Ripple, Deutsche Bank and XRP: Do Institutional Rails Translate to Durable Payment Flows?

Summary

Executive snapshot

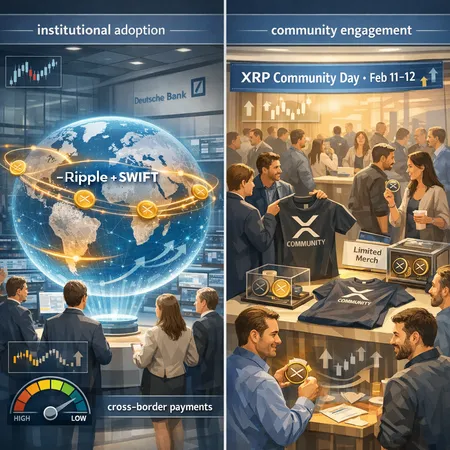

Institutional conversations about faster cross-border rails have moved from theory to pilots. Deutsche Bank’s exploration of a hybrid model using Ripple alongside SWIFT is one concrete example of that trend, and Ripple’s community activities—most notably XRP Community Day on Feb 11–12—aim to convert awareness into network effects. That said, marketing spikes and institutional pilots are different animals. This piece unpacks the Deutsche Bank pilot, explains how community-driven actions interact with on-chain selling and the fear index, and offers a pragmatic framework for payments strategists and corporate execs who need to judge whether partnerships will deliver sustainable payment volumes and price stability.

What Deutsche Bank’s Ripple+SWIFT test actually means

Deutsche Bank’s move to test Ripple technology in tandem with SWIFT attracted attention because it pairs a long-established interbank messaging system with a newer blockchain-based settlement layer. The report covering the pilot shows a pragmatic approach: banks are less often looking to replace SWIFT entirely and more often to use distributed-ledger capabilities to speed reconciliation and liquidity cycling where it makes sense (Coinpaper report).

For payments strategists, the core takeaway is modest but important: institutional interest is maturing from proofs-of-concept to mixed-architecture pilots. That implies potential operational benefits—faster settlement, lower nostro/vostro friction, improved transparency—but not automatic demand for on-chain native tokens. Banks evaluate rails on settlement finality, regulatory compliance, and integration costs, not on token narratives.

Institutional adoption vs product exposure: reading filings and headlines

Media cycles frequently conflate three distinct things: a bank trialing a DLT solution, an institutional filing that mentions crypto vehicles, and an approved spot ETF that would create direct institutional demand for a token. These are not the same. Recent clarifications show how easily filings and headlines are misread: some stories implied institutional products gave direct XRP exposure when in reality filings were ambiguous or unrelated to an approved spot product (NewsBTC clarification).

Executives should treat partnership announcements as signal-not-proof. Key questions to ask after a press release: Is the work a sandbox or a production integration? Are tokens being used as a settlement asset in the pilot or only for testing liquidity mechanisms? What compliance and custody arrangements exist? These operational details determine whether a partnership could materially increase payment volumes or token buy-side demand.

XRP Community Day (Feb 11–12): timing, goals and mechanics

XRP Community Day, held Feb 11–12, is emblematic of Ripple’s two-track strategy: pursue institutional deals while cultivating grassroots adoption and developer activity. The event’s aims are straightforward—regional meetups, developer sessions, and brand activations such as exclusive merch to reward and grow local engagement (Cointribune overview).

From a product and network perspective, community events matter because they can seed developer interest, improve KYC/partner relationships in local corridors, and drive on-chain experimentation with payments rails. But community activations also create short-term supply dynamics: participants may sell merch-linked rewards, airdrops, or newly created tokens, and local meetups can temporarily concentrate sell-side liquidity.

How marketing and community actions interact with on-chain selling pressure and the fear index

Community-driven engagement often coincides with heightened visibility—and that visibility can attract both buyers and sellers. In volatile markets, visibility sometimes amplifies selling instead of supporting price. Empirical coverage around recent community events shows XRP coming under pressure while broader market fear metrics spiked: the aggregated fear index reflected extreme fear during some of these phases (Bitcoin.com coverage).

Why does this happen? A few mechanisms are worth noting:

- Incentive timing: merch drops, event rewards, or presales create discrete moments where recipients realize gains and may liquidate.

- Visibility arbitrage: increased attention reveals shallow order books on certain exchanges or corridors, allowing large holders to execute without wide spread pricing impact, which can trigger downward pressure.

- Macro sensitivity: community wins amid a risk-off macro environment are less likely to produce sustained capital inflows; instead, they coincide with rebalancing and de-risking by institutional and retail holders.

These dynamics don’t mean community events are counterproductive—they often build loyalty and developer pipelines—but payments strategists should expect short-term noise and prepare for it in liquidity and settlement models.

Separating signal from noise: what indicates durable payment volumes?

For a Ripple partnership to translate into sustained cross-border payment volumes (and—to a lesser extent—meaningful upward token pressure), look for the following operational signals rather than headline counts:

- Production vs. pilot status: Is the integration live on production rails, or still in a sandbox with simulated flows?

- Counterparty breadth: Are multiple banks or remittance providers using the same corridor, or is it a single bilateral trial that can be shut down?

- Corridor liquidity and settlement frequency: Are liquidity pools (if used) replenished regularly? Does the system reduce nostro/vostro balances measurably?

- Compliance + custody readiness: Are AML/KYC, custody, and reconciliation automated and audited for regular operations?

- Commercial incentives: Are banks being charged (or saving costs) in a way that scales, or is the solution subsidized as a proof-of-concept?

If a pilot ticks these boxes, then operational volume—transaction counts, settlement value, and recurring counterparties—becomes an early leading indicator that the partnership might generate repeatable demand.

Token price support is not the primary KPI for corporate partners

A practical tension exists: crypto-native communities often view token price as a validation metric, while banks treat token usage as an operational tool. That divergence matters when evaluating long-term success. Firms like Ripple can provide attractive rails, but corporate partners will prioritize predictable costs, regulatory clarity, and settlement finality over speculative token appreciation.

Payments executives should therefore model two separate return streams: operational ROI from faster, cheaper settlements and incidental market effects (e.g., token demand). Relying on token price appreciation as a justification for a payments integration is risky—tokens are subject to macro cycles, liquidity concentration, and short-term on-chain behaviors triggered by marketing events.

Practical checklist for payments strategists and corporate execs

Before committing to a production rollout tied to Ripple or similar DLT providers, validate these items:

- Production readiness: Is the solution running on production rails with audited settlement finality?

- Legal and compliance sign-off: Are AML/KYC, sanctions screening, and custody arrangements legally reviewed for your jurisdictions?

- Corridor pilot metrics: Are transaction size, frequency, and counterparty churn compatible with expected revenue and cost savings?

- Liquidity plan: How is liquidity provisioned? Is there a reliance on volatile token holdings that could create settlement risk?

- Integration cost and vendor lock-in: What are the integration, monitoring, and fallback costs if the provider changes terms?

- Market-impact mitigation: Do you have hedging or liquidity buffers to handle on-chain selling during marketing peaks (like community days)?

These practical steps help turn a promising pilot into a scalable, auditable payment service.

Conclusion — balanced realism

Deutsche Bank’s pilot with Ripple plus SWIFT and Ripple’s focus on community engagement are both meaningful developments for cross-border payments. Institutional pilots show willingness to experiment with DLT, and community events can spark developer and local-market momentum. Yet the leap from pilot to durable payment volumes—and from increased visibility to token price support—is not automatic.

Payments strategists should evaluate partnership announcements critically, focusing on production readiness, corridor liquidity, and regulatory fit. Meanwhile, expect community-driven marketing to create short-term on-chain noise and possible selling pressure, especially when broader market sentiment is fearful. Approached with operational rigor, these technologies can deliver real cost and speed advantages; approached as a token bet, they are far riskier.

Bitlet.app users and payments teams can use these signals to separate durable infrastructure wins from headline-driven hype and build integrations that prioritize settlement quality over narrative.

Sources

- Report on Deutsche Bank using Ripple alongside SWIFT: https://coinpaper.com/14482/deutsche-bank-taps-ripple-and-swift-to-supercharge-cross-border-payments?utm_source=snapi

- Overview of XRP Community Day: https://www.cointribune.com/en/xrp-community-day-connects-users-across-continents/?utm_source=snapi

- Coverage of XRP under market pressure and the fear index: https://news.bitcoin.com/xrp-under-pressure-as-fear-index-flashes-extreme-fear-across-crypto/

- Clarification on institutional filings and XRP ETF exposure: https://www.newsbtc.com/news/goldman-sachs-xrp-etf-exposure-liquidchain-presale/

For related context, see discussions on XRP and broader DeFi settlement innovation on DeFi.