Quantum, Corporates, and CFIUS: Existential Risks to Bitcoin Security and What to Do Next

Summary

Why this matters now

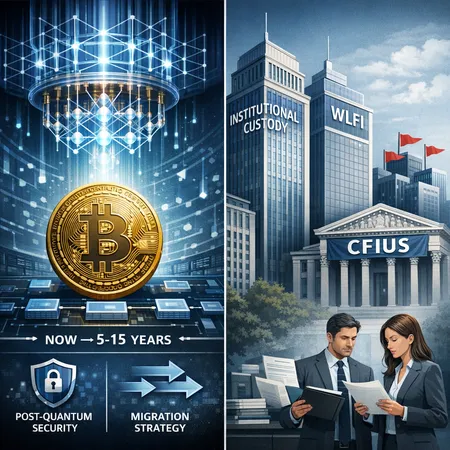

Two trends are colliding into a compound threat to Bitcoin security: accelerating research in quantum computing and heightened geopolitical scrutiny of crypto capital flows. The first is a technical fault-line — the cryptographic primitives underlying BTC (secp256k1 ECDSA and Schnorr/Taproot) are vulnerable to Shor-style quantum attacks. The second is a socio-political fault-line — concentrated corporate holdings and politically sensitive investments can prompt regulatory intervention (for example, recent calls for a CFIUS review into a UAE-backed stake in a firm linked to WLFI), which could suddenly reshape custody, liquidity, and market confidence.

For many practitioners — developers, security leads, and policy analysts — the right question is not whether these risks exist, but how to quantify exposure and deploy defensible mitigation plans now. This piece synthesizes technical timelines, developer recommendations, institutional custody concerns, and the policy trade-offs that follow.

The technical threat: what quantum computing actually endangers

Bitcoin's security rests on asymmetric cryptography: private keys sign transactions; public keys and addresses verify them. Both the classic ECDSA scheme and the newer Schnorr signatures used by Taproot derive security from the discrete-log problem on the secp256k1 elliptic curve. If a sufficiently large, fault-tolerant quantum computer runs Shor's algorithm, it can compute private keys from public keys in polynomial time — effectively breaking the signature scheme.

Two important subtleties change the operational risk profile:

- Address reuse and public-key exposure: Bitcoin addresses created from public keys are safe until the public key is revealed — typically when you spend from that address. That means funds in unspent addresses whose public keys were never revealed are less immediately exposed. But many wallets and services reuse addresses or publish public keys (e.g., change addresses, Taproot outputs), increasing harvestability.

- Harvest-now, crack-later: Even if large Shor-capable machines are a decade away, adversaries can harvest public keys, signatures, and transaction data today and store them to decrypt once quantum capability exists. This long-term confidentiality risk is the most immediate technical worry.

Cointelegraph's recent analysis captures the developer community's alarm and the call for rapid action to harden Bitcoin against quantum risk analysis warning and call to action.

Timeline: how soon could large-scale risk materialize?

Predicting quantum timelines involves uncertainty. Estimates in the community range from the late 2020s to multiple decades. Two factors could accelerate the arrival of capability:

- focused national or corporate programs (heavy public-private funding), and

- breakthroughs in error correction and qubit scaling.

Because of the harvest-now threat, even a conservative timeline does not imply safety: signatures and public keys published today remain attractive intelligence for future quantum adversaries. That makes planning urgent even if a fully capable quantum machine is still several years out.

Developer and protocol mitigations: migration paths and post-quantum signatures

There is no single silver-bullet. Mitigation is layered and must be both technical and procedural.

Short to medium term: hygiene and gradual upgrades

- Minimize address reuse and prefer one-time-use addresses. Audit wallets and custodial flows to ensure public keys are not unnecessarily leaked.

- Encourage Taproot users to avoid revealing public keys more than necessary and design UTXO management to consolidate at controlled times.

- Rotate keys for custodial holdings more frequently, and migrate high-value balances into addresses managed under more conservative signing policies.

Protocol-level options and migration strategies

- Hybrid signatures: Support transactions that require both a classical (ECDSA/Schnorr) and a post-quantum signature. This hybrid model hedges risk while preserving backward compatibility; it's attractive because it allows incremental deployment.

- Soft-fork vs hard-fork trade-offs: Adding new verification rules for post-quantum schemes likely requires consensus changes — probably via a soft-fork that introduces new script ops or taproot-compatible spending rules. Planning must start now so the community can converge on standards without panic.

- Standardization and interoperability: Developers should converge on a small set of vetted post-quantum signature algorithms (NIST PQC finalists and hybrid candidates are a starting point) and define wallet formats and migration semantics.

Post-quantum signature choices and practical constraints

Many post-quantum algorithms (lattice-based, hash-based, multivariate) carry trade-offs: larger signatures, bigger public keys, and different key-management semantics. Wallet UX, block-space costs, and privacy implications must be considered. Hybrid signing schemes help ease the transition at acceptable cost.

Institutional custody, MPC, and the corporate concentration problem

Large corporate holders of BTC concentrate risk. Recent reporting on the largest corporate Bitcoin holders highlights how falling BTC prices and concentrated exposures can stress balance sheets and counterparties; institutions that combine large holdings with opaque custody arrangements or political entanglements amplify systemic vulnerability (see analysis of major corporate holders and exposure dynamics) corporate holder report.

Institutional custody models (traditional custodians, MPC providers, and multisig vaults) will need to adapt:

- MPC and threshold-signature schemes reduce single-key risk but rely on cryptographic primitives that may also need post-quantum redesign.

- Cold storage practices must incorporate post-quantum-safe signing modules; hardware wallets and air-gapped signers must be updated to support hybrid or PQ algorithms.

- Custodians, exchanges, and OTC desks should publish migration roadmaps and verify crypto-agility in vendor contracts (including providers listed on platforms like Bitlet.app that touch custody or settlement flows).

Large holders are also attractive regulatory targets. If governments perceive a corporate holder as strategically tied to a foreign power, they may demand asset disclosure, forced divestment, or give regulators powers to intervene — actions that would force rapid on-chain movement, creating liquidity shocks.

WLFI and CFIUS: a regulatory case study

Recent political scrutiny provides a concrete example of how geopolitics intersects with crypto security: U.S. senators have urged a CFIUS probe into a UAE-backed stake in a crypto firm linked to WLFI, arguing the investment could pose national-security risks. That debate illustrates how investments in crypto firms can cross into national-security territory and trigger intervention (CFIUS probe story).

Policy actions driven by such concerns could include forced divestment, limits on cross-border custody, or enhanced vetting of institutional holders. The market consequences can be sudden: if a major custodian is compelled to transfer or freeze assets, counterparties scramble to re-establish custody, moving funds on-chain and increasing exposure to both price volatility and transactional risks (including the very quantum-related harvest risk described above).

Policy implications and recommended governance responses

The intersection of quantum risk and national-security scrutiny requires a coordinated response that balances security, market stability, and innovation.

For developers and standards bodies:

- Begin standardizing hybrid and post-quantum signature schemes for Bitcoin and related tooling. Engage with NIST and other international PQC standards workstreams.

- Produce clear upgrade roadmaps with test vectors, reference implementations, and open-source tooling so custodians and wallets can deploy safely.

For institutional security leads and custodians:

- Demand crypto-agility from vendors: proof of PQC compatibility, key-rotation policies, and transparent migration timelines.

- Maintain diversified custody strategies and rehearsal plans to move funds under duress without creating market panic.

- Inventory exposures and publish public, auditable plans for PQ migration.

For policymakers:

- Avoid ad-hoc, opaque interventions that prioritize short-term politics over systemic resilience. Instead, coordinate with technical bodies, require disclosure where appropriate, and support a phased regulatory playbook that accounts for technical realities.

- Encourage international cooperation on standards and non-proliferation of offensive quantum capabilities targeted at civil infrastructure.

CFIUS-style reviews are a legitimate national-security tool, but they must be used with surgical precision: overly broad actions risk market instability and could push actors to clandestine or less-regulated jurisdictions.

Action checklist for security teams (practical, immediate steps)

- Audit wallet behavior for address reuse and public-key leakage.

- Require custodians and MPC vendors to provide PQ migration roadmaps and hybrid-key support timelines.

- Implement faster key rotation for high-value holdings and avoid long-lived on-chain publishings of public keys where possible.

- Participate in cross-industry working groups to standardize PQC choices and test interoperability.

- Engage legal and policy advisers early to understand how WLFI-style regulatory actions could affect custody and corporate holdings.

Conclusion

Quantum computing and geopolitical scrutiny are not independent nuisances — they compound. A future quantum adversary could exploit on-chain public information harvested today, and concentrated, politically sensitive corporate holdings could invite regulatory actions that stress market plumbing. The right response is both technical and institutional: prepare migration paths to post-quantum and hybrid signatures, harden custody practices, and press for measured policy frameworks that encourage coordination rather than reactionary intervention.

The clock is not simply about qubits; it's about governance, coordination, and preparedness. Developers, security leads, and policymakers should treat post-quantum readiness and prudent institutional governance as complementary pillars of Bitcoin security, and platforms and vendors (including custody channels and marketplaces like Bitlet.app) should be explicit about their roadmaps.

Sources

- Cointelegraph — Bitcoin quantum computing risk and developer warnings: https://cointelegraph.com/news/bitcoin-quantum-computing-risk-institutions-developers?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- Cointelegraph — Senators urge CFIUS probe into UAE-backed stake and WLFI: https://cointelegraph.com/news/senators-urge-cfius-probe-uae-stake-trump-linked-wlfi?utm_source=rss_feed&utm_medium=rss&utm_campaign=rss_partner_inbound

- The Motley Fool — Report on large corporate Bitcoin holders and exposure dynamics: https://www.fool.com/investing/2026/02/15/is-the-worlds-largest-corporate-holder-of-bitcoin/

For further reading on practical migration patterns and cryptographic choices, follow community working groups and NIST PQC developments. For context on market and DeFi implications, see how on-chain liquidity and smart-contract platforms can amplify operational shocks in interconnected systems such as DeFi.