Altcoins

Coinbase expanded its USDC-backed loan product to accept XRP, DOGE, ADA and LTC as collateral, offering up to $100k loans. This explainer breaks down the mechanics, borrower and platform risks, market liquidity effects, and a practical checklist for retail borrowers.

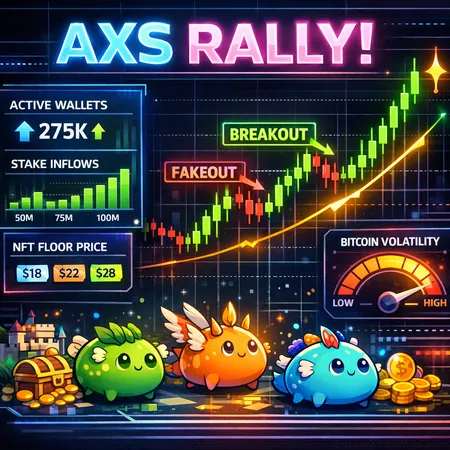

Axie Infinity’s sudden AXS rally has drawn traders back to play-to-earn and gaming tokens — but is the move a sustainable recovery or a short-lived pump? This analysis breaks down on-chain drivers, the technical structure, Bitcoin’s role, and the metrics traders should monitor to confirm a lasting comeback.

XRP has re-emerged as a retail favorite, backed by a meaningful private valuation update for Ripple and a technical pivot at $1.40. This piece maps the bullish scenarios traders watch, the catalysts that could validate a breakout to $3.00+, and the risks that would snuff the momentum.

XRP is seeing notable spot ETF demand even as on-chain and technical signals look deeply oversold and regulatory frictions between TradFi and DeFi keep rallies capped. This analysis reconciles flows, metrics, and regulation into scenario-based outcomes for traders and investors.

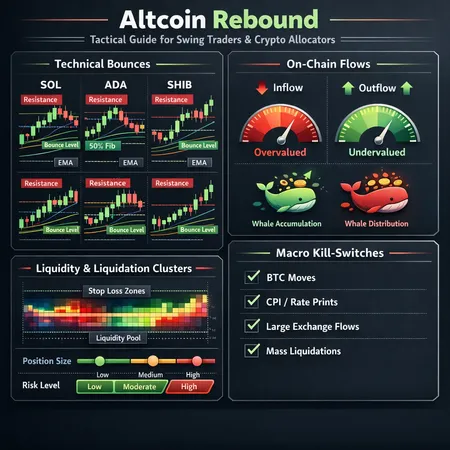

A tactical playbook for swing traders and allocators to navigate recent altcoin rebounds, blending technical levels, on-chain flow, whale signals and liquidation-cluster risk. Practical sizing rules and a macro watchlist identify what will sustain — or kill — these short-term rallies.

Several altcoins have outperformed during recent BTC-led sell-offs. This article examines MYX Finance, XMR and SHIB to determine whether their strength is idiosyncratic or an early sign of market rotation.

SOL slipping under $100 is a wake-up call: the altcoin selloff is exposing fragile market structure and liquidity mismatches. This piece breaks down technical setups for SOL and other large-cap altcoins, diagnoses contagion drivers, and offers actionable risk-management and recovery scenarios for traders.

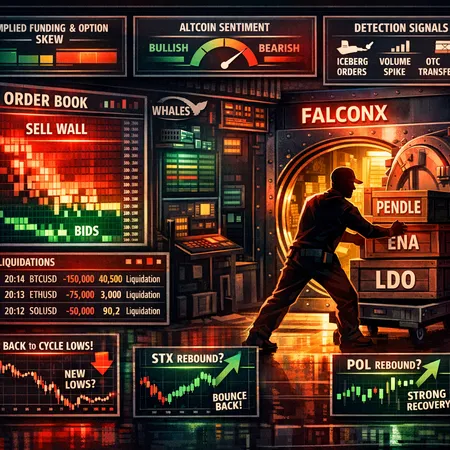

Large transfers of PENDLE, ENA and LDO to FalconX at prices below entry reframe how traders should read whale flows, order books and funding markets. This piece explains why big players use custodial/OTC counterparties, how those moves shape liquidity and derivatives, and practical signals traders can use to spot imminent exits.

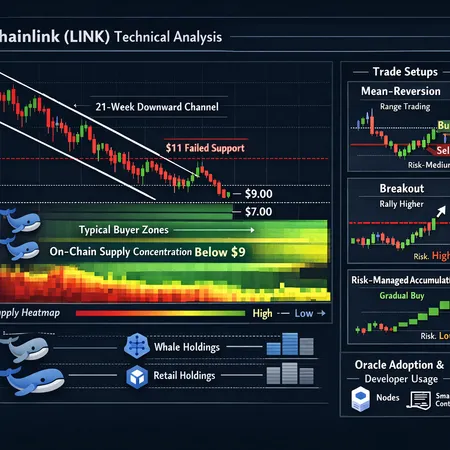

A technical and on‑chain dive into LINK’s sustained sell-off, where supply is clustering, and practical trade plans for different timeframes. Includes support levels, whale behaviour, oracle adoption implications and three disciplined setups to trade or accumulate LINK.

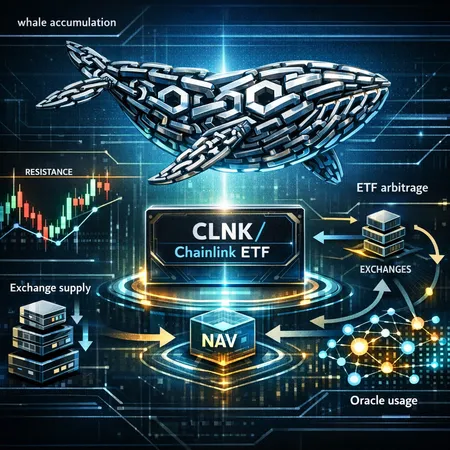

The Bitwise Chainlink ETF (CLNK) opened a new chapter for LINK markets — but whales, on-chain flows and ETF arbitrage mechanics are doing the heavy lifting behind price moves. This guide breaks down what on-chain analysts should track before following whale activity into LINK.