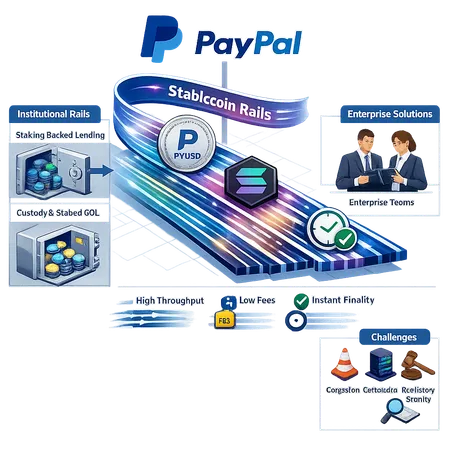

What PayPal’s Move to Solana Means for PYUSD, Payments, and Institutional Rails

Summary

Why PayPal’s decision matters

PayPal naming Solana as its default network for stablecoin processing is more than a headline — it's a real-world stress test and endorsement of Solana's suitability for high-volume payments. The move signals that a major mainstream payments company believes a Layer-1 blockchain can meet the latency, cost, and throughput requirements of consumer-grade stablecoin flows. PayPal’s choice also accelerates a feedback loop: higher transactional demand will reveal where Solana's stack scales and where operational gaps remain.

PayPal’s announcement is summarized in the reporting here: PayPal designates Solana as default network for stablecoin processing.

Technical and economic drivers behind the choice

Solana’s appeal to a payments giant hinges on three practical metrics: throughput, transaction cost, and finality. Those translate directly into user experience and margin for a company processing millions of micro-transactions.

Throughput and latency

Solana was designed for high throughput — thousands of transactions per second under ideal conditions — and sub-second block propagation on good hardware. For a payments flow, that reduces queueing and makes on-chain settlement feel instant to end users. Faster settlement also reduces the need for custodial pre-funding and complex off-chain reconciliation layers.

Transaction fees and unit economics

Low per-transaction fees are an obvious draw. When you process large volumes of micropayments or remittances, a few cents saved per transaction compounds quickly. Lower fees also widen the set of viable use-cases: recurring micro-billing, tipping, and small-value merchant payouts become practical without bespoke batching.

Finality and user experience

Solana offers rapid finality compared with many slower Layer-1s. For payments UX, that reduces ambiguous “pending” states and the need for multi-step confirmations or intrusive off-chain guarantees. Finality also matters for downstream reconciliation, chargeback windows, and liquidity planning.

What this means for PYUSD and stablecoin UX on Solana

Designing PYUSD flows on Solana can deliver a markedly better consumer experience: near-instant settlement, lower friction for on-chain transfers, and simpler merchant integration. That said, implementation choices matter.

First, wallet UX: many consumer wallets are optimized around EVM paradigms. Native Solana wallet integrations and abstractions that hide token account creation costs will be essential. Custodial and non-custodial wallets must ensure that account setup, signing, and recovery remain seamless for users unfamiliar with Solana’s model.

Second, liquidity and rails: merchants and payout processors expect predictable settlement amounts. Routing PYUSD across liquidity pools, or offering on-demand conversion between PYUSD and off-chain fiat or other tokens, will shape acceptance. Integration teams should tie on-chain settlement to order-management systems and reconciliation pipelines.

Third, batching and gas management: even though fees are low, intelligent batching and fee-sponsorship can eliminate friction for low-value payments. PayPal-like operators can absorb fees to guarantee a “free” user experience, but custodians and PSPs need robust fee-management logic.

Institutional rails and the rise of staking-backed treasury products

PayPal’s move dovetails with emerging institutional services on Solana. Notably, institutional treasury products that enable borrowing against staked SOL create a new liquidity primitive: teams can stake SOL for yield while still accessing liquidity via custody-backed lending against those stakes. See coverage of such institutional products here: Solana company unveils first digital-asset treasury for institutional borrowing against staked SOL.

This combination — cheap, fast settlement plus staking-backed credit — forms a compact use case for treasuries: firms can hold reserves in SOL or PYUSD, earn staking yield, and borrow against locked positions to meet short-term obligations. For corporate treasurers and exchanges, that reduces the friction between idle balance yields and operational liquidity.

However, these integrated rails create new interdependencies: a liquidity crunch that depresses SOL or a slashing event could impair lending facilities, and a contested governance decision on Solana could ripple into custodian risk books.

Key risks and friction points

The PayPal endorsement does not eliminate meaningful risks. Teams should evaluate these carefully before leaning heavily on Solana as a single settlement rail.

Congestion and degraded UX: Solana has experienced episodes of congestion and degraded processing in the past. High demand (driven by a large PSP like PayPal) could expose new scaling or mempool management issues under production traffic.

Centralization and validator economics: While Solana’s architecture gives it speed, questions about validator distribution, hardware requirements, and node run-rate can raise centralization and censorship concerns. Enterprises should assess reliance on a network where a small number of validators could influence transaction ordering or availability.

Regulatory scrutiny and compliance: Routing a major stablecoin like PYUSD over a public Layer-1 will invite attention from regulators, especially where AML/KYC and settlement finality intersect. Firms need granular audit trails, on-chain/off-chain reconciliation, and cooperation agreements with custodians to satisfy compliance teams.

Market and valuation risk: Institutional products that rely on SOL as a collateral primitive expose treasury balance sheets to SOL’s price volatility. Technical analysis and market debate about whether SOL is undervalued or priced correctly inform risk tolerances — see further context in this piece: Solana’s divergence explained — is SOL undervalued or not?.

Recommendations for developers, custodians, and enterprises

Design and testing

- Run production-representative load tests that simulate PayPal-scale settlement volumes, including spikes and long-tail traffic. Test wallet onboarding flows and account creation patterns.

- Implement graceful degradation: build queuing, retry logic, and deterministic user states to handle latency or temporary network outages.

Custody, risk, and compliance

- Custodians should offer audit-grade logs that map on-chain transaction IDs to internal customer accounts, and provide APIs for real-time reconciliation.

- Diversify collateral and liquidity sources. If you use staking-backed lending, include collateral haircuts, margin call automation, and stress tests for SOL price shocks.

- Prepare compliance playbooks that connect on-chain analytics to KYC/AML workflows. Maintain off-chain records for dispute resolution.

Architecture and product

- Consider multi-rail settlement strategies. Use Solana as a primary low-cost rail but retain fallbacks (or on-chain bridges) to other L1s or trusted off-chain settlement in extreme scenarios.

- Optimize UX for wallets inexperienced with Solana semantics. Abstract away token-account complexity and provide fee-sponsorship where appropriate.

- Monitor mempool, fee markets, and validator health continuously. Integrate observability to detect signs of impending congestion.

Commercial and strategic

- Negotiate clear SLAs with custodians and settlement partners. Expect to codify responsibilities around replay protection, dispute handling, and emergency key rotations.

- For treasuries, prefer conservative borrowing structures against staked SOL with clearly defined liquidation thresholds and lender protections.

Final thoughts

PayPal’s defaulting to Solana for stablecoin processing is a milestone for blockchain payments and institutional rails. It validates the thesis that Layer-1 networks can power consumer-grade stablecoin UX when they deliver speed and predictable cost. But the operational and regulatory complexity of real-world payments means this is not a turnkey decision: architects must plan for congestion, counterparty risk, and compliance overhead while experimenting with staking-backed liquidity products.

For teams evaluating Solana, pragmatic testing and conservative risk design will separate successful integrations from painful rollouts. As adoption scales, expect the ecosystem — wallets, custodians, and infrastructure providers — to accelerate maturity. Payments and product leads should track both network telemetry and the evolving regulatory landscape as they bring PYUSD and other stablecoins into production on Solana.

Bitlet.app teams building payment flows should use these operational checks as part of their integration playbook.

Sources

- PayPal designates Solana as default network for stablecoin processing: https://zycrypto.com/paypal-designates-solana-as-default-network-for-stablecoin-processing/

- Solana company unveils first digital-asset treasury for institutional borrowing against staked SOL: https://blockonomi.com/solana-company-unveils-first-digital-asset-treasury-for-institutional-borrowing-against-staked-sol/

- Solana’s divergence explained — is SOL undervalued or not?: https://ambcrypto.com/solanas-divergence-explained-is-sol-undervalued-or-not/

For broader context on layer selection and settlement risk, consider how other rails like Solana compare to long-established markets where Bitcoin and DeFi primitives intersect with payment flows.