Tokenomics, Linked-Wallets and Whale Risk: Lessons from the Pump.fun (PUMP) Dump

Summary

What happened with Pump.fun (PUMP) and why it matters

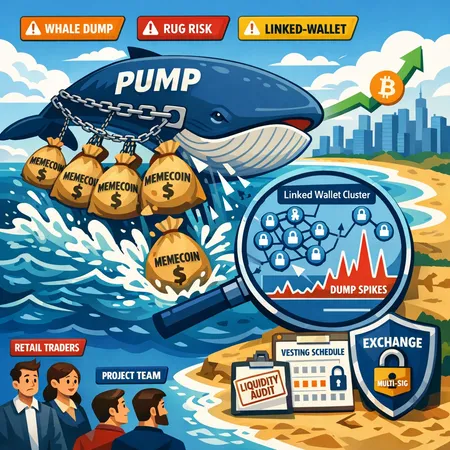

On-chain analysis shows a linked-wallet associated with Pump.fun offloaded roughly 2.07 billion PUMP tokens, a sale reported at approximately $4.55 million. The dump wasn’t a single isolated transfer: patterns of transfers between wallets already linked on-chain made the exit abrupt and effectively coordinated, allowing a concentrated holder group to monetize while price and liquidity evaporated for everyone else (AmbCrypto tracked this activity and the linked-wallet attribution).

Why this is worth your attention: memecoins like PUMP often trade on hype and low liquidity. When tokenomics concentrate supply in a few hands, a single coordinated exit can cascade into a market crash. That asymmetric exit risk is the core consumer-protection problem in many altcoin cycles.

How tokenomics and concentration create asymmetric exit risk

Tokenomics is the DNA of how a token can be bought, sold, and drained. Key risk factors include large allocations to founders/marketing wallets, unlocked or poorly-vested reserves, and small liquidity pools on DEXs. High concentration means a handful of addresses control the supply that matters for price discovery.

In practice, a whale or group of whales can:

- Withdraw liquidity from a pool or swap large amounts through a thin order book, causing price slippage.

- Coordinate sales from multiple addresses that have been deliberately obfuscated but are linked via on-chain metadata, creating the appearance of distributed selling while the exit is centralized.

- Use router interactions, approval sweeps, and flash routing to extract value before the wider market reacts.

Combined with the current macrodynamic—an ongoing rotation of capital back to Bitcoin that has shrunk altcoin volumes—memecoins are especially vulnerable. As one recent market analysis notes, trading volumes on many altcoins have halved, concentrating liquidity in Bitcoin and leaving small caps exposed during capital flight (see NewsBTC analysis for the broader context).

Linked-wallets: what they are and how they’re detected

A linked-wallet is a set of addresses that, while separate, show on-chain or off-chain signals tying them to the same actor or coordinated group. Linking can be inferred from transaction timing, repeated gas-price patterns, shared contract interactions, routing through the same intermediary wallet, identical nonce sequences, and re-use of deposit addresses on centralized services.

Common detection heuristics used by analysts and traders:

- Identical transfer sizes and timing across multiple addresses within short time windows.

- Chains of small transfers consolidating into a single wallet before a DEX swap.

- Repeated approvals to the same router and identical calldata patterns.

- Token flow through the same intermediary exchange or bridge node.

- IP or tagging metadata exposed by on-chain analytics providers.

These signals are probabilistic, not definitive. But when multiple indicators align, the confidence that wallets are linked increases—and so does the urgency for retail traders to take protective steps.

How retail traders can spot a likely whale dump: a practical checklist

Check holder concentration: open the token’s holder distribution on a block explorer. If the top 5–10 addresses control a large share (e.g., >40–60%), treat the token as high risk.

Watch liquidity pool health: look at pool depth and ratio of locked liquidity. Thin pools (small native token + little paired asset) mean heavy slippage on sell pressure.

Monitor transfer clusters: sudden bursts of transfers between non-exchange wallets or consolidations into a withdrawal address are red flags.

Observe approvals and router activity: mass allowance grants to a router or repeated router swaps can precede dumps.

Track social and on-chain tempo: spikes in gas usage tied to token contract calls, coupled with muted organic buying, often precede coordinated sells.

Use tools—but cross-check manually: aggregators can surface concentration and unusual flows, but don’t rely solely on algorithmic labels.

If several of these checks trigger, consider exiting or hedging exposure rather than doubling down on a memecoin narrative.

Best practices for projects and exchanges to mitigate whale and rug risk

Projects and venues can substantially reduce harm with a few straightforward, technical and governance controls:

Vesting and cliff schedules: meaningful vesting for team and treasury allocations prevents immediate large sales and aligns incentives.

Liquidity locks and gradual releases: locking a percentage of pair liquidity for a fixed time and using timelocks for unlocking prevents instant rug-style liquidity drains.

Multi-signature and on-chain governance: require multiple independent signatures for large transfers. Multi-sig plus public timelocked proposals increases transparency.

Audit and transparency: security audits and on-chain proofs of reserves (with periodic snapshots) help build trust and expose irregular flows early.

Avoid renouncing ownership without safeguards: while renouncing can be a marketing point, it also removes a safety valve for quick fixes. Better: combine a well-documented admin strategy with community oversight.

Exchange listing controls: centralized exchanges and aggregators should enforce minimum liquidity and audited token standards prior to listing new memecoins.

These measures aren’t silver bullets, but they change the game by turning a single large exit into a slower, more observable process where the community and market makers can respond.

Market-structure lessons amid altcoin capital flight

When capital rotates back to Bitcoin or into safer large-caps, smaller memecoins lose depth fast. NewsBTC’s coverage of the altcoin exodus highlights how decreased volumes concentrate risk: fewer participants mean one whale can move markets more easily. For market health, that implies two things:

- Improved on-chain transparency and standardization are needed so market participants can assess concentration before taking positions.

- Liquidity provisioning and maker incentives should be better designed so small-cap pools aren’t trivially exploitable during volatility.

Platforms, analytics providers, and project teams must collaborate on standards (tokenomics disclosures, mandatory vesting schedules, liquidity-lock attestations) to make the small-cap market less binary—less a lottery ticket and more an investible asset with observable risks.

Actionable takeaway: what retail traders and teams should do today

For retail traders:

- Run the checklist above before committing capital. If you lack time, set alerts for large transfers, router approvals, or sudden liquidity changes.

- Size positions assuming the worst-case: thin liquidity and coordinated selling.

- Use limit orders on CEXes where appropriate to avoid slippage traps on DEXs.

For projects and teams:

- Publish clear tokenomics and vesting schedules, lock liquidity, and use multi-sig controls.

- Pre-announce unlock schedules publicly and use timelocks for any admin changes.

- Consider third-party liquidity audits and make those reports easily accessible.

Every participant benefits from better practices: projects retain credibility, traders avoid catastrophic losses, and exchanges reduce post-listing disputes. Even small platform choices—like where to store documentation or how to display vesting—can materially reduce rug risk.

Final thoughts

The PUMP linked-wallet dump is a practical reminder that memecoins, by design or neglect, can concentrate risk in ways retail traders don’t expect. Detection is possible with consistent on-chain monitoring and an instinct for irregular patterns; prevention requires better tokenomics, operational safeguards, and industry standards.

As capital rotates in cycles—back to core assets like Bitcoin or into fresh narratives—those who trade or build in memecoins must combine skepticism with tools and governance. Education and transparency (tools available across analytics providers and resources like Bitlet.app) will be central to reducing the asymmetric harms of whale dumps.

Sources

- On-chain report and analysis of the Pump.fun dump and linked-wallet activity: AmbCrypto — Pump.fun dumps 4.55M in PUMP; will prices fall below 0.002?

- Macro context on altcoin volume contraction and capital flowing back to Bitcoin: NewsBTC — The altcoin exodus: trading volumes halve as capital flees to Bitcoin