPL could benefit as a fast, low‑cost rails provider for tokenized securities or stablecoins. Tokenization expands the utility set beyond pure speculation: payments, programmable corporate treasury, and fractionalized assets all raise the long‑term revenue potential for associated ecosystems.

Together, these infrastructure shifts make the case that address growth could morph into deeper capital commitment if developers and end users adopt new yield primitives and tokenization flows. But adoption takes time; these are medium‑term catalysts, not instant price switches.

Tactical frameworks: DCA, tranches, and signals to watch

For long‑term investors and on‑chain analysts, the choice usually narrows to accumulate now in tranches or sit out and wait for macro clarity. Here are practical frameworks that blend both approaches.

Dollar‑Cost Averaging (DCA) with a risk budget: Allocate a fixed capital percentage to XRP and deploy over scheduled intervals. Use smaller tranches than usual during heightened uncertainty (for example, 6–12 tranches instead of 3–4) to smooth entry and lower timing risk.

Signal‑driven tranche buys: Combine DCA with on‑chain triggers. Consider a tranche when one or more of these occurs: sustained decline in exchange balances, a multi‑week rise in median wallet holdings, a measurable uptick in XRPL token issuance or Flare lending TVL, or visible migration of liquidity into FLR‑paired pools.

Event tranches: Reserve capital for binary catalysts — broader risk‑on rotations, macro downtrend exhaustion, or meaningful institutional reinvestment flows into XRP. NewsBTC’s analysis on institutional stagnation suggests these catalysts are still needed to confirm a durable price recovery.

Position sizing and stop discipline: For long‑term holders, stop‑losses can be counterproductive; instead, size positions so drawdowns are tolerable. If you prefer tighter risk control, use protective hedges or defined exit rules rather than emotional stops.

Use tooling and services: Track on‑chain dashboards for XRPL metrics, monitor Flare TVL and FLR liquidity, and keep an eye on regulatory news. Platforms like Bitlet.app can help structure recurring buys (installments) for investors wanting mechanical DCA without timing the market.

Signals that matter most

Prioritize a short list of metrics rather than chasing every on‑chain vanity stat:

- Exchange net flows for XRP (sustained withdrawals are bullish).

- Active unique addresses and median balance (indicates real holding growth).

- Flare lending TVL and FLR pair liquidity (real yield adoption).

- Token issuance and volume on XRPL (evidence of tokenization demand).

- Institutional custody announcements or large OTC flow reports.

Also watch broader market context: if Bitcoin resumes a confident uptrend, risk assets including XRP often benefit; conversely, macro stress can mute any positive network signals.

Bottom line: reconcile on‑chain optimism with market realism

Rising wallet counts and participation give a constructive read on XRPL’s health — they show people building, holding, and using the ledger. But price is ultimately set by marginal buyers, which today still include cautious institutions and macro‑sensitive traders. The path from network growth to meaningful price appreciation likely runs through yield adoption (Flare) and tokenization use cases that attract durable capital.

For long‑term investors: you don’t need perfect timing. Use DCA, smaller tranches, and clear on‑chain triggers to tip each buy. For analysts: watch exchange balances, Flare TVL, and real token issuance on XRPL as the signals most likely to presage a market rerating. And remember: utility and tokenomics can realign with markets — but usually on a slower cadence than price volatility.

Sources

- XRP wallets grow despite price dump and Liquid presale dynamics

- XRP hits 15‑month low and eyes long‑term accumulation zone

- XRP price narrative: institutional stagnation and smart capital flow shifts

- White House advisor predicts tokenization boom putting XRPL in the spotlight

- XRP enters a new yield era as modular lending goes live on Flare