On‑Chain

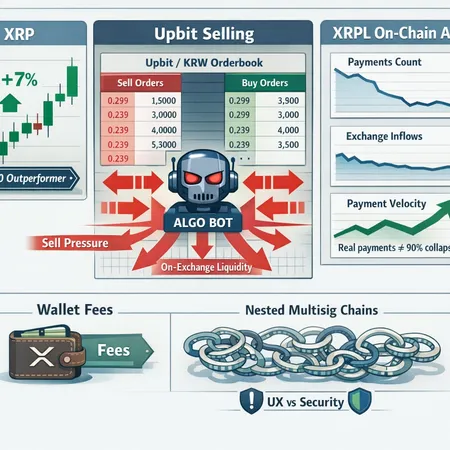

XRP has been a top‑10 price outperformer, yet XRPL payment volume, exchange flow data and community disputes paint a stressed picture. This article unpacks the technicals, on‑chain metrics, Upbit selling reports, the Xaman wallet fee row and scenarios that reconcile the rally with degraded on‑chain activity.

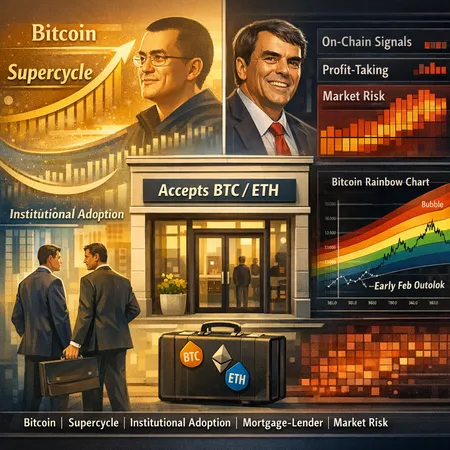

A pragmatic look at how bullish long-term narratives for Bitcoin can coexist with current on‑chain indicators that warn of near‑term volatility, and what investors should do about it.

Capital rotation is reshaping altcoin season: legacy meme leaders DOGE and SHIB are losing share while new meme winners and select alts like SDEX, LINK, ETH, SOL and AVAX attract fresh flows. This article explains why, with case studies and a practical framework to separate durable rerates from short‑lived pumps.

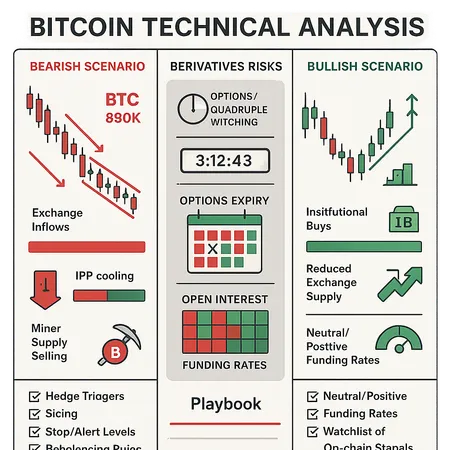

A balanced deep-dive comparing the bearish path toward $80K with the bullish compression/breakout thesis. Synthesizes technical structure, on‑chain flow, and derivatives positioning into a practical checklist for traders and portfolio managers.

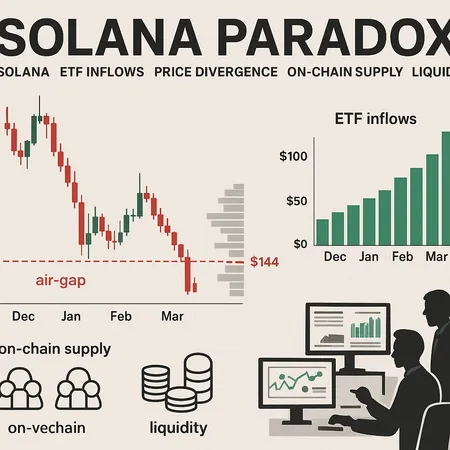

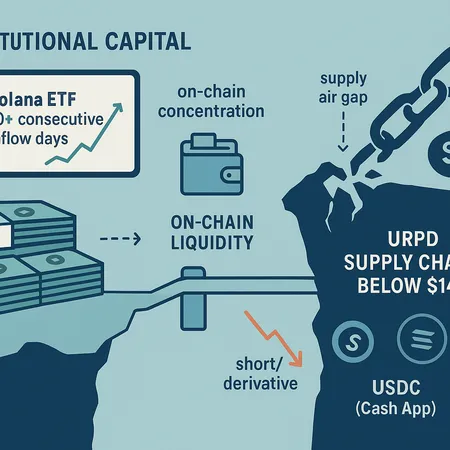

A Franklin Templeton Solana ETF could materially change liquidity and derivatives pricing for SOL, but recent exchange exploits have created near-term selling pressure. This piece lays out the technicals, on‑chain signals, and concrete trade setups for swing traders and institutions managing the ETF catalyst and exchange risk.

A step‑by‑step investigation into recent claims that MicroStrategy sold large BTC holdings, the evidence refuting those stories, and a practical verification framework traders can use to avoid knee‑jerk moves. Learn how on‑chain checks, corporate disclosures, and market psychology interact when whale rumors surface.

Solana-based ETFs have recorded consecutive inflows, yet SOL has slid to multi-month lows. This article unpacks ETF timing, on‑chain supply issues, the ‘air gap’ below $144, and whether institutional demand can overcome structural liquidity risks.

Bitcoin slipping under its 365‑day moving average and large ETF outflows have raised red flags, but models and institutional buys paint a mixed picture. This article weighs technicals, on‑chain downside scenarios, ETF liquidity stress, and practical risk management steps for investors.

Solana is seeing persistent spot‑ETF inflows while SOL’s market price remains weak—an uneasy divergence driven by liquidity mismatches, derivatives, and an on‑chain supply ‘air gap’ below key levels. This deep dive unpacks the evidence, the mechanics, and practical risk management for traders and allocators.