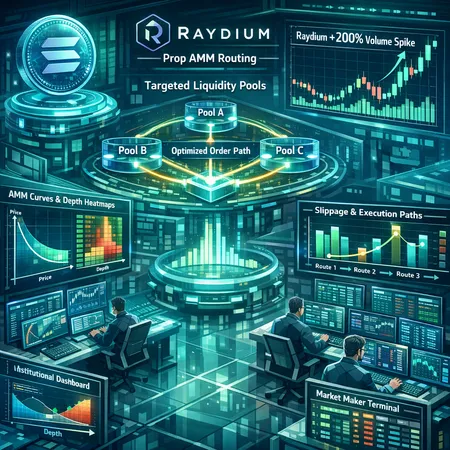

How Prop AMMs and DEX Liquidity Engineering Are Changing On‑Chain Execution on Solana

Summary

Context: Why execution quality matters on Solana now

Solana’s throughput and low latency made it a natural host for ambitious on‑chain execution primitives. But raw speed only matters when liquidity and pricing are engineered to serve large orders. Traditional constant‑product AMMs are simple and robust, yet they fragment depth across price ranges and produce outsized slippage for institutional‑sized trades. Enter Prop AMMs and targeted DEX liquidity engineering — approaches designed to concentrate depth, tailor curves to real trading patterns, and improve on‑chain execution metrics that quants and market makers care about.

For many traders the platform matters as much as the contract: see how Solana ecosystems are evolving to host both sophisticated market microstructure experiments and high‑frequency flows. At the same time, the growth of specialized pools is a DeFi theme: concentrated liquidity and engineered AMMs are reshaping what we measure when we say a venue has “good execution.” That’s why protocol changes on Solana are important to study now.

What a Prop AMM does differently (and why it can lower slippage)

A Prop AMM is not just another fee tweak; it rethinks how liquidity is partitioned and priced. Instead of a single constant‑product curve where liquidity spreads thin across all prices, Prop designs introduce targeted or proprietary curves and pool structures that place more depth where real trades occur. Two mechanics matter most:

- Concentration of depth around active price bands. Rather than equalizing liquidity across broad ranges, Prop AMMs bias capital into price regions with expected flow, delivering better marginal pricing for orders that would otherwise walk the book. This reduces realized slippage for large fills.

- Multi‑pool and cross‑routing primitives. Prop setups often combine specialized pools (e.g., high‑depth near‑market pools + wide‑range backup pools) with smart routing to stitch execution together, emulating an order book’s price continuity on chain.

A recent report on Solana’s Prop AMM rollout highlights that these modifications can generate better end prices for takers by offering on‑chain depth in tighter bands—particularly effective for liquid pairs like SOL where institutional flow shows repeatable footprints (report and analysis).

How this changes slippage math in practice

Concentrated liquidity alters the price impact function. Under constant‑product x*y=k, price impact grows quickly with size; with targeted curves you compress that growth within the band, so a trade that would incur 100 bps slippage on a vanilla pool might see 20–40 bps instead if routed through a deep, concentrated band. That matters for quants running execution algorithms: market impact models shift and implementation shortfall improves, but only where the engineered pools actually have persistent depth.

Raydium’s ~200% volume spike: a live case study

In mid‑period activity on Solana, Raydium experienced roughly a 200% volume spike that tested the breakout strength of RAY‑related liquidity and routing. Reporting on the event points to a concentration of on‑chain flow and improved fills on pools that had been optimized for depth (analysis).

What happened in plain terms: a burst of buy (and subsequent hedge) pressure hit Raydium’s optimized pools and aggregators. Because Raydium had been participating in DEX liquidity engineering—layering concentrated pools and closer spreads—many taker orders were executed with lower slippage and tighter realized spreads than if liquidity had been evenly distributed.

Short‑term effects visible during the spike

- Spreads compressed on active pools as liquidity providers (LPs) in targeted bands absorbed flow. The visible on‑chain spread improved, benefitting immediate execution quality.

- Price discovery accelerated: with deeper bands near market, large orders moved price less in percent terms, which allowed the market to better reflect demand without runaway temporary impact.

- Token momentum followed volume: RAY’s price action benefited from the meta narrative of on‑chain strength, amplifying the breakout.

These outcomes are promising for takers, but the Raydium episode also illustrates that much of the benefit came from flow concentration and temporary LP willingness to absorb trades—factors that may reverse outside peak demand windows.

Implications for market makers and institutional execution on Solana

The arrival of Prop AMMs changes the playbook for both passive LPs and active market makers.

- Capital efficiency improves for LPs who correctly size and position in concentrated bands. Instead of spreading capital thinly across prices that rarely trade, LPs can earn fees on the majority of volume concentrated near mid‑price. But that demands better predictive models for where flows will materialize.

- Market makers must rethink quoting and hedging cadence. When a specialized pool reduces slippage for takers, MMs face tighter effective spreads and potentially faster inventory turnover. Hedging costs can fall if on‑chain fills are cleaner, but only if routing is reliable and latency remains low.

- For institutional desks, venue selection calculus shifts from simple TVL or aggregate volume metrics to realized execution metrics — average slippage, fill rate for block sizes, and path reliability. Aggregators that can prioritize Prop AMMs or hybrid routing strategies will become valuable.

Bitlet.app and other execution layers will need to incorporate these nuances into venue scoring: it’s no longer enough to show that a pool exists; you must demonstrate how it behaves for 10k–1M USD notional trades during both high and low demand.

How protocol designers should respond

Protocol designers should bake in observability: on‑chain metrics that show effective depth at granular price bands, historical realized slippage for a range of sizes, and incentive durability (how long LPs stayed after the spike). Those telemetry feeds make it possible to design fairer fees and incentive curves that match real execution value.

Risks and the sustainability question

The most important caveat: many liquidity engineering wins require demand persistence or ongoing incentives. If aggressive trading demand wanes, several failure modes can emerge:

- Liquidity retreat. LPs optimized for concentrated bands may withdraw if fee income falls, instantly widening effective spreads and reversing slippage improvements. The Raydium spike showed how quickly liquidity can fortify and then thin when flows subside.

- Incentive dependence. Protocols that attract depth primarily via rewards are vulnerable when those rewards end. The apparent on‑chain depth is then not organic, and execution quality degrades.

- Adverse selection and MEV. Concentrated bands can become predictable MEV vectors if arbitrageurs can front‑run or sandwich large known flows, increasing realized cost for institutional takers despite the theoretical depth.

These risks matter for quants and market makers because they change the tail risk profile: a venue that offers low average slippage but high variance (occasional full liquidity evaporation) is poor for large, time‑sensitive executions.

Practical checklist for evaluating on‑chain execution on Solana

For quant traders, market makers, and protocol teams deciding where to route or design liquidity, prioritize these tests and metrics:

- Realized slippage by notional band. Empirically measure slippage for 10k, 50k, 250k, 1M USD trades across time windows.

- Effective depth at X bps. Compute cumulative depth available within 10, 25, and 50 bps of mid‑price on the target pool and across routed paths.

- Liquidity persistence. Track how long concentrated pools maintain depth after volume spikes expire.

- Fee vs. rebate elasticity. Simulate how LPs respond to fee changes and reward tapering; test whether depth is reward‑driven.

- Routing determinism and latency. Aggregator reliability under load and cross‑pool stitching capabilities.

Running these diagnostics will reveal whether a Prop AMM or a Raydium‑style DEX setup truly improves execution for your strategies or simply looks attractive during episodic demand.

Conclusion — better execution, new tradeoffs

Prop AMMs and targeted DEX liquidity engineering on Solana bring a meaningful improvement in on‑chain execution when pools are properly provisioned and demand is present. Raydium’s ~200% volume spike acted as a stress test: it demonstrated reduced slippage and tighter spreads, but it also exposed the fragility of those gains when incentives or flow recede. For market makers, quants, and protocol designers, the takeaway is nuanced: these tools can close the gap between on‑chain AMMs and off‑chain venue quality, yet they introduce new operational and incentive risk that must be measured explicitly.

If you’re evaluating execution venues on Solana, don’t trust headline TVL or a single high‑volume day. Instead, quantify realized slippage, persistence of depth, and how pools behave under both feast and famine — that’s the practical path to choosing a venue that will survive beyond one breakout. And as always, combine on‑chain telemetry with execution testing; simulation and dry‑run fills remain the best early warning system.

Sources

- Solana on‑chain Prop AMM and liquidity engineering analysis: https://www.cryptopolitan.com/sol-on-chain-liquidity-offers-better-price/

- Raydium ~200% volume spike and breakout analysis: https://ambcrypto.com/raydiums-200-volume-spike-tests-rays-breakout-strength-heres-why/