ETF Inflows

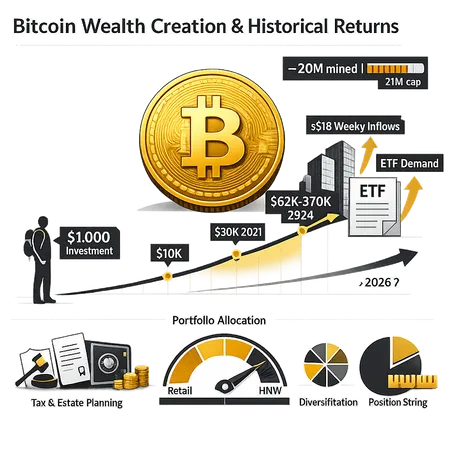

Bitcoin’s early price trajectory produced extraordinary paper wealth for tiny stakes — a useful lens to reassess allocation, scarcity, institutional demand and risk management in 2026. This article breaks down the historical numbers, supply dynamics, recent ETF/institutional flows, tax and estate implications, and pragmatic portfolio rules for retail and HNW investors.

The Federal Reserve’s inclusion of XRP in its crypto risk calibration elevates the token from litigation-era outlier to a policy-relevant instrument. Traders and IR teams must now balance macro-driven price moves (CPI, ETF inflows) with an emerging regulatory lens that alters liquidity and tradability.

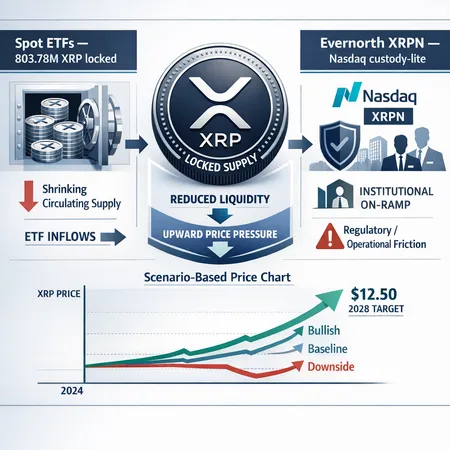

Spot ETFs have already locked a material tranche of XRP supply and Evernorth’s planned XRPN could lower custody friction — together these channels change the calculus for institutional allocators. This article quantifies the 803.78M XRP locked in ETFs, examines XRPN’s custody-lite mechanics and frictions, and models scenario-driven price implications up to sell‑side targets like Standard Chartered’s $12.50 forecast.

54 straight days of ETF inflows have refocused attention on an ambitious $2.70 XRP price target. This article synthesizes ETF flow dynamics, whale activity, new spot venues like FXRP, and near‑term liquidity risks to judge whether that target is realistic.

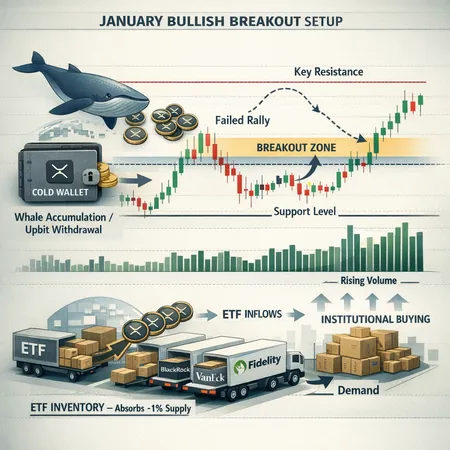

XRP’s January rally is being driven by concentrated whale flows, rising on‑chain volume and spot‑ETF demand that reportedly absorbs ~1% of supply — a mix that creates a textbook breakout setup but also clear failure scenarios. This post breaks down the on‑chain signals, ETF mechanics, technical levels to watch, and practical trading/position‑sizing rules for 2026.

Bitcoin’s sharp break to roughly $93,000 in early January 2026 was driven by a mix of geopolitical shock, renewed institutional ETF demand and heavy derivatives positioning. This article unpacks the timeline, how ETFs can soak up supply, the options market’s $100k bets, risk scenarios and tactical steps for traders and allocators.

Renewed US spot-BTC ETF inflows, dovish macro expectations and cleaner market plumbing have tilted the odds toward Bitcoin testing six figures in early 2026. Traders should weigh entry scales, hedges and concentration risks from large institutional holders like MSTR.

Institutional capital is flowing into Solana‑linked ETFs even as network and project issues persist. This feature explains the drivers behind ETF inflows, case studies from the Solana ecosystem, and practical takeaways for SOL holders.

A deep dive into the recent streak of spot‑XRP ETF inflows, how Cboe approval of 21Shares XR ticker channels demand, and scenario analysis for $5B–$10B in ETF assets on liquidity, price discovery and on‑chain activity.

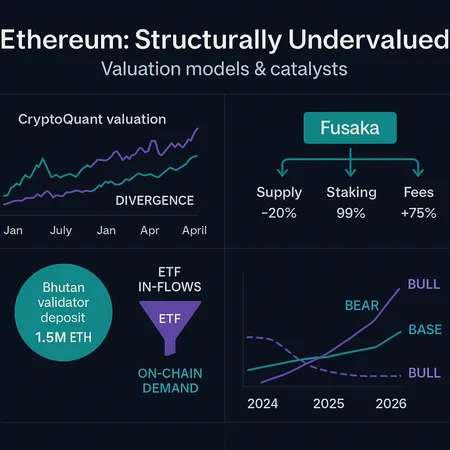

Multiple valuation models and on‑chain indicators suggest Ethereum is trading below intrinsic value. Upcoming protocol changes like Fusaka plus growing institutional staking and ETF flows could compress supply and trigger a re-rating.

DeFi

All DeFi postsBitcoin

All Bitcoin postsLiquidity

All Liquidity posts- How US–Israel Strikes, an Oil Shock, and Strait of Hormuz Risk Are Roiling Bitcoin — What Traders Should Watch

- How U.S. Spot Bitcoin ETF Inflows Are Changing BTC Price Discovery and Liquidity

- Bitcoin's Tug-of-War: ETF Inflows Lift BTC to ~$68–70K — But Liquidity and a Multi‑Billion Options Expiry Threaten Volatility