Treasury

XRP is moving from retail speculation toward institutional utility as ETFs, treasury models like Evernorth’s, and lending products deepen market plumbing. Treasurers and allocators must weigh yield and liquidity gains against custody and regulatory risks.

Binance converted roughly $1 billion from its SAFU reserve into Bitcoin, adding an estimated ~15,000 BTC to its treasury. This analysis unpacks the mechanics and timing, the effect of a large on‑exchange BTC reserve on floating supply and sentiment, and the regulatory and market spillovers to ETFs and derivatives.

Justin Sun’s recent TRX treasury accumulation raises a key question for allocators: can concentrated, on‑balance‑sheet buys meaningfully stabilize an altcoin and seed wider market confidence? This piece breaks down scale, mechanics, historical precedent and tradeable signals for tactical entries.

A detailed post‑mortem of the Step Finance treasury breach that drained roughly $27–30M in SOL, why the STEP token collapsed, and concrete hardening measures DeFi projects should adopt to protect treasuries.

Tether reported a 23% profit decline in 2025 amid record USDT supply and rising treasury holdings, raising fresh questions about issuer economics, reserve resilience, and regulatory risk as new entrants like Ripple’s RLUSD target institutional flows.

Institutional-linked stablecoins and equity-funded bitcoin purchases are reshaping corporate treasuries and on-ramps. CFOs and treasury teams must weigh liquidity, custody, accounting, and regulatory trade-offs as bond market repricing nudges allocations toward BTC, ETH and SOL.

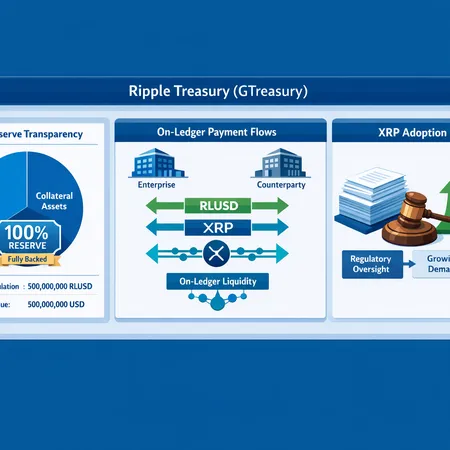

Ripple's GTreasury-powered Treasury offering and RLUSD stablecoin aim to give corporate treasuries a ledger-native option for institutional payments and liquidity management. This analysis examines what the product actually delivers, how RLUSD's reserve signals affect credibility, and the potential knock-on for on-ledger liquidity and XRP adoption amid improving regulatory clarity.

Ripple Treasury combines GTreasury’s enterprise FX and cash-management tooling with Ripple’s payment rails to offer real‑time cash deployment, on‑chain settlement and tokenized disbursements for corporates and banks. This feature explains the product, why Ripple bought GTreasury and what it means for institutional demand for XRP and blockchain-native treasury stacks.

USD1’s rapid climb past PYUSD and recent on‑chain incidents expose tradeoffs between adoption and centralized stablecoin risk. This guide helps treasurers and compliance officers evaluate reserves, cross‑chain custody, and counterparties.

In 2026 the stablecoin landscape is defined by geopolitical moves, institutional custody evolution, and multichain settlement choices. Compliance officers and treasury managers must reassess rails—USDT, ENA, TRX-based tokens, and regionally targeted issuances like RLUSD—against new regulatory and custody realities.