ETF

The CLARITY Act’s march toward implementation is redefining regulator roles and ETF engineering, while Abu Dhabi sovereign-linked funds quietly building IBIT stakes signal a new layer of institutional demand. Together these forces reshape allocation, liquidity risk, and cross‑border flows for long‑term BTC investors.

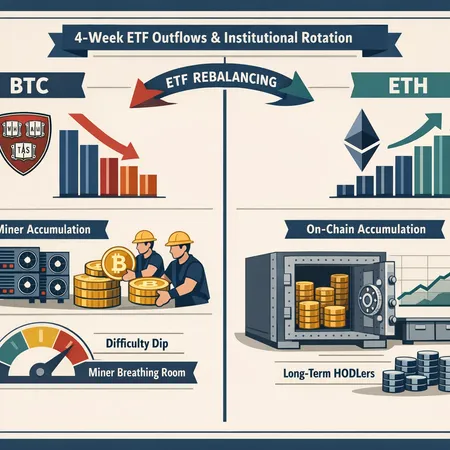

Universities and funds appear to be rebalancing away from BTC while miners and long‑term holders accumulate on‑chain. That divergence changes the effective supply curve — and should influence how allocators weight BTC vs ETH.

Recent ETF outflows and renewed debate about cryptographic risk (the so‑called 'quantum discount') raise a practical question for allocators: is the market already embedding a long‑term premium for quantum threats? This article dissects ETF flows, Willy Woo’s thesis on lost‑coins assumptions, miner/hodler behavior and offers a framework for position sizing if a quantum risk premium is material.

Grayscale’s move to convert its AAVE trust into a 1940 Act-style spot ETF raises complex questions about custody, liquidity, and governance. The SEC review will shape not only AAVE tokenomics but the roadmap for future altcoin spot ETFs.

XRP is seeing notable spot ETF demand even as on-chain and technical signals look deeply oversold and regulatory frictions between TradFi and DeFi keep rallies capped. This analysis reconciles flows, metrics, and regulation into scenario-based outcomes for traders and investors.

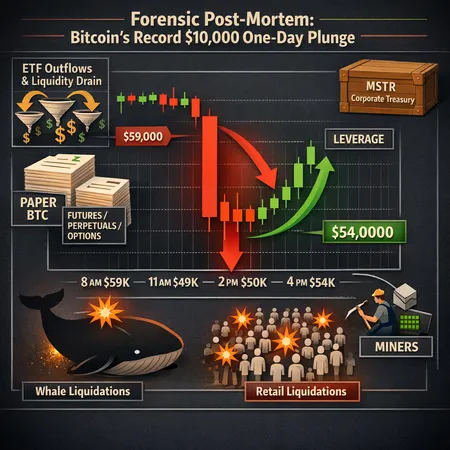

A forensic post-mortem of Bitcoin’s record one-day drop, examining the timeline, ETF outflows, derivatives-driven synthetic supply, liquidation dynamics, and practical risk-management lessons for institutions and retail.

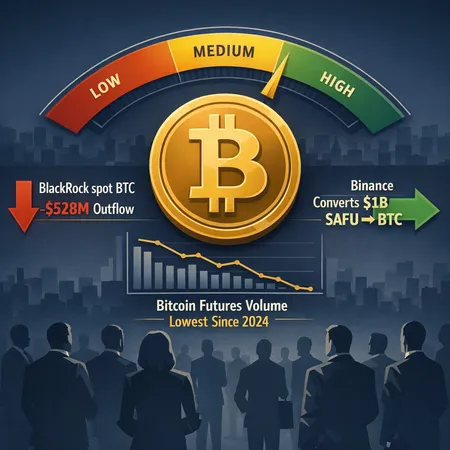

Recent data — a $528M outflow from BlackRock's spot BTC ETF, collapsing futures volumes and corporate BTC purchases — paint a mixed picture for institutional demand. This feature unpacks which metrics act as early-warning signals and outlines scenarios for BTC price dynamics under different institutional-return assumptions.

In 2026 the market is debating whether XRP’s story has moved from a litigation-driven trade to one powered by ETF interest and real on‑ledger demand. This article breaks down 21Shares’ scenarios, on‑chain signals like millionaire wallets and RLUSD liquidity, key technical levels, and what a matured narrative means for holders and traders.

VanEck’s new spot AVAX ETF listing on Nasdaq marks a milestone for spot altcoin products in the U.S., with likely ripple effects on liquidity, institutional access, and short‑term price dynamics. This analysis breaks down supply interactions, on‑chain signals, analyst price scenarios, and what the launch implies for future layer‑1 ETFs.

Jan 26 ETF data showed $116.9M net inflows into spot Ethereum ETFs led by Fidelity’s FETH while BlackRock’s ETHA experienced outflows. Coupled with large corporate buys and growing staking demand, these flows are reshaping short- and medium-term ETH price dynamics and portfolio tactics.