Institutional Adoption

SBI Holdings’ new $64.5M on‑chain bond that pays investors in XRP adds a credible institutional use-case even as Ripple’s routine 1B monthly escrow unlocks introduce recurring supply risk. Asset managers should weigh settlement efficiency against short‑term technical pressure and plan hedges accordingly.

Aave surpassing $1 billion in tokenized real‑world asset deposits signals a structural shift for DeFi, moving lending markets toward hybrid on‑chain/off‑chain capital and new counterparty models. This analysis explains tokenization mechanics, the risk and liquidity implications, regulatory considerations, AAVE token dynamics, and plausible 3–5 year adoption scenarios.

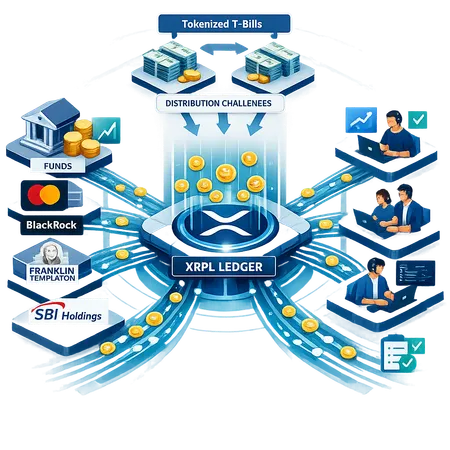

The XRP Ledger has become the primary rails for tokenized U.S. Treasuries and is posting rapid short‑term RWA growth, but issuance metrics mask weaker on‑chain activity and price pressure. Institutional product teams should separate custody and issuance flows from secondary liquidity when evaluating XRPL as an RWA backbone.

A convergence of protocol upgrades, rising Wall Street interest and renewed token‑economics scrutiny suggests XRPL could see a fresh wave of institutional and developer activity. For product and compliance teams, the shift raises opportunity — and new questions about liquidity, custody and counterparty transparency.

Deutsche Bank’s tests with Ripple+SWIFT and Ripple’s community push highlight a tension: institutional rails are advancing, but XRP’s price and on-chain flows often react to community events and market fear. This article separates partnership headlines from product exposure and offers a practical checklist for payments strategists.

XDC Network’s integration with BitGo brings regulated custody and institutional-grade controls to token issuers; Brazil’s Liqi $100M RWA deal shows how that plumbing enables large-scale, regional tokenization. This guide explains what custody enables, how USDC/USDT custody shifts counterparty risk, and an operational/legal checklist for launching tokenized assets on XDC.

A pragmatic case for initiating or adding to an ETH position before July 2026, driven by potential regulatory catalysts and on‑chain accumulation by long‑term holders — plus a risk appendix and practical buy/sizing and tax checklists for U.S. and EU investors.

Chainlink Labs joining a Korean KRW stablecoin alliance underscores growing enterprise demand for robust oracles. This piece explains what institutional stablecoin standards need, how on‑chain signals point to LINK’s potential rebound, and which catalysts matter for token demand.

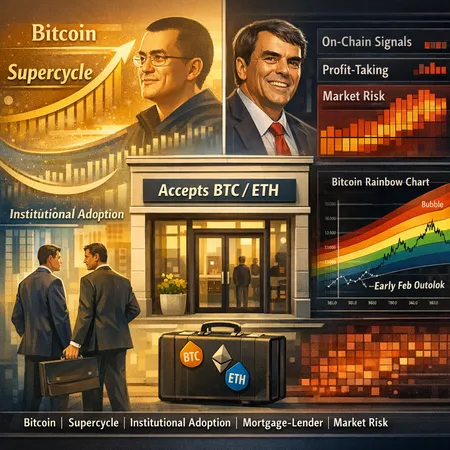

The next institutional phase of Bitcoin adoption is arriving via two complementary channels: conservative pension fund access and consumer-facing payment rails for games. Together they stitch asset allocation and everyday utility into a clearer path for BTC adoption in 2026.

A pragmatic look at how bullish long-term narratives for Bitcoin can coexist with current on‑chain indicators that warn of near‑term volatility, and what investors should do about it.