Blockchain

Injective’s recent governance-approved upgrade and roughly 2 million INJ of on-chain accumulation create a favorable setup. This case study reconciles the upgrade mechanics, accumulation dynamics, analyst technicals, and risk-adjusted trade scenarios for speculative allocators.

A rapid, record-setting jump in Bitcoin mining difficulty and a V‑shaped hashrate rebound signal shifting miner economics and stronger network security — but consequences for short‑term supply and price dynamics are nuanced. This explainer breaks down technical causes, miner behavior, on‑chain signals to watch, and practical trading/hedging takeaways.

Hyperliquid’s new D.C. Policy Center and lobbying arm mark a shift from grassroots decentralization rhetoric toward professional, targeted advocacy — with important consequences for perpetual derivatives, custody rules, and infrastructure policy. This analysis breaks down regulatory targets, token-market reactions for HYPE, comparisons to earlier advocacy, and practical next steps for DeFi teams and investors.

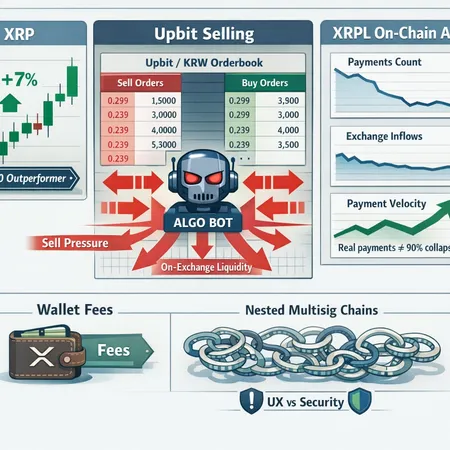

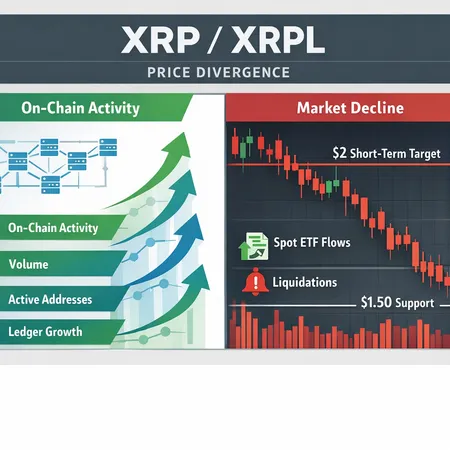

XRP has been a top‑10 price outperformer, yet XRPL payment volume, exchange flow data and community disputes paint a stressed picture. This article unpacks the technicals, on‑chain metrics, Upbit selling reports, the Xaman wallet fee row and scenarios that reconcile the rally with degraded on‑chain activity.

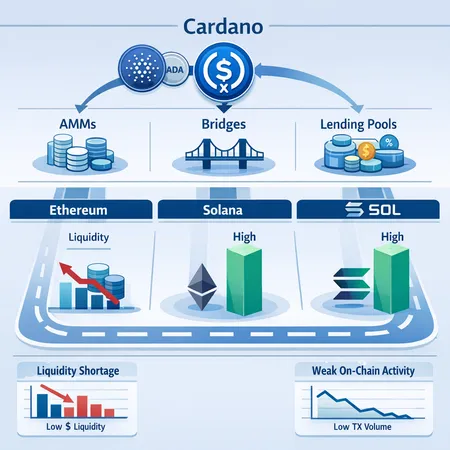

Cardano plans to launch USDCx to address dollar liquidity shortages—this article evaluates the product timeline, mechanics, and whether a native USDC-like stablecoin can materially change DeFi liquidity dynamics for ADA. We compare models on Ethereum and Solana and outline likely short-term effects for projects and holders.

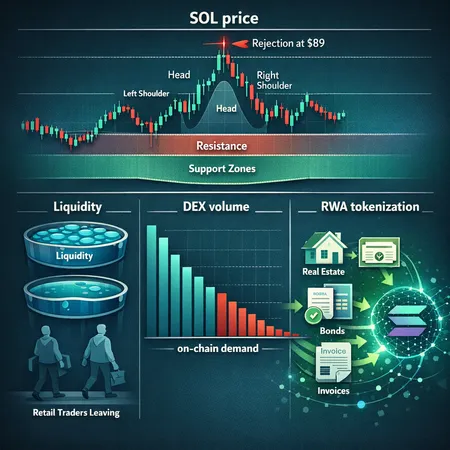

Solana's recent rejection near $89 and a drop in DEX volume has many asking whether this is a market top or an entry. This article weighs technical setups, on‑chain volume, and growing RWA tokenization to offer a balanced view for traders and DeFi builders.

Ripple expanded its Zand Bank partnership to create RLUSD ↔ AEDZ rails on the XRP Ledger, aiming to turn stablecoins into practical cross‑border plumbing for Gulf and regional corridors. This piece breaks down what the integration enables, why the UAE is the launchpad, and the practical decisions payments teams must make.

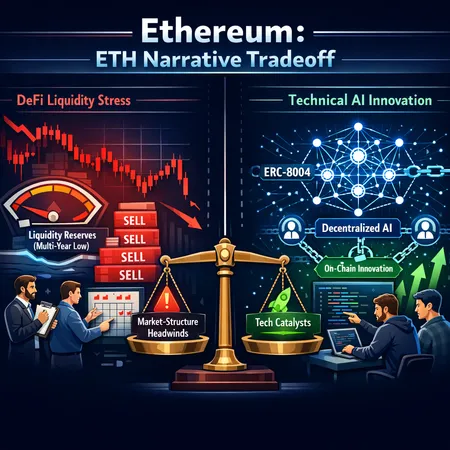

Ethereum faces a tug-of-war between DeFi liquidity stress and technical innovation from on‑chain AI standards like ERC‑8004. This deep-dive assesses reserve trends, price dynamics, and how decentralized AI could reshape Ethereum’s developer and economic moat.

XRP's ledger is seeing record transaction growth even as the token trades near 9–14 month lows. This deep dive explains why on‑chain strength can coexist with price weakness, and what technical and on‑chain signals traders should watch for a potential rebound toward $2.

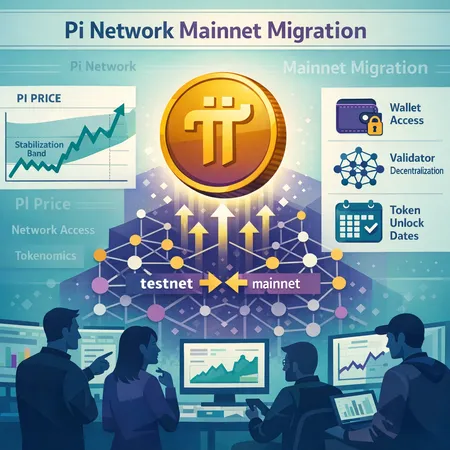

A deep-dive case study of Pi Network’s recent mainnet migration, the drivers behind the PI price rebound and early stabilization signs, and practical guidance for projects communicating migrations to avoid sell-the-news dynamics.